Rystad Energy: Extended trade war could wipe out half of China’s anticipated oil demand growth

Uncertainties surrounding US President Donald Trump’s tariff policies disrupted the markets' initial trajectory and raised concerns about the broader economy and demand prospects.

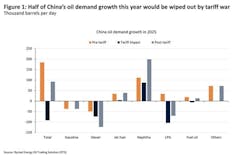

According to Rystad Energy analysis, a prolonged trade war could eliminate up to half of China’s anticipated 2025 oil demand growth of 180,000 b/d if downside risks to the country’s outlook materialize.

With tensions between the US and China continuing to simmer, a potential tit-for-tat tariff war is expected to further pressure oil prices, which have already shown signs of weakening—dragging down product prices as well, according to Rystad Energy.

China’s first-quarter gross domestic product (GDP) growth beat expectations at 5.4%, together with other macroeconomic indicators showing growing signals such as exports, the Purchasing Managers’ Index (PMI), and retail sales. Strong economic growth in the first quarter was based on last September’s stimulus taking effect gradually.

Assuming trade relations between China and the US remain disrupted, a mild scenario is likely for this year, with China’s GDP growth slowing down by 1 percentage point, Rystad Energy said.

Slower GDP growth is expected to reduce Chinese oil demand growth by 0.47 percentage points, given the economy's continued reliance on industry and exports. However, with the government poised to introduce additional stimulus measures in response to the trade war, there is potential for upside that could help counterbalance the negative effects and lessen the decline in oil demand growth. Overall, the current forecast suggests a reduction of 90,000 b/d in oil demand growth, down from an initial estimate of 180,000 b/d.

“The biggest loss is in diesel and biggest gain in naphtha – offsetting some demand loss. Petrochemical and diesel demand will bear the most downside pressure because of the trade war, as consumer spending and industry prosperity and industry-related transportation will be damaged by potential trade decline,” said Rystad Energy.

However, domestic petrochemical feedstock demand could be supported by less dependence on imports amid the lifted tariffs. Liquefied petroleum gas (LPG) demand growth will slow with a shift towards naphtha demand upside as a potential utilization rate increase of steam crackers will offset the loss from propane dehydrogenation (PDH) as propane relies on external supply.

Around 100,000 b/d of propane demand will be at risk if the trade war sustains and PDH operators are unable to pivot, with the US dominating supply.

Gasoline and jet fuel demand, strongly associated with personal and business mobility, will not be negatively impacted in a mild trade war scenario. There could, however, be some restructuring between international and domestic travel and potentially a changed average distance of travel, while some upside potential exists as lower prices are likely to boost consumption.

Market dynamics

China crude oil imports rebounded to 12 million b/d in March, a 19-month high, amid recovering imports from Russia and Iran after a muted January and February. Significant stock draws have been seen in the first 2 months of this year amid sanctions, and crude storage levels are expected to rebound amid active crude buying in March and April, according to Rystad Energy.

Chinese state-owned refineries are still shunning sanctioned Russian crudes, while Shandong refiners are taking the chance to increase Russian imports. Iranian crude unloading in China has slightly recovered after falling to zero last week following US sanctions.

“We expect China will carefully unload more Iranian cargos at Shandong ports, and any further sanctions will again plunge the weekly unloading to zero. The market is still concerned the US will sanction more companies for buying Iranian crude,” said Rystad Energy.

Teapot refineries currently rely to a large degree on Russian crude and a small share of Iranian barrels to run their refineries as fuel oil processing has become unprofitable since the start of this year with the policy change.

ExxonMobil has started up and produced ethylene at its new 1.6-million tonnes/year (tpy) cracker in Huizhou, in China’s Guangdong province, the US major said Apr. 12. The start-up will support China’s naphtha demand and imports.

China’s LPG market has reacted rapidly to tariffs. Refineries have been selling LPG in the domestic market instead of using it on-site, while some propane users may switch to naphtha or reduce run rates.

China remains a net importer of ethylene and propylene, despite rapid cracker and PDH plant expansions. Imports from South Korea, Japan, and other Asian countries could rise if domestic run rates decline because of tariffs.