First-quarter 2024 earnings down year-on-year on lower refining margins, natural gas prices

A group of 44 US-based oil and gas producers and refiners recorded a total net earnings of $27 billion in first-quarter 2024, down from earnings of $48.5 billion in the previous year's first quarter. The decrease was mainly driven by lower refining margins and natural gas prices. Total revenues were $319 billion for the quarter, compared with $341 billion a year ago.

Brent crude oil prices averaged $83/bbl in first-quarter 2024, compared with $81/bbl in first-quarter 2023. Crude prices rose during the quarter as the voluntary OPEC+ production cuts, initially introduced in 2023, were prolonged until second-quarter 2024. West Texas Intermediate (WTI) averaged $77.6/bbl in first-quarter 2024, compared with $76/bbl a year earlier.

A winter storm in mid-January hit US production and refining activity hard, leading to sharp declines in both. However, activity rebounded.

US crude oil production in first-quarter 2024 averaged 12.96 million b/d, compared with 12.62 million b/d in the previous year's first quarter, according to the US Energy Information Administration (EIA). Natural gas liquids (NGL) production averaged 6.39 million b/d during the quarter, compared with 6.01 million b/d a year earlier.

According to Baker Hughes, the number of active oil rigs in the US climbed to 510 at end-march from 500 at end-December. There were 592 rigs running end-March 2023.

US commercial crude oil stock at end-March was 454 million bbl, compared with 465 million bbl a year ago and a 5-year average of 464.4 million bbl. The US Strategic Petroleum Reserve (SPR) at end-March held 364 million bbl, compared with 371 million bbl a year ago and a 5-year average of 571.4 million bbl.

US oil products stock at end-March was 758 million bbl, compared with 765 million bbl at the end of the same quarter a year ago and a 5-year average of 788.4 million bbl.

In January and February 2024, US crude oil refinery inputs experienced a sharp decline due to the impact of cold winter conditions, scheduled maintenance at refineries along the Gulf Coast, and unplanned outage in the Midwest.

For first-quarter 2024, US crude oil refinery inputs were 15.38 million b/d, compared with 15.25 million b/d the same period a year ago and 15.93 million b/d for the previous quarter. Refinery utilization rate was 85.7%, compared to 87.1% in first-quarter 2023 and 89.9% in fourth-quarter 2023.

According to Muse, Stancil & Co., refining cash margins in first-quarter 2024 averaged $20.79/bbl for Middle-West refiners, $20.29/bbl for West Coast refiners, $18.43/bbl for Gulf Coast refiners, and $9.42/bbl for East Coast refiners. In the same quarter in 2023, the margins were $30.66/bbl, $27.19/bbl, $30.11/bbl, and $17.25/bbl, respectively.

High levels of inventory have resulted in lower prices at Henry Hub this year. Natural gas prices at Henry Hub averaged $2.13/MMbtu in first-quarter 2024, compared with $2.65/MMbtu a year earlier.

US marketed gas production rose to 113.3 bcfd from 111.2 bcfd in first-quarter 2023, according to data from EIA.

Natural gas inventory ended the quarter at 2,289 bcf, compared with a 5-year average of 1,653 bcf.

US LNG exports averaged 12.38 bcfd during the quarter, an increase of 0.93 bcfd (+8.08%) from the previous year's fourth quarter.

The number of active gas rigs in the US decreased to 116 end-March from 120 at end-December. There were 160 rigs working end-March 2023.

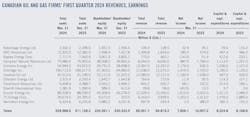

A sample of 13 oil and gas producers and pipeline companies with headquarters in Canada reported combined net earnings of $7.83 billion (Can.) in first-quarter 2024, compared with net earnings of $10.06 billion in the prior year’s quarter.

The average Western Canadian Select (WCS) differential to WTI averaged $19.34/bbl in first-quarter 2024, higher than both first-quarter 2023 and fourth-quarter 2023, primarily reflecting the startup of the Trans Mountain pipeline expansion project (TMX) and stronger US Gulf Coast heavy oil pricing.

US oil, gas producers

ExxonMobil Corp. recorded first-quarter 2024 net profit of $8.2 billion, compared with a net profit of $11.43 billion a year ago. Excluding identified items, adjusted earnings were $8.2 billion, a decrease from $11.6 billion in the same quarter last year.

Earnings decreased as industry refining margins and natural gas prices came down from last year's highs. Timing effects from unsettled derivative mark-to-market impacts and other primarily non-cash impacts from tax and inventory adjustments as well as divestments contributed to the lower earnings.

