Shell: Global LNG demand set to rise 60% by 2040

Global demand for liquefied natural gas (LNG) is projected to increase by around 60% by 2040, driven by economic expansion in Asia, emissions reduction efforts in heavy industry and transportation, and the growing impact of artificial intelligence, according to Shell’s LNG Outlook 2025.

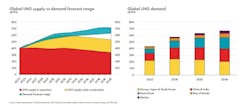

Industry forecasts now anticipate LNG demand to reach 630-718 million tons/year (tpy) by 2040, reflecting an upward revision from previous estimates.

In 2024, global LNG trade expanded by just 2 million tons, reaching 407 million tons—the smallest annual growth in a decade. This slowdown was primarily due to limited new supply development. However, more than 170 million tons of new LNG capacity is expected to come online by 2030, which will help meet rising demand, particularly in Asia. That said, uncertainties remain regarding the timeline for new LNG project start-ups.

“Upgraded forecasts show that the world will need more gas for power generation, heating and cooling, industry and transport to meet development and decarbonization goals,” said Tom Summers, senior vice-president, Shell LNG Marketing and Trading.

“LNG will continue to be a fuel of choice because it’s a reliable, flexible and adaptable way to meet growing global energy demand,” he added.

Asia’s expanding role in LNG demand

China is significantly boosting its LNG import capacity while also expanding its natural gas pipeline network to connect an additional 150 million people by 2030. Meanwhile, India is ramping up its natural gas infrastructure, planning to add gas connections to 30 million people within the next 5 years.

LNG as a bridge to lower-carbon fuels

The marine sector is seeing a surge in LNG adoption. The increasing number of LNG-powered vessels is expected to drive annual LNG demand to more than 16 million tons by 2030, marking a 60% increase from previous forecasts. LNG continues to be a cost-effective option for shipping and road transport, reducing emissions while offering future pathways for integrating bio-LNG and synthetic LNG, according to Shell’s outlook.

In Europe, LNG will remain critical into the 2030s, helping balance intermittent renewable power generation while ensuring energy security. In the long term, existing gas infrastructure may be repurposed to import bio-LNG, synthetic LNG, or even green hydrogen.

The US is set to strengthen its position as the world’s largest LNG exporter, potentially reaching 180 million tpy by 2030 and accounting for roughly one-third of global supply. Qatar is also expected to significantly expand its LNG supply.

Market tightness in 2024

Early 2024 saw spot LNG prices drop to their lowest level since early 2022, but prices rebounded by mid-year due to delays in bringing new supply capacity online.

Asian demand surged in first-half 2024, with China importing 79 million tons—taking advantage of lower prices—while India’s imports climbed to 27 million tons, a 20% year-on-year increase driven by stronger power needs amid hot summer conditions.

In contrast, European LNG imports declined by 23 million tons (19%) in 2024, due to strong renewable energy generation and sluggish recovery in industrial gas demand. However, cold winter temperatures and periods of low wind power output led to higher gas storage withdrawals.

The expiration of Russian pipeline gas flows via Ukraine on Dec. 31, 2024, further tightened the market, pushing prices higher. Looking ahead, Europe is expected to increase LNG imports in 2025 as it works to replenish its gas storage levels.