Technical buying leads to late-week rally for crude, natural gas struggles

Oil, fundamental analysis

A downwardly revised jobs report kept last week’s bearish market going into this week until Friday. However, oil prices rebounded on technical buying and rate cut optimism after hitting lows not seen since January. The continuing concerns over lessening demand and ceasefire talks overshadowed a large, unexpected draw in inventories. However, a 'too far, too fast' scenario for falling prices led to a key technical stop which resulted in buying interest by Friday.

The week’s High for WTI was $76.90/bbl set on Monday while the Low was Wednesday’s $71.45. Brent crude saw a Hi/Lo range of $79.80/75.65. And, though both grades were higher at week’s end, they settled lower than last week. The WTI/Brent spread now sits at ($4.15/bbl.).

China, the No. 1 importer of crude, saw a 35% decline in gasoline exports last month due to shrinking refining margins. That has the OPEC+ group reconsidering plans to lift output curtailments this fall. Rising production in non-OPEC countries such as the US, Brazil, and Guyana is also giving the cartel pause.

Countering those consumption fears is Standard Chartered who indicated that global demand for oil in June was a record-high 103 million b/d. StanChart is forecasting similar consumption for the rest of the year. Furthermore, positive comments from Federal Reserve Chairman Powel at the annual meeting in Jackson Hole, Wyo., is providing optimism about an interest rate cut in the near term. The resultant economic growth would be a boost for energy demand in general. Equity markets reacted favorably