Fourth-quarter 2024 earnings down on lower commodity prices, refining margins

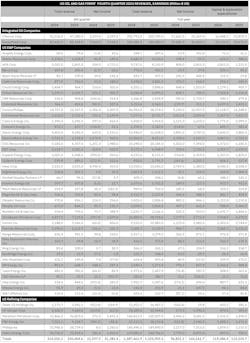

A group of 51 US-based oil and gas producers and refiners had combined net earnings of $22.34 billion in fourth-quarter 2024, compared with earnings of $31.28 billion a year earlier. Total revenues were $314.55 billion for the quarter, compared with $330.4 billion a year ago. For full-year 2024, the group posted combined earnings of around $96.8 billion, down from $144.2 billion in 2022.

The declines in full-year and fourth-quarter earnings reflect lower commodity prices and refining margins, partly offset by higher volumes.

Brent crude oil prices averaged $74.65/bbl in fourth-quarter 2024, compared with $83.90/bbl a year earlier and $80.03/bbl in third-quarter 2024. West Texas Intermediate (WTI) averaged $70.70/bbl in fourth-quarter 2024, compared with $78.41/bbl a year earlier and $76.43/bbl in third-quarter 2024.

Brent price averaged $81/bbl for full-year 2024, compared with $83/bbl in 2023. WTI price averaged $76/bbl for full-year 2024, compared with $78/bbl in 2023.

For fourth-quarter 2024, US crude oil production averaged 13.45 million b/d, compared with 13.25 million b/d in the previous year's fourth quarter, according to US Energy Information Administration (EIA) data. US natural gas liquids (NGL) production averaged 7.22 million b/d during the quarter, compared with 6.75 million b/d a year ago.

US commercial crude oil stock at end-December was 413 million bbl, compared with 426 million bbl at the end of the same quarter a year ago and a 5-year average of 438.8 million bbl.

US oil product stock at end-December was 823 million bbl, compared with 824 million bbl at the end of the same quarter in 2023 and a 5-year average of 819.8 million bbl.

The US Strategic Petroleum Reserve (SPR), at end-December, held 393.6 million bbl, compared with 354.7 million bbl at the end of fourth-quarter 2023 and a 5-year average of 518.2 million bbl.

US refinery distillation inputs were 16.8 million b/d in fourth-quarter 2024, compared with 16.47 million b/d in fourth-quarter 2023 and 16.95 million b/d for the previous quarter. The refinery utilization rate was 91.6% for the quarter, compared with 89.9% in fourth-quarter 2023 and 92.5% in third-quarter 2024.

According to Muse, Stancil & Co., refining cash margins in fourth-quarter 2024 averaged $12.98/bbl for Middle-West refiners, $12.66/bbl for West Coast refiners, $8.74/bbl for Gulf Coast refiners, and $4.54/bbl for East Coast refiners. In the same quarter of the prior year, these refining margins were $20.64/bbl, $18.38/bbl, $12.76/bbl, and $9.58/bbl, respectively.

Natural gas spot prices at Henry Hub averaged $2.44/MMbtu in fourth-quarter 2024, compared with $2.74/MMbtu for the same quarter a year ago and $2.11/MMbtu for third-quarter 2024. US marketed gas production averaged 114.32 bcfd, compared with 114.46 bcfd for the same quarter a year ago and 113 bcfd in the prior quarter, according to EIA data.

Natural gas inventory ended the quarter at 3,438 bcf, compared with a 5-year average of 3,224 bcf. US LNG exports averaged 12.64 bcfd during the quarter, compared with 12.97 bcfd in the previous year's fourth quarter.

A sample of 13 companies based in Canada, including oil and gas producers and pipeline operators, recorded combined income of $4.9 billion (Can.) in fourth-quarter 2024. In the fourth quarter of the prior year, this group’s combined earnings were $9.96 billion.

WTI/WCS (Western Canadian Select) spread narrowed to $12.55/bbl in fourth-quarter 2024 from $21.90/bbl in fourth-quarter 2023. The differential was $18.62/bbl in 2023, comparable to $14.70/bbl in 2024.

US oil, gas producers

ExxonMobil Corp. posted quarterly revenue of $83.4 billion, marginally lower than $84.3 billion in fourth-quarter 2023. Net income stood at $7.61 billion, almost flat from the previous year. For the full year, ExxonMobil reported revenue of $349.6 billion, with net income totaling $33.68 billion, down from $36.01 billion in 2023. The company increased its capital and exploration expenditures significantly, reaching $25.13 billion, up from $22.67 billion (OGJ Online, Jan. 31, 2025).

