EIA forecasts higher crude oil prices despite recent slump

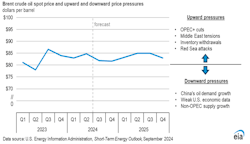

Despite a drop in the Brent crude oil spot price to $73/bbl on Sept. 6, the US Energy Information Administration (EIA), in its latest Short-Term Energy Outlook (STEO), said it expects ongoing withdrawals from global oil inventories to push prices back above $80/bbl this month.

“Persistent economic concerns have reduced market expectations around global oil demand growth. Slowing global economic activity and reduced fuel demand in China, one of the leading sources of global oil demand growth, as well as signs of slowing US job growth in recent months, have limited any upward price momentum in recent months,” EIA said.

However, “we still expect oil prices will rise in the coming months, driven by ongoing withdrawals from global oil inventories as a result of OPEC+ production cuts. The OPEC+ production cuts continue to cause less oil to be produced globally than is being consumed. Even before OPEC+ announced that it will delay production increases until December (OGJ Online, Sep. 5, 2024), we expected a significant reduction in global oil inventories through the end of this year. We now expect more oil will be taken out of inventories than we previously expected,” EIA said.

EIA estimates global oil inventories are falling by 900,000 b/d in third-quarter 2024, and expects they will decrease by more than 1 million b/d through first-quarter 2025. As a result, EIA expects Brent prices will rise to average $82/bbl in December and $83/bbl in first-quarter 2025 from $74/bbl at the beginning of September. EIA also estimates that global oil inventories will increase by an average of 500,000 b/d in second-half 2025. Overall, Brent price will average $84/bbl in 2025, according to EIA’s forecast.

Meantime, recent production outages in Libya add a new source of uncertainty for crude oil prices in the coming months, according to EIA. These outages compound existing uncertainties driven by attacks on oil tankers in the Red Sea shipping channel and the possibility the conflict in Gaza spills into neighboring countries, potentially disrupting regional oil production. Similarly, OPEC+ members could further delay the unwinding of voluntary oil production cuts now set to begin in December, EIA said.

Oil consumption

In the Sept. 5 STEO, EIA forecasts that global consumption of liquid fuels will increase by 900,000 b/d in 2024 and by 1.5 million b/d in 2025.

“Our 2024 forecast is down about 200,000 b/d from last month and our 2025 forecast is down 100,000 b/d due to downward revisions to demand in China and OECD Europe. Most of the expected liquid fuels demand growth is from non-OECD countries, which increase their liquids consumption by 1 million b/d in 2024 and 1.3 million b/d in 2025,” EIA said.

“We revised our forecast petroleum consumption growth in China for 2024 and 2025 down because of slower economic activity as well as new monthly statistics showing a slowdown in diesel demand, jet fuel consumption, and crude oil refinery runs in China. We now forecast China’s petroleum and liquid fuels consumption will grow by about 100,000 b/d in 2024 and 300,000 b/d in 2025.”