US natural gas inventories enter winter at highest levels since 2016

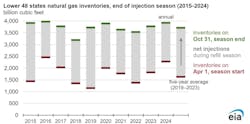

US natural gas inventories entered winter 2024–25 at the highest levels since 2016, sitting 6% above the 5-year (2019–23) average.

According to estimates from the US Energy Information Administration (EIA), working natural gas storage in the Lower 48 states closed the injection season with 3,922 bcf. This, despite below-average injections into storage for the entire injection season spanning Apr. 1 to Oct. 31, EIA said. Nearly every week in the 2024 injection season saw less natural gas injected than the 5-year average, partly because starting inventories were relatively full.

EIA data show natural gas inventories in the Lower 48 at end-March 2024 (the end of withdrawal season) totaled 2,282 bcf, 25% more than the same period in 2023 and 40% more than the 5-year average for March. This enabled storage operators to reach end-of-season targets with smaller natural gas injections, EIA said.

Meanwhile, low natural gas prices in 2024 led producers to cut back on production, thereby decreasing the natural gas available for injections.

“Net injections into natural gas storage during the injection season totaled 1,640 bcf, 21% less than the 5-year average. Weekly injections ranged from a maximum of 96 bcf in late May to 10 bcf in mid-July. Although natural gas is typically injected into storage in the summer, withdrawals occasionally occur, particularly in the Pacific and South-Central regions,” EIA said.

Specifically, the US South Central region has exhibited a unique seasonal pattern in recent years with weekly net natural gas withdrawals following early summer injections, particularly at the salt dome facilities, to meet summer cooling demand. For the week ending Aug. 9, withdrawals in the South-Central region and Pacific region combined totaled 29 bcf, with a net withdrawal of 6 bcf from US natural gas storage, the first net withdrawal from US storage during the summer since July 2016.

Meanwhile, natural gas injections into storage for the weeks ending Oct. 25 and Nov. 1 (the last 2 weeks of injection season) exceeded their 5-year averages, further boosting the volume of natural gas in storage.

Overall, EIA forecasts natural gas withdrawals during the 2024–25 heating season will total 1,957 bcf and that inventories will be 6% above the 5-year (2020–24) average at the end of March 2025.