IEA: Global oil market faces setback amid trade tensions

The global oil market is feeling the impact of intensifying trade tensions and a softening economic outlook, prompting a downward revision in demand growth for the year.

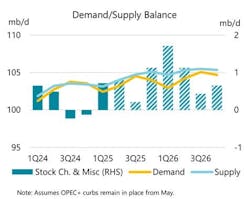

According to the latest monthly oil market report from the International Energy Agency (IEA), global oil demand is now expected to rise by just 730,000 b/d in 2025 — a 300,000 b/d reduction from last month’s estimate. Roughly half of this downgrade occurs in the US and China, with most of the remainder in trade-oriented Asian economies.

The deceleration is projected to continue into 2026, with growth further slowing to 690,000 b/d. However, risks to the forecasts remain rife given the fast-moving macro backdrop, IEA noted.

“While imports of oil, gas and refined products were given exemptions from the tariffs announced by the US, concerns that the measures could stoke inflation, slow economic growth and intensify trade disputes weighed on oil prices. With negotiations and countermeasures still ongoing, the situation is fluid and substantial risks remain,” IEA said.

Notably, the downgrade comes on the heels of robust oil consumption in first-quarter 2024, up by 1.2 million b/d year-over-year – its strongest rate since 2023, as a relatively cold end to the winter season in key regions boosted heating use.

Oil supply

On the supply side, world oil output climbed by 590,000 b/d in March to reach 103.6 million b/d, marking a 910,000 b/d increase from a year earlier. The gains were driven primarily by non-OPEC+ producers.

While OPEC+ plans to raise production targets by 411,000 b/d in May, the actual increase may fall short due to overproduction issues among certain member nations, according to IEA.

“Notably, Kazakhstan crude oil output reached a record high of 1.8 million b/d following the start-up of the Chevron-operated Tengiz oilfield expansion project. This puts Kazakhstan some 390,000 b/d above its OPEC+ output quota. In addition, several countries in the group have committed to compensate for earlier overproduction in the coming months, which may negate most of the increase,” IEA said.

Full-year global supply growth for 2025 has been revised down by 260,000 b/d to 1.2 million b/d, primarily due to weaker output expectations from the US and Venezuela. For 2026, production is forecast to expand by 960,000 b/d, with offshore developments playing a key role.

“The significant drop in oil prices rattled the US shale patch, with firms arguing they need $65/bbl on average to profitably drill new light tight oil wells, according to the latest Dallas Fed Energy Survey,” IEA said.

Meantime, “new tariffs may also make it more expensive to buy steel and equipment, further discouraging drilling. Along with the impact of Chinese tariffs on imports of US ethane and LPG, this has resulted in a downward revision of 150,000 b/d to our US oil supply forecast for this year, with growth now assessed at 490,000 b/d. However, conventional oil projects remain on track, with total non-OPEC+ supply expected to rise by 1.3 million b/d,” IEA said.

Refining, inventory

Refining activity is also feeling the pressure from reduced demand expectations. Global crude runs are forecast to average 83.2 million b/d in 2025 — with the annual growth estimate cut by 230,000 b/d to 340,000 b/d. In 2026, throughputs are projected to rise slightly to 83.6 million b/d. Refining margins delivered a mixed performance in March, with weakness across the Atlantic Basin offset by gains in Asia, particularly for sour crude processing in Singapore. Softer middle distillate cracks were largely responsible for the margin pressure.

Inventory data showed global observed oil stocks increasing by 21.9 million bbl in February to reach 7.647 billion bbl. This build, however, still left inventories near the lower end of the 5-year range. Crude oil, natural gas liquids (NGLs), and feedstocks contributed a combined 41.2 million bbl to the increase, with 14.1 million bbl coming from OECD onshore stockpiles.

Oil product inventories declined by 19.2 million bbl, largely due to a significant 34.2 million-bbl drawdown in OECD countries. Preliminary figures suggest stockpiles continued to grow in March, led by crude builds in non-OECD regions and oil on water.