Oil, fundamental analysis

Oil prices continued into an 11-day downtrend this week as geopolitics took a backseat to talks of tariffs, a US Federal Reserve rate freeze, a stronger US Dollar, decreased manufacturing activity in China, and the first increase in commercial crude inventories in 10 weeks.

WTI saw a High of $75.15/bbl on Monday while the Low was Friday’s $71.95, repeating the pattern from the prior week. Brent crude saw its High on Monday as well at $79.00/bbl but had its Low of $76.00 occur on Wednesday. Both grades were lower on the week. The WTI/Brent spread has widened to -$4.15/bbl.

President Donald Trump said he will decide Friday night whether or not to impose 25% tariffs on imports coming from Canada and Mexico that would become effective Feb. 1. Tariffs would raise the cost of all goods coming from the two countries, including bitumen flowing down from Alberta.

The USD traded higher as a result of that prospect which has a negative impact on US exports and caused crude prices to fall as a result. Last year, 75% of the heavy crude US refiners need came from Canada with a smaller amount coming from Mexico.

The US Federal Reserve this week said it would hold the line on any rate decreases at this time, citing an inflation reading that has yet to retreat to its target level of 2%, on top of the potential inflationary impact of any new tariffs on imported goods.

OPEC+ will meet on Monday. Market observers do not expect a decision to increase output despite the appeal from Pres. Trump, especially with the downturn in prices of the last 2 weeks.

Meanwhile, Chinese oil firms CNOOC and CNPC continue to develop ultra-deep projects for oil exploration utilizing 'smart' rigs that can reach depths up to 50,000 ft. In October, CNOOC reported record oil and gas production from Deep Sea #1 field. This comes as China’s crude imports have decreased due to a slower economic climate as manufacturing activity was lower than last month.

The Energy Information Administration's (EIA) Weekly Petroleum Status Report indicated that commercial crude oil inventories increased for the first time in 10 weeks. The Strategic Petroleum Reserve gained 250,000 bbl to 394 million bbl. Total US oil production dipped 237,000 b/d to 13.24 million b/d vs. 13.0 last year at this time. The US oil rigs increased by 7 last week to 479 vs. 499 at this time last year.

The USD is higher which is a factor in crude’s lower prices this week.

Oil, technical analysis

March 2025 NYMEX WTI Futures are continuing a post-Martin Luther King, Jr. holiday slide and remain below the 200-, 13-, 8- and now, the 21-day Moving Average but above the 100-day. Volume is about average at 210,000. The Relative Strength Indicator (RSI), a momentum indicator, is “slightly-oversold” at the “44” mark. Resistance is now pegged at $73.65 (8-day MA) with near-term Support at $72.00.

Looking ahead

If enacted, the tariffs by the Trump administration would create a Catch-22 for oil prices. Imports of crude will become more expensive with the added tax, but any resultant strength in the USD will potentially lower oil prices. Markets have a 'wait and see' attitude.

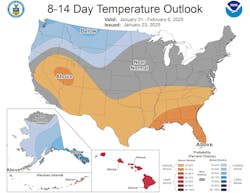

Heating oil demand looks bleak for the coming 2 weeks while distillate inventories continue to decline. Monday’s OPEC+ meeting will be crucial in ascertaining whether or not the group will concede to Pres. Trump’s demands to increase output. Russia won't want to see the lower prices that could result, but Saudi Arabia essentially holds all the cards.

Natural gas, fundamental analysis

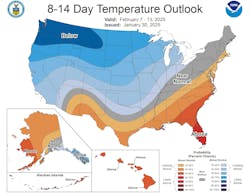

Natural gas storage withdrawals last week were the 4th-highest ever at 321 bcf and led to a deficit vs. the 5-year average. Despite that, prices fell as traders cited a warmer February forecast and growing supplies.

The June 2025 contract is trading higher than March, perhaps due to markets looking to another hot summer and lower inventories entering the season.

The Henry Hub High was $3.83/MMbtu on Monday with a Low of $2.99 on Friday. Supply last week was an additional 0.3 bcfd to reach 110.4 bcfd vs. 110.1 the prior week. Demand was -7.1 bcfd to 140.1 bcfd vs. 157.2 bcfd the week prior, with the biggest decrease in residential consumption.

Exports to Mexico were 6.5 bcfd vs. 6.7 the prior week. LNG exports were 13.7 bcfd vs. 14.7 bcfd the prior as Freeport LNG works to get back to full volumes after a storm-related power outage.

EIA’s Weekly Natural Gas Storage Report indicated a withdrawal of 321 bcf vs. a forecast of a withdrawal of 317 bcf. Total gas in storage is 2.57 tcf, dropping to 5.3% below last year and now 4.1% below the 5-year average.

Natural gas, technical analysis

March 2025 NYMEX Henry Hub Natural Gas futures have fallen below 8-, 13- and 21-day Moving Averages now and have breached the Lower-Bollinger Band limit, a BUY signal. Volume is about average at 100,000 after trading 200,000 yesterday on the storage withdrawal. The RSI is “oversold” at “38”. Support is pegged at $3.00 with Resistance at $3.07 (Lower-Bollinger Band threshold).

Looking ahead

Global LNG imports are expected to set a new record high this month with most shipments delivered to Europe where spot prices, quoted recently at $14/MMbtu, are about +$1.50/MMbtu higher than in Asia. March TTF futures are trading around $13.00/MMbtu.

The Federal Regulatory Commission has approved the increase in production at Venture Global’s Plaquemines Parrish LNG export plant as volumes there increase towards the 1.5 bcfd nameplate capacity.

As with heating oil, the next 14 days look bearish for natural gas demand. However, it appears that global LNG demand will remain robust in the near-term.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.