Oil, fundamental analysis

After a bullish start to the holiday-shortened trading week, oil prices look to settle lower on market uncertainty as numerous conflicting factors played out.

An attack on a crude pipeline pumping station, Trump administration tariffs and plans for the Strategic Petroleum Reserve (SPR), a possible ceasefire between Russia and Ukraine and the fourth-straight increase in crude inventories had traders looking at mixed signals all week. In the end, the failure to breach a key technical area sent prices lower ahead of the weekend.

April 2025 WTI saw a High of $73.20/bbl on Thursday’s inventory report that showed draws in both gasoline and distillate stocks. The Low was Tuesday’s $70.20/bbl. Brent hit a High of $77.20 on Thursday and a Low of $74.10 on Monday. Both grades settled lower week-on-week. The WTI/Brent spread is currently at -$4.00.

The Tuesday drone attack on the CPC pipeline, Kazakhstan’s key export conduit, set a bullish tone for the week. Announcements by President Trump were a “mixed bag” for oil. On one hand, his plan to refill the SPR added some upside to prices as well but “(filling) it up fast” is easier said than done as there are limitations on how much crude can flow into the various caverns on a daily basis. On the other hand, talk of a Russia/Ukraine ceasefire is seen as bearish as is his talk of tax breaks for US oil and gas companies which would only increase production.

Goldman Sachs does not see much of a drop in oil prices should a Russia/Ukraine ceasefire take place as the former’s participation in OPEC+ constrains their output. Meanwhile, BofA predicts that a ceasefire could lead to as much as a $10/bbl drop in the price of Brent crude.

The other wild card is whether or not OPEC+ will increase output in April as previously announced. Bloomberg is reporting that, according to analysts with the oil exporting group, there are talks about pushing out the increase further despite the US President’s call for them to release more production.

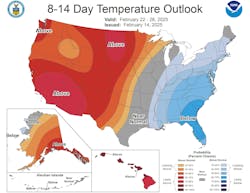

Meanwhile, the cold weather in the US has created a double-edged sword for oil prices as heating oil demand has increased but frigid temperatures have reduced production in areas such as the Bakken shale in North Dakota.

In light of President Trump’s threat of tariffs on Canadian crude imports, legislators there are considering some shelved oil pipeline projects that would increase volumes shipped to their West Coast. And, in China, the retaliatory tariffs on US energy imports has led to cargoes of LNG being diverted to Europe and less US coal being brought in.

The Energy Information Administration’s (EIA) Weekly Petroleum Status Report indicated that commercial crude oil inventories for last week increased while gasoline and distillate stocks decreased. The SPR was steady at 395 million bbl. Total US oil production rose 3,000 b/d to 13.497 million b/d vs. 13.3 last year at this time.

Consumer sentiment fell this month to a 15-month low of 64.7 as households worry that the Trump tariffs will eat at their purchasing power. Sales of existing homes last month fell -4.9%, much higher than the forecasted -2.6%. All three major US stock indexes are lower on the week mainly on the consumer perspective on tariffs. The USD is lower which may be helping set a floor for crude prices this week.

Oil, technical analysis

April 2025 became the “prompt” month this week and NYMEX WTI Futures are below the 8-, 13-, 20- and 200-day Moving Averages but above the 100-day MA. They have been range-bound for 3 weeks, and the failure to hold above the 200-day was technically bearish. Volume is about average at 225,000. The Relative Strength Indicator (RSI), a momentum indicator, is “slightly-oversold” at the “44” mark. Resistance is now pegged at $72.15 (-day MA) with near-term Support at $70.50.

Looking ahead

US refiners will soon enter the turnaround period where they prepare for summer blends of gasoline and conduct routine maintenance. While this could raise pump prices in the near-term, this also reduces demand for crude feedstocks. The Trump administration’s “flood the zone” strategy is causing uncertainty and chaos in global crude markets currently.

As some of these policies become clearer and are implemented, traders will ascertain their impacts. There are questions to be answered in the near term. “Will OPEC+ delay again their output increase?” “How soon will the Trump administration announce bulk crude purchases for the SPR?” “Will a ceasefire be negotiated between Russia and Ukraine and will it last?" "Will that be enough for sanctions against Russia to be removed?” Near-term, the NOAA 8-14-day forecast is bullish for heating oil demand in the Northeast.

Natural gas, fundamental analysis

The rally in natural gas has continued into the third week on below-normal temperatures and another large storage withdrawal that has increased the deficit to year-ago and 5-year average levels. Additionally, LNG send out continues to increase and set a new record high.

March NYMEX Henry Hub prices had a High of $4.35/MMbtu Thursday with a Low of $3.55 on Tuesday. Supply last week was -1.0 bcfd to 111.5 bcfd vs. 112.5 the prior week on weather-related freeze-offs.

Demand was +11 bcfd to 146.5 bcf vs. 135 bcfd the week prior, with the biggest increase in Residential consumption. Exports to Mexico were 6.4 bcfd vs. 6.4 the prior week. LNG exports were 16.1 bcfd (a new high) vs. 15.7 bcfd the prior week.

The EIA’s Weekly Natural Gas Storage Report indicated a withdrawal of 196 bcf vs. a forecast of -188 bcf. Total gas in storage is now 2.1 tcf, dropping to 15.5% below last year and 5.3% below the 5-year average.

Natural gas, technical analysis

March 2025 NYMEX Henry Hub Natural Gas futures remain above the 8-, 13- and 21-day Moving Averages and are around the Upper-Bollinger Band limit, a SELL signal. Volume is about average at 200,000. The RSI is “very overbought” at “70”. Critical Support is pegged at $4.00 with Resistance at $4.20 (Upper-Bollinger Band threshold).

Looking ahead

European natural gas storage levels were most recently reported at 1.8 tcf as large withdrawals continue. Prices were most recently at $14.40/MMbtu. As with heating oil, the next 14 days look bullish for natural gas demand. However, it appears that global LNG demand will remain robust in the near-term.

Cheniere Energy is reporting first deliveries of LNG from its expansion project at the Corpus Christi LNG plant (OGJ Online, Feb. 20, 2025). More mild temperatures appear to be in the forecast for early March after the coming week’s cold along the Eastern Seaboard.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.