Strong advantaged volume growth primarily from Guyana and the Beaumont, Tex., refinery expansion, as well as structural cost savings helped to offset lower base volumes from divestments, unfavorable entitlements and government-mandated curtailments, and higher expenses from scheduled maintenance.

First-quarter upstream earnings totaled $5.7 billion, a $797 million decrease from the same quarter last year. The prior-year period was negatively impacted by tax-related identified items. Excluding identified items, earnings decreased by $955 million driven by a 32% decrease in natural gas realizations and other primarily non-cash impacts from tax and inventory adjustments as well as divestments. These factors were partially offset by a 4% increase in liquids realizations and less unfavorable timing effects mainly from derivatives mark-to-market impacts.

Net production was 47,000 boe/d lower than the same quarter last year. However, excluding the impacts from divestments, entitlements, and government-mandated curtailments, net production grew 77,000 boe/d, driven by the start-up of the Payara development in Guyana. Payara reached nameplate capacity of 220,000 b/d in mid-January, ahead of schedule.

The company also made a final investment decision for the Whiptail development in Guyana. The sixth project offshore Guyana is expected to add about 250,000 boe/d of gross capacity with start-up targeted by year-end 2027.

Chevron Corp. posted first-quarter 2024 net income of $5.5 billion, compared with net earnings of $6.6 billion a year earlier. The decrease was primarily due to lower margins on refined product sales and lower natural gas realizations, partly offset by higher upstream sales volumes in the US. Adjusted earnings of $5.4 billion in this year’s first quarter were down from $6.7 billion in the year-ago period.

US upstream earnings of $2 billion were higher than first-quarter 2023’s $1.78 billion, primarily due to higher sales volumes, including from legacy PDC assets, partly offset by higher depreciation, depletion, and amortization mainly from higher production, and lower realizations.

International upstream earnings of $3.2 billion were lower than last year’s first quarter earnings of $3.4 billion, primarily due to lower natural gas realizations, partly offset by favorable tax impacts, including the absence of first-quarter 2023 tax charges related to the energy profits levy in the UK, higher liquids realizations, and favorable foreign currency effects.

US and international downstream earnings both declined from the year-ago levels, due to lower margins on refined product sales. In the US, downstream earnings were also negatively impacted by higher operating expenses from planned shutdowns.

ConocoPhillips reported net earnings of $2.6 billion for first-quarter 2024 as compared with net earnings of $2.9 billion for first-quarter 2023. Excluding special items, first-quarter 2024 adjusted earnings were $2.4 billion, compared with first-quarter 2023 adjusted earnings of $2.9 billion.

The decrease was primarily due to impacts from lower prices, higher costs, and higher depreciation, depletion and amortization, partially offset by increased volumes and a benefit from the investment tax incentive special item.

Production for first-quarter 2024 was 1.9 million boe/d, an increase of 110,000 boe/d from the same period a year ago. After adjusting for closed acquisitions and dispositions, first-quarter 2024 production increased 43,000 boe/d, or 2%, from the same period a year ago.

For the quarter, cash provided by operating activities was $5 billion. The company funded $2.9 billion of capital expenditures and investments, repurchased $1.3 billion of shares, and paid $0.9 billion in ordinary dividends and VROC and retired debt of $0.5 billion at maturity.

Occidental Petroleum had first-quarter 2024 net earnings of $718 million, compared with net earnings of $983 million for the prior year's first quarter.

In the quarter, Occidental's overall production was 1.17 million boe/d compared with 1.22 million boe/d in early 2023. The reduction was primarily a result of Gulf of Mexico output declining to 90,000 boe/d, nearly half of the previous level, due to a November spill from a Main Pass Oil Gathering Co. pipeline. Occidental's Gulf of Mexico platforms resumed production in mid-April.

Production volumes from the Rockies and other domestic sources surpassed guidance at 286,000 boe/d, while the Permian basin and international volumes met guidance at 567,000 boe/d and 229,000 boe/d, respectively.

In first-quarter 2024, Permian Resources Corp. had net income of $146.6 million, an increase from $102 million in the same period of 2023. Operating revenues saw a more than twofold increase to $1.24 billion, with operating income jumping to $469 million from $236 million.

In first-quarter 2024, Permian Resources achieved an output of close to 152,000 b/d of crude oil and over 319,000 boe/d in total average production, attributed to improved well productivity and the expedited integration of Earthstone Energy Inc. operations.

US independent refiners

Marathon Petroleum Corp. had a net income of $937 million for first-quarter 2024, down from net earnings of $2.7 billion in first-quarter 2023. Adjusted EBITDA was $3.3 billion, compared with $5.2 billion for first-quarter 2023. The decrease in net income and adjusted EBITDA from a year ago was driven by lower refining margins.

