China's oil demand slowdown raises questions about future global trajectory

China’s centrality to oil demand growth this century has been so great that a precipitous slowdown raises questions about the future global trajectory, the International Energy Agency (IEA) said in its latest Monthly Oil Market Report.

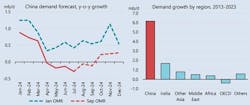

After a post-COVID surge of 1.5 million b/d in 2023, China's oil consumption growth is set to slow sharply to just 180,000 b/d in 2024, affecting oil markets.

“In January we projected 2024 gains of 700,000 b/d but the pace of expansion has been pared back on a combination of broad economic factors and accelerating substitution away from oil in favor of alternative fuels. This may signal that the projected plateauing of demand in the country over the medium term is ahead of schedule, setting the stage for lower growth in global oil markets,” IEA said.

More importantly, “if this long upsurge is really losing momentum, and with OECD demand flat on 2014 levels and set to decline, questions abound over whether other countries or regions could fill China’s role," IEA continued.

Who will replace China?

Owing to its size and relative dynamism, Asia is most likely to provide growth going forward, according to IEA. Demand in Africa grew by a mere 380,000 b/d between 2013 and 2023, equivalent to 8 months of China’s average growth rate over the same period. The decade’s gains in the Middle East were equal to less than 10 months of China’s pace and Latin American demand was essentially flat over the period.

Conversely, oil demand in non-OECD Asia, excluding China, increased by 2.5 million b/d from 2013 to 2023, significantly less than China’s 6 million b/d but indicating substantial growth potential.

“In Oil 2024, our medium-term report published in June, we projected that by 2030 the rest of Asia would see demand rise by almost 3 million b/d, twice as much as in China. With China already falling behind its forecast trend, other Asian countries will become increasingly indispensable to growth in oil demand,” IEA said.

India, which is now set to post the largest growth in oil consumption in 2024 at 200,000 b/d, is projected to account for almost half of this medium-term ‘other Asian’ increase.

“Despite (India) being the world’s fastest growing major economy, the comparatively limited scale of Indian oil use, at only one-third of China’s level in 2024, and the smaller role of manufacturing, construction and petrochemicals in its growth model will limit the impact of these rapid proportional gains in oil use,” IEA said.

The same applies to the major Southeast Asian countries. Although the rest of Asia is expected to lead in oil demand growth, it is unlikely to fully replicate China's role over the past 20 years. Additionally, economic activity across Asia is closely tied to China's fortunes, so any significant economic slowdown would reduce oil demand in neighboring countries.

“If China's slowdown continues or worsens, we may face a period of declining global oil demand growth,” IEA said.