Oil, fundamental analysis

Oil prices were lower this week as the post-election enthusiasm waned, demand concerns returned, and as the US dollar strengthened. Again, geopolitical tensions in the Middle East were not a major contributor to price movements. Downwardly-revised demand and price forecasts for next year also put pressure on prices.

A large refined product draw in inventory provided the week’s only bullish news but the impact was short-lived. Slightly higher inflation for October led to pessimism among investors that another interest rate cut would be in the offing. WTI saw a High/Low range of $70.55/bbl (Monday) $66.80/bbl (Friday) while Brent’s range was $74.15/$70.80. The Brent/WTI has widened to -$4.05/bbl. Both grades of crude settled lower week-on-week.

The International Energy Agency (IEA) expects there to be an oil surplus of more than 1.0 million bbl next year based upon a continuing decline in demand centered around China. The agency’s head of oil industry and markets went so far as to suggest China’s oil consumption has peaked. Its refinery demand in October fell -4.6% year-on-year and was the 7th-consecutive month of declines.

OPEC also cut its demand forecast for the 4th-consecutive month, lowering this year’s consumption growth to +1.82 million b/d vs. their prior estimate of +1.93. Next year’s demand is now expected to increase by 1.54 million b/d vs. a previously-stated +1.64. Meanwhile, production from the US, Brazil, Canada, and Guyana is expected to increase by 1.5 million b/d in 2025, leading to the foreseen excess. Additionally, the US Energy Information Agency (EIA), in its latest Short-Term Energy Outlook report, lowered its forecasted price for Brent crude to $76.06 for next year from $77.59/bbl.

The EIA's Weekly Petroleum Status Report indicated that commercial crude oil inventories for last week increased while refined products declined considerably. Total US oil production dipped to 13.4 million b/d from 13.5 million b/d the prior week and vs. 13.2 million b/d last year at this time.

The US total rig count was 1 unit lower last week to 584 vs. 618 a year ago. The US Department of Energy has announced that it has ended the repurchasing of crude for the Strategic Petroleum Reserve. There are growing signs that the US shale boom may be nearing a peak as recent measures of “oil recovered per foot” indicate a drop of 15% since 2020. And, the US Department of Energy has completed its planned re-purchases of oil for the SPR. Last week’s 9.4 million b/d of gasoline demand was on par with several of last summer’s weekly demand figures while the refinery utilization of 91.4% was also unseasonably high.

October’s CPI was +0.2% to an annual rate of +2.6% vs. the +2.4% in September. Fed Chair Powell indicated this week that there is no rush to reduce interest rates further given inflation is still above 2%, the economy is strong and unemployment remains low. Meanwhile, industrial production for October was -0.3%, in-line with expectations; retail sales rose +0.4% and the number of unemployment claims last week was the lowest in 6 months. The dust has settled post-election and the uncertainty about the reality to come has equities lower this week. Meanwhile, the USD has risen quite a bit and holding at the new higher levels which is bearish for crude prices.

Oil, technical analysis

December 2024 NYMEX WTI futures contracts prices have slipped below the 8-, 13-, and 21-day Moving Averages and are nearing the Lower-Bollinger Band level. Volume is lower than average at 155,000. The Relative Strength Indicator (RSI) is neutral at the 40 mark. 30 or below is considered very oversold while 70 or above is considered very overbought. Resistance is now pegged at $67.50 with near-term Support is $66.50.

Looking ahead

When looking back on what has influenced oil prices over the past 6 months, lower demand has over-ridden all other factors consistently. And the current outlook does not indicate any improvement. In terms of the actual impact of the new administration, it will take months after the implementation of new policies to take effect.

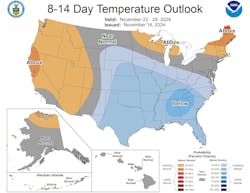

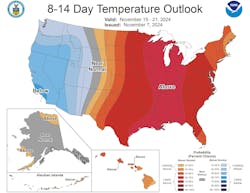

The next week doesn’t look very favorable for heating oil demand. However, Thanksgiving Week could see below-normal temperatures for major areas of the US. And, as we approach the official end of hurricane season on the 30th, what has been a very active period continues with the formation of Tropical Storm Sara which is expected to impact portions of Central America and Mexico’s Yucatan and eventually turn northeasterly and bring heavy rains to Florida…. again! There is currently no threat to oil and gas infrastructure in the Gulf of Mexico.

Natural gas, fundamental analysis

December natural gas still can’t maintain prices above $3.00/MMbtu as the storage surplus continues to build and consumption lags. A brief cold front provided some upward momentum this week but temperatures returned to normal.

The week’s High was $3.02/MMbtu on Wednesday while the Low was Friday’s $2.68. Supply last week was -0.3 bcfd to 107.5 bcfd vs. 107.8 the prior week. Demand was 106.9 bcfd, up +5.5 bcfd the week prior with increases in residential usage and LNG send-out.

Exports to Mexico were 6.1 bcfd vs. 5.8 the prior week. LNG exports were 14.1 bcfd. vs. 12.7 bcfd the prior week. The latest European natural gas prices were quoted at $11.60/MMbtu as the region continues to experience “windless” days. EU storage levels are currently down to 93%, lower than last year at this time.

The EIA’s Weekly Natural Gas Storage Report indicated an injection of 42 bcf vs. a forecast of +44 bcf vs. a 5-year average of +32 bcf. Total gas in storage is now 3.974 tcf, lowering to +4.1% above last year and rising to 6.1% over the 5-year average. There is a very good possibility that we could reach the 4.0 tcf level when this week’s storage numbers are released next week.

The 7-day forecast looks widely mild. Thanksgiving Week should provide increase demand if only due to increase use for baking. The German government has ordered its ports to reject all shipments of LNG entering from Russia as it completes its mission to wean-off Russian natural gas.

Natural gas, technical analysis

December 2024 NYMEX Henry Hub Natural Gas futures are above the 13- and 21-day Moving Averages and hovering around the 8-day MA. Volume is about the recent average at 157,000. The RSI is neutral at 56. Support is pegged at $2.70 with Resistance at $2.85.

Looking ahead

As with heating oil, the next week doesn’t bode well for natural gas consumption but the holiday week could. Continued storage injections will only suppress prices further.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.