Adjusted EBITDA for the Refining & Marketing (R&M) segment was $1.9 billion in first-quarter 2024, versus $3.9 billion for first-quarter 2023. The decrease in segment adjusted EBITDA was driven by lower market crack spreads and lower throughputs.

R&M margin was $18.99/bbl for first-quarter 2024, versus $26.15/bbl for first-quarter 2023. Crude capacity utilization was 82%, leading to total throughput of 2.7 million b/d.

Phillips 66 recorded a net income of $748 million for first-quarter 2024, down from net earnings of $2 billion in the year-ago first quarter.

In first-quarter 2024, refining reported a pre-tax income of $131 million, a decrease from $814 million in fourth-quarter 2023. First-quarter results included a $104 million asset impairment and a $7 million benefit from a legal settlement. In comparison, fourth-quarter results featured a $17 million tax benefit.

Refining's adjusted pre-tax income stood at $228 million in the first-quarter, down from $797 million in the fourth quarter. This decline was primarily attributed to reduced realized margins, impacts from inventory hedging, and lower Gulf Coast clean product realizations. The first-quarter pre-tax turnaround expense reached $160 million, with $36 million linked to the Rodeo Renewable Energy Complex. Key operational metrics included a crude utilization rate of 92%, a clean product yield of 84%, and a market capture of 69%.

The Chemicals segment reflects Phillips 66’s equity investment in Chevron Phillips Chemical Co. LLC (CPChem). Chemicals first-quarter 2024 reported and adjusted pre-tax income was $205 million, compared with fourth-quarter 2023 reported and adjusted pre-tax income of $106 million, thanks to higher polyethylene margins driven by improved sales prices and a decline in feedstock costs, as well as lower turnaround costs.

Valero Energy Corp. recorded a net income of $1.25 billion for first-quarter 2024, down from net earnings of $3 billion in first-quarter 2023. The Refining segment reported operating income of $1.7 billion for first-quarter 2024, compared with $4.1 billion a year ago. Refining throughput volumes averaged 2.8 million b/d in first-quarter 2024.

The Renewable Diesel segment, which consists of the Diamond Green Diesel joint venture (DGD), reported $190 million of operating income for first-quarter 2024, compared with $205 million in the year-ago quarter.

Canadian firms

All financial figures are presented in Canadian dollars unless noted otherwise.

Canadian Natural Resources Ltd. had a net income of $987 million for first-quarter 2024, compared with a net income of $1.8 billion for first-quarter 2023. Adjusted net earnings from operations was $1.5 billion.

Canadian Natural drilled a total of 77 net crude oil and natural gas wells in first-quarter 2024, compared with 106 net wells in first-quarter 2023, a decrease of 29 net wells over this time period. This decrease in drilling activity reflects the company's decision to focus on longer-cycle development opportunities in first-half 2024 and shorter-cycle development opportunities in second-half 2024.

Suncor Energy Inc. had a net profit of $1.6 billion for first-quarter 2024, down from a net income of $2 billion in first-quarter 2023. Suncor's adjusted operating earnings of $1.8 billion in this year’s first quarter were comparable to $1.81 billion in the prior year quarter, primarily due to higher oil sands sales volumes and refinery production, partially offset by lower refined product realizations, lower average oil dands price realizations and increased oil sands royalties.

In first-quarter 2024, Suncor's total oil sands bitumen production rose to 932,100 b/d from 811,300 b/d in the previous year's quarter. This increase was primarily driven by higher absolute bitumen output at Fort Hills, in addition to the company's increased working interest, higher bitumen production at oil sands operations, including a record Firebag production. Conversely, exploraiton and production declined compared with the previous year's quarter, mainly due to the divestment of Suncor's UK portfolio and the non-operation of White Rose, partially balanced by production from Terra Nova as the ramp up of the asset progresses.

Refinery crude throughput for the first quarter reached 455,300 b/d, while refinery utilization stood at 98%, a notable rise from 367,700 b/d and 79% in the prior year's quarter.

Imperial oil reported estimated net income in the first quarter of $1.2 billion, down from net income of $1.36 billion in fourth-quarter 2023, reflecting an expected seasonal decrease in upstream production volume.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.

Laura Bell-Hammer

Statistics Editor

Laura Bell-Hammer is the Statistics Editor for Oil & Gas Journal, where she has led the publication’s global data coverage and analytical reporting for more than three decades. She previously served as OGJ’s Survey Editor and had contributed to Oil & Gas Financial Journal before publication ceased in 2017. Before joining OGJ, she developed her industry foundation at Vintage Petroleum in Tulsa. Laura is a graduate of Oklahoma State University with a Bachelor of Science in Business Administration.