Oil, fundamental analysis

While markets expected the US Federal Reserve to cut interest rates this week, the magnitude of the change, a 0.05% reduction, was unexpected. The announcement sent equities higher which, in turn, spurred crude markets as economic growth cannot take place without an increase in energy consumption.

Stepped-up attacks on Hezbollah by Israel and an inventory draw also played a role in supporting the rally. Furthermore, the US is back in the oil market as the US Department of Energy (DOE) announced its intent to purchase up to 6.0 million bbl to replenish the Strategic Petroleum Reserve (SPR) with deliveries occurring during first-quarter 2025.

However, while higher week-on-week, prices remained capped by ongoing concerns over demand in China as its central bank decided not to lower key interest rates despite a sluggish economy and despite the move by the US government. The high for WTI of $72.50/bbl was set on Thursday while the low was Monday’s $68.65/bbl.

Brent crude also stair-stepped higher with $75.20/bbl as its high on Thursday and the week’s low of $71.50 on Monday. Substantial buying interest was seen when Brent dipped below $70/bbl the prior week, suggesting a key level of support. Both grades of oil look to settle higher week-on-week. The WTI/Brent spread tightened to -$3.52.

The geopolitical situation in the Middle East shows no signs of abating as Israel was able to sabotage walkie-talkies and pagers used by Hezbollah in Lebanon by loading them with explosives that killed several operatives and wounded thousands when triggered. The rebel group has pledged retaliation.

JP Morgan estimates that global oil demand was 102.5 million b/d through mid-September. While up 200,000 b/d from September 2023, it was 600,000 b/d below their earlier projections.

Russia’s “shadow fleet” of tankers, mostly destined for Asia, have kept its exports moving despite sanctions but these aging and poorly-maintained ships now pose the threat of spills.

The Energy Information Administration’s (EIA) Weekly Petroleum Status Report indicated that commercial crude oil and refined product inventories declined last week. In particular, inventory at the key Cushing, Okla., hub is now down to 30% of capacity. Total US oil production was down 100,000b/d to 13.2 million b/d vs. 13.3 million b/d last week and 12.9 million b/d last year at this time. Most oil and gas production in the Gulf of Mexico has returned post-Hurricane Francine. Meanwhile, the US oil and gas rig count fell by 2 units last week to 588 vs. 630 last year at this time.

While the Fed rate cut provided the biggest positive economic news for the week, August home sales fell 2.5% to 3.86 million, off from the forecasted 3.9 million. There was a significant rise in housing starts, however. Real wages increased last month and are now higher than they were on Election Day 2020 while retail spending also increased. All three major US stock indexes are much higher than at the end of the prior week. The USD is down on the move into equities which is supportive of crude prices.

Oil, technical analysis

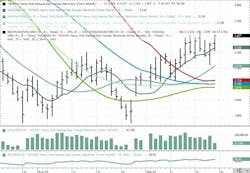

October 2024 WTI NYMEX futures prices are holding near the 21-day moving average (MA) while above the 8- and 13-day MA. Volume is nominal at 10,000 as the October contract expires today, and traders are focused on November. The Relative Strength Indicator (RSI) is neutral at the 50 mark. Thirty or below is considered very oversold while 70 or above is considered very overbought.

Resistance is now pegged at $70.50, Thursday’s high, with near-term support at $71.20, the 21-day MA.

Looking ahead

Next week, there is the possibility for development of a tropical system near the Yucatan Peninsula that, if it forms, would move into the Gulf of Mexico. Due to lower inventory levels, US refiners are expected to have a lighter upcoming maintenance season which would support underlying demand for crude feedstocks. The turnaround period in October/November allows refineries to prepare for the winter blends as well as to perform any routine maintenance. Heating oil inventories will need to be increased ahead of winter.

Additionally, traders are starting to focus on diminishing inventories at Cushing which represents 16% of US commercial inventory capacity and is the world’s largest crude hub and storage facility. There appears to be no end in sight for the Israel/Hamas-Hezbollah conflict as it appears that Israel’s intention now is one of annihilation of the Iranian-backed rebel groups.

Natural gas, fundamental analysis

Natural gas prices got a boost this week on some pockets of late season heat, the Fed rate cut, and on shrinking storage surpluses. The week’s high was $2.435/MMbtu on Tuesday while the low was Thursday’s $2.225. Supply last week was 107.2 bcfd vs. 107.8 the prior week. Demand was 95.4 bcfd, down from 96.6 the week before on lower LNG exports. Exports to Mexico were 6.7 bcfd vs. 6.8 the prior week. LNG exports were 12.9 bcfd. vs. 13.4 the prior week.

The latest European natural gas prices were quoted at about $10/MMbtu, down considerably on weakening demand. The EIA’s Weekly Natural Gas Storage Report indicated an injection of 58 bcf vs. a forecast of an additional 57 bcf and the 5-year average of an additional 80 bcf. Total gas in storage is now 3.445 tcf, up 6.0% from last year and up 8.6% over the 5-year average.

Natural gas, technical analysis

October 2024 NYMEX Henry Hub Natural Gas futures are now trading above the 8-, 13- and 21-day Moving Averages and remain above the Upper-Bollinger Band level, a pending sell signal. Volume is about average at about 100,000. The RSI is neutral at 60. Support is pegged at $2.22 (13-day MA) with resistance at $2.435 (Tuesday’s high).

Looking ahead

AI’s expected thirst for electric power has led to plans for the construction of upwards of 86 Gw of natural gas-fired generation over the next 8 years throughout the US. With lower emissions than coal, gas-fired generation also helps grid operators better manage load fluctuations than intermittent sources such as wind and solar. Meanwhile, Microsoft is partnering with Constellation to restart the un-damaged unit at the Three Mile Island Nuclear Plant to power its proposed data centers in the area.

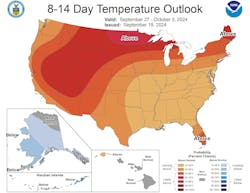

Some areas of the US are experiencing well-above normal temperatures which has helped support natural gas prices. Further out, the center of heat shifts to less populated areas.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.