2021 construction costs rose at double-digit rates

Pritesh Patel

IHS Markit

Houston

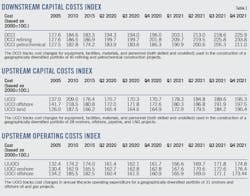

IHS Markit indices are proprietary measures of cost changes similar in concept to the Consumer Price Index (CPI) and draw upon proprietary IHS Markit tools to provide a benchmark for comparing construction costs around the world. Construction costs are tracked on a quarterly basis and then reported as an index value to show how upstream and downstream project cost have changed. Therefore, an index of 225.9 means construction costs have increased 125.9% since 2000.

Capital costs index for downstream projects (DCCI) increased 3% quarter-on-quarter (q-o-q) during fourth-quarter 2021 to an index value of 225.9. The index rose 15.2% for full-year 2021 due to higher material prices.

Steel and equipment costs increased 14% and 2% respectively during the fourth quarter. Steel needed for the manufacturing of electrical equipment is in short supply. Electric vehicles consume most of the output of the electrical steel market. Steel mills have told battery vehicle makers that for 2022 they will get all the electrical steel they need. But if you make electrical machinery, you’re only going to get about 80%, at best 90%, of your requirements.

While project activity recovered in 2021, it was still not robust. Engineering and project management (EPM) rates remained subdued. There is limited movement on project announcements. During the fourth quarter, EPM rates increased only 0.04%. Meantime, skilled labor is tough to come by. Hiring has been a struggle for the industry.

Specifically, the DCCI refining index rose 3.5% during fourth-quarter 2021 and 16% for the whole year. The procurement of materials has led to higher project costs. However, there are more issues at hand than simply paying a higher dollar amount. Material prices have risen due to supply shortages, exacerbated by the supply chain crunch of 2021. Higher costs have also come with bottlenecks and long lead times. Supply availability is a real concern for project managers. The inability to source materials in a timely manner has wrecked project timelines. This, combined with current issues with the construction workforce, has resulted in a drop in productivity. The inexperience of the workforce is resulting in tasks taking longer to complete. While issues with material prices will be resolved over time, the labor force issue is likely to persist.

The DCCI petrochemical index rose 2.8% during the fourth quarter and 14% for the whole year. Petrochemical project costs rose during the fourth quarter due to higher equipment costs and longer lead times. Cost for electrical and instrumentation equipment increased 3% during the quarter. While electrical and instrumentation costs only account for 7% of total project cost, the current bottlenecks within the market are resulting in project delays, leading to severe cost blowouts. Labor costs increased 1% during the quarter. Companies are struggling to fill vacancies. Despite the increase in pay packages, there are still many job openings.

The IHS Markit Upstream Capital Costs Index (UCCI), which tracks the cost of developing upstream oil and gas assets, rose 3% in fourth-quarter 2021, ending the year with an overall increase of 14%. Steel prices continued to drive the index, although all 10 markets tracked by UCCI posted gains for the quarter and year. Rising costs reflect high energy prices, rising inflation, supply chain issues, and higher labor and raw material costs.

Steel costs tracked by the UCCI rose a further 13% in the fourth quarter, ending 2021 with a 74% year-on-year increase. Steel prices have had a knock-on effect on costs in several upstream markets, most notably bulk materials and equipment. Both these markets were further impacted by bottlenecks in global supply chains, which propagate disruptions and force manufacturers to look for alternate suppliers.

Strong oil prices have revitalized certain sluggish markets like rigs and offshore vessels. However, while demand began to pick up again in second-half 2021, persistent oversupply in both markets hindered the recovery. There remain far too many of these expensive assets on the market for the elevated demand to bring fleet utilization rates up to a point where suppliers have enough negotiating power to command higher day rates.

Meantime, other markets exhibited slight increases. Subsea equipment, construction labor, engineering and project management, and offshore yards and fabrication cost all ticked up by around 1% during fourth-quarter 2021.

IHS Markit forecasts an increase of 3% in 2022 for the UCCI as project activity rises with increased capital spending. As economies continue to recover from the pandemic, demand for fossil fuels is expected to increase, with costs projected to rise in tandem. Contractors and suppliers are likely to take advantage of higher commodity prices in 2022 and push their own cost increases to operators, thus raising the costs of upstream development.

The global Upstream Operating Costs Index (UOCI) grew by 8% year-over-year (y-o-y) in 2021, recovering beyond the third-quarter 2019 pre-pandemic value. This uplift was largely driven by factors outside the oil industry, namely raw material price increases and supply/demand disruptions which fed through into steel products, equipment, and chemicals. We expect UOCI to rise further in 2022, led by a recovery in upstream activity. Increased hiring will drive upstream wages to catch up on inflation as competition for skilled crews heats up in both operating and service companies.