IEA: Global oil demand growth continues to decelerate

Global oil demand growth continues to decelerate, with first-half 2024 gains of 800,000 b/d year-over-year (y-o-y) being the lowest since 2020, according to the International Energy Agency (IEA)’s September issue Oil Market Monthly Report.

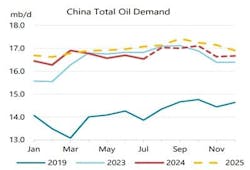

The chief driver of this downturn is a rapidly slowing China, where consumption contracted y-o-y for a fourth straight month in July, by 280,000 b/d. “The country's [China] oil demand is now set to expand by only 180,000 b/d in 2024, as the broad-based economic slowdown and an accelerating substitution away from oil in favor of alternative fuels weigh on consumption. Surging EV sales are reducing road fuel demand while the development of a vast national high-speed rail network is restricting growth in domestic air travel,” IEA said.

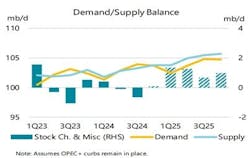

World supply increased by 80,000 b/d to 103.5 million b/d in August. This rise came despite outages due to a political dispute in Libya and maintenance in Norway and Kazakhstan, as they were offset by higher production from Guyana, Brazil, and other regions. Annual supply growth is expected to strengthen to 2.1 million b/d in 2025 from 660,000 b/d this year. Non-OPEC+ production will increase by 1.5 million b/d this year and next, while OPEC+ may see a decline of 810,000 b/d in 2024 but could rise by 540,000 b/d next year if voluntary cuts continue.

Global refinery throughputs are forecast to increase by 440,000 b/d to 83 million b/d in 2024, and by 630,000 b/d to 83.7 million b/d next year. “Much weaker than expected Chinese runs in July and a further deterioration in margins continue to weigh on the forecast. Cracking margins briefly turned negative in Europe and Singapore. US Gulf Coast cracking margins are more resilient, but they have nevertheless fallen by two-thirds versus year-ago levels,” IEA said.

Global observed oil stocks declined by 47.1 million bbl in July. The drawdown was concentrated in crude oil, NGLs, and feedstocks (-75.5 million bbl), while oil products built to their highest level since January 2021. OECD industry stocks fell counter-seasonally by 12.3 million bbl in July to stand 78.5 million bbl below the 5-year average. Preliminary data show continued stock declines in August.

In August and early September, oil prices dropped sharply, with ICE Brent futures falling by about $10/bbl as weakening Chinese demand and economic challenges heightened oversupply concerns.

“Investor selling added to the bearish sentiment, with net speculative exchange holdings slumping to multi-year lows,” IEA said. When the IEA wrote this report, Brent was trading at around $70/bbl, the lowest level since late 2021 and $20/bbl below April 2024's peak.