ExxonMobil achieved a net production of 4.6 MMboe/d in the fourth quarter, marking an increase of 20,000 boe/d compared with the previous quarter. This growth was primarily driven by record outputs from its Guyana and Permian basin operations. For the full year, ExxonMobil's production averaged 4.3 MMboe/d, the highest level in over a decade, representing a 16% increase, or 595,000 boe/d.

Chevron Corp. reported total fourth-quarter revenue of $52.2 billion, up from $47.1 billion in the previous year’s fourth quarter. Net income improved to $3.24 billion, compared with $2.26 billion in fourth-quarter 2023 (OGJ Online, Feb. 3, 2025).

Despite a positive quarter, Chevron's full-year net income dropped to $17.66 billion, a significant decline from $21.37 billion in 2023. The company attributed this decline to weaker refining margins, lower realizations, and severance charges. Capital and exploration expenditures for the year rose modestly to $16.45 billion from $15.83 billion in 2023, primarily due to higher upstream investments.

In 2024, Chevron started several key projects in the Gulf of Mexico, including the industry-first, high-pressure Anchor project. In Kazakhstan, Tengizchevroil completed the Wellhead Pressure Management Project and started up the Future Growth Project. Chevron also repurchased over $15 billion of its shares in 2024.

During 2024, Chevron’s worldwide and US net oil-equivalent production set annual records. Worldwide production increased 7% from a year ago primarily due to nearly 18% growth in the Permian basin and a full year of legacy PDC Energy production.

Among US exploration and production (E&P) firms, ConocoPhillips reported fourth-quarter 2024 earnings of $2.3 billion, compared with fourth-quarter 2023 earnings of $3.0 billion. Excluding special items, fourth-quarter 2024 adjusted earnings were $2.4 billion, compared with fourth-quarter 2023 adjusted earnings of $2.9 billion. Full-year 2024 earnings were $9.2 billion, compared with full-year 2023 earnings of $11.0 billion.

ConocoPhillips delivered full-year total and Lower 48 production of 1.98 MMboe/d and 1.15 MMboe/d, respectively (OGJ Online, Feb. 6, 2025). The company reached first production at Nuna in Alaska and Bohai Phase 5 in China in the fourth quarter and at Eldfisk North in Norway in the second quarter. The operator also reported a preliminary reserve replacement ratio of 244% for 2024, with an organic reserve replacement ratio of 123%.

Diamondback Energy Inc. reported robust earnings with fourth-quarter revenue rising to $3.71 billion, up from $2.23 billion. The company's net income also improved, hitting $1.07 billion versus $960 million in the same quarter last year. Full-year revenue stood at $11.07 billion, with net income rising to $3.34 billion, reflecting strong operational efficiency.

During fourth-quarter 2024, Diamondback spent $834 million on operated and non-operated drilling and completions, $93 million on infrastructure and environmental, and $6 million on midstream, for total cash capital expenditures of $933 million. During the quarter, Diamondback drilled 131 gross wells in the Midland basin and 6 gross wells in the Delaware basin. The company turned 124 operated wells to production in the Midland basin and 4 gross wells in the Delaware basin, with an average lateral length of 11,810 ft.

EOG Resources Inc. posted quarterly revenue of $5.58 billion, down from $6.36 billion in fourth-quarter 2023 (OGJ Online, Feb. 28, 2025). Net income followed a similar downward trend, recording $1.25 billion, compared with $1.99 billion a year earlier. Full-year net income fell to $6.4 billion from $7.59 billion, due to lower commodity prices and higher operating expenses.

US independent refiners

Marathon Petroleum Corp.’s (MPC) net income plunged to $371 million in fourth-quarter 2024 from $1.45 billion in the previous year, reflecting tightening refining margins. For the full year, Marathon generated revenue of $140.4 billion, a slight decline from $150.3 billion in 2023. Net income fell sharply to $3.45 billion from $9.68 billion.

MPC’s Refining & Marketing (R&M) segment adjusted EBITDA was $559 million in fourth-quarter 2024, versus $2.2 billion for fourth-quarter 2023. The decrease in segment adjusted EBITDA was driven primarily by lower market crack spreads. R&M margin was $12.93/bbl for fourth-quarter 2024, versus $17.81/bbl for fourth-quarter 2023. Crude capacity utilization was about 94%, resulting in total throughput of 3.0 million b/d for the quarter.

