EIA: India leads global oil consumption growth in 2024, 2025

India has emerged as the top contributor to expected global oil consumption growth, accounting for 25% of the increase for 2024 and 2025, according to the US Energy Information Agency (EIA)’s latest Short-Term Energy Outlook (STEO).

EIA expects global liquid fuel consumption to rise by 1.0 million b/d in 2024 and 1.2 million b/d in 2025. This growth is below the pre-pandemic 10-year average of 1.5 million b/d of annual growth, as well as below the oil demand growth seen in the 2021-23 pandemic recovery.

“We expect consumption of liquid fuels in India to increase by 300,000 b/d in both 2024 and 2025, driven by rising demand for transportation fuels. We forecast China’s petroleum and liquid fuels consumption will grow by less than 100,000 b/d in 2024 before recovering to almost 300,000 b/d 2025,” EIA said.

“We have revised China’s 2024 consumption downward several times over the past year. In China, rapidly expanding electric vehicle ownership, rising use of liquefied natural gas for trucking goods, and decelerating economic growth have limited consumption growth for transportation fuels.”

Meantime, EIA forecasts more distillate fuel consumption in the US next year after 2 years of declines, largely because US manufacturing activity is expected to increase.

Oil prices

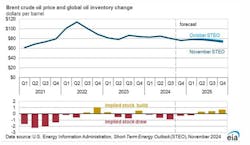

The Brent crude oil spot price averaged $76/bbl in October, up $2/bbl from the average in September. Crude oil prices increased in October in part because of market concerns that an Israeli response to Iran’s missile attack would reduce Iran’s ability to produce or market oil. However, Brent fell to $71/bbl on Oct. 29 after Israel’s military response did not target Iran’s oil infrastructure.

Despite the drop in oil prices in late October, EIA expects that geopolitical risks and OPEC+ cuts are likely to raise oil prices, with Brent crude averaging $78/bbl in first-quarter 2025. As production grows, inventories will build in second-quarter 2025, reducing prices to $74/bbl in second-half 2025.

“By second-quarter 2025, we expect OPEC+ production increases and supply growth from countries outside of OPEC+ will outweigh global oil demand growth and cause oil to be put into inventory. We expect that global oil inventories will increase by an average of 400,000 b/d in second-quarter 2025, before inventories rise by an average of 600,000 b/d in second-half 2025. We forecast that inventory builds will put downward pressure on crude oil prices, with Brent falling to an average of $74/bbl in second-half 2025. In our forecast, the Brent price averages $76/bbl for the full year of 2025,” EIA said.

However, EIA sees at least two main sources of oil price uncertainty: the future course of the ongoing Middle East conflict and OPEC+ members’ willingness to adhere to voluntary production cuts.

US natural gas

EIA expects the Henry Hub natural gas spot price to rise in the coming months to average $2.80/MMbtu in first-quarter 2025, following seasonal patterns during which prices typically rise during the winter.

“The monthly average Henry Hub daily spot price fell to $2.20/MMbtu in October and below $2.00/MMbtu in early November. Low prices reflected warm temperatures, which could delay the beginning of withdrawals of natural gas from storage until mid-November. We expect the Henry Hub price to average around $2.90/MMbtu in 2025, as global demand for US LNG exports, a component of US natural gas demand, continues to increase,” EIA said.

Marketed US natural gas production in EIA’s forecast averages 113 bcfd in 2024. Production in 2024 is relatively unchanged from 2023, a contrast to the production growth in the previous 3 years, as low natural gas prices curtailed production in some regions. EIA expects US marketed natural gas production to increase by 1% next year, averaging 114 bcfd, led by a 6% increase in the Permian region.