WoodMac predicts mixed outlook for upstream sector in 2025

High geopolitical tensions and supply and demand concerns set up 2025 to be a year of mixed messages in the global upstream segment, Wood Mackenzie predicts.

In a recent report, WoodMac noted five elements to watch this year. Key themes include a heightened focus on efficiency, renewed focus on resource capture, strategic mergers and acquisitions (M&A), Americas liquids growth outside the Permian basin, and a new wave of LNG projects.

Upstream efficiency

“This focus is not a new phenomenon, but operators will progressively lean more heavily on artificial intelligence (AI) and other sophisticated tools to optimize costs, production and revenues,” said Fraser McKay, head of upstream analysis at WoodMac. “The risk of global tariffs and softer prices adds impetus.”

Resource capture

According to the report, increasing confidence in a higher-for-longer demand outlook for oil and gas is forcing upstream companies to revisit portfolio longevity.

“Sentiment towards upstream investment will continue to improve, tempered only by near-term macro headwinds,” said Robert Clarke, vice-president, upstream research. “Investors will pay more attention to reserves and resource lives than in the last decade, and companies will look to reload their hoppers.”

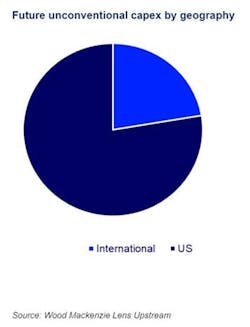

Trends will include the resurgence of conventional exploration, increased activity, albeit with capital discipline, and deals providing more immediate resource capture boost, WoodMac said. It could also be a breakout year for global unconventional, with key opportunities in Saudia Arabia’s Jafurah basin, Argentina’s Vaca Muerta and Algeria.

Mergers and acquisitions

Merger and acquisition activity will continue, however, given the wave of consolidation in 2023 and 2024, it is unlikely that the industry will exceed the average of $130 billion/year that it has over the past decade, according to the report. Yet for the same reasons operators will increase organic resource captures, mergers and acquisitions will help with portfolio longevity and meet demand outlooks.

“We will still see plenty of activity in the US as Independents look to expand in markets outside of the Permian,” said Clarke. “Euro and US Majors will also be keen to bolster post 2030 cash flow. Mega-deals are possible, but rare. Many national oil companies (NOCs) will continue to be active, most notably in the Middle East, China, and Southeast Asia.”

Americas liquids growth expands from Permian basin

Despite concerns around near-term oil demand and potential oversupply, projects in the Americas will deliver relatively robust growth of roughly 1 million b/d in 2025, the same level as 2024, according to the report.

The Permian basin slows again and is projected to add 300,000 b/d of crude and condensate versus 450,000 b/d in 2024. More robust growth will be seen in other regions, with Latin America adding 400,000 b/d of liquids. Deepwater Gulf of Mexico is expected to add capacity of more than 300,000 b/d of liquids and near 2 million b/d for the first time.

New LNG wave

“We expect 2025 to be a quiet year for upstream LNG FIDs [final investment decisions],” said McKay. “This is, in part, due to service sector squeeze and rising costs, but that doesn’t mean projects won’t progress.”

A 'wildcard' might come from US tariffs, McKay continued, "which could force China to retaliate, such as importing less US LNG, making new project approval acceleration a moot point. Asian LNG buyers could acquire US Lower 48 upstream gas positions as part of wider value-chain plays.”