Valero Energy Corp. generated net income of $281 million for fourth-quarter 2024, compared with $1.2 billion for fourth-quarter 2023. Adjusted net income attributable to Valero stockholders was $207 million, compared with $1.2 billion for fourth-quarter 2023. For 2024, Valero’s net income was $2.8 billion, compared with $8.8 billion in 2023. Adjusted net income was $2.7 billion in 2024, down from $8.9 billion in 2023.

Valero Energy’s refining segment had operating income of $437 million for fourth-quarter 2024, compared to $1.6 billion for fourth-quarter 2023. Refining throughput volumes averaged 3.0 million b/d in fourth-quarter 2024. Valero’s refining margin dropped to $8.44/bbl in fourth-quarter 2024 from $12.89/bbl in fourth-quarter 2023.

Phillips 66 Co. generated fourth-quarter revenues of $34 billion, a decrease from $38.7 billion in the same quarter last year. Net income for the fourth quarter of 2024 dropped significantly to $8 million, down from $1.26 billion in the previous year. For the full year, net income also fell to $2.12 billion in 2024 from $7.02 billion in 2023. The decline in 2024 was largely attributed to a decrease in realized refining margins, primarily due to lower market crack spreads, though it was somewhat mitigated by a lower income tax expense.

The Refining segment experienced a $5.7 billion decline in results in 2024 compared with the previous year, mainly due to reduced realized margins linked to falling market crack spreads. Worldwide realized refining margins dropped to $8.80/bbl in 2024 from $17.3/bbl in 2023 and $21.77/bbl in 2022. The company’s global crude oil refining capacity utilization rates were 95% in 2024, compared with 92% in 2023.

In contrast, the Chemicals segment saw an improvement of $276 million in 2024 results compared with 2023, driven by better margins resulting from higher sales prices, reduced feedstock costs, increased volumes, and lower utility expenses.

Canadian firms

All financial figures are presented in Canadian dollars unless noted otherwise.

Suncor Energy Inc.’s net earnings were $818 million in fourth-quarter 2024, compared with $2.82 billion in the prior year quarter. The decrease was due to lower refined product realizations, increased royalties due to higher heavy crude price realizations, and increased depreciation, depletion and amortization (DD&A) expense, partially offset by higher sales volumes.

The company’s total oil sands bitumen production increased to a record 951,500 b/d in fourth-quarter 2024, compared with 866,200 b/d in the prior year quarter, primarily due to record production at Firebag, the company’s increased working interest at Fort Hills, and strong mining performance. The company’s net synthetic crude oil (SCO) production increased to a fourth-quarter record of 543,600 b/d, compared with 475,700 b/d in the prior year quarter due to fewer planned maintenance activities.

Production increased to 57,500 b/d in the fourth quarter of 2024, compared with 50,700 b/d in the prior-year quarter, primarily due to the addition of production from Terra Nova and increased production at Hibernia, partially offset by the absence of production from White Rose due to the asset life extension project.

Imperial Oil Ltd. generated estimated net income in the fourth quarter of $1.225 billion, compared with net income of $1.237 billion in third-quarter 2024, primarily due to lower realizations, partially offset by higher production and stronger downstream refinery capacity utilization. Quarterly cash flows from operating activities were $1.789 billion, up from $1.487 billion generated in third-quarter 2024.

Upstream production in fourth-quarter 2024 averaged 460,000 boe/d, which is the highest quarterly production in over 30 years when adjusting for the divestment of XTO Energy Canada.

The company’s downstream throughput in the quarter averaged 411,000 b/d, resulting in an overall refinery capacity utilization of 95%, even with the completion of the Nanticoke turnaround. Full-year throughput achieved the high end of the company's 2024 guidance, averaging 399,000 b/d, with capacity utilization of 92% and petroleum product sales of 466,000 b/d. Construction continued on Canada’s largest renewable diesel plant at the Strathcona refinery, with a targeted start-up date of mid-2025.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.

Laura Bell-Hammer

Statistics Editor

Laura Bell-Hammer is the Statistics Editor for Oil & Gas Journal, where she has led the publication’s global data coverage and analytical reporting for more than three decades. She previously served as OGJ’s Survey Editor and had contributed to Oil & Gas Financial Journal before publication ceased in 2017. Before joining OGJ, she developed her industry foundation at Vintage Petroleum in Tulsa. Laura is a graduate of Oklahoma State University with a Bachelor of Science in Business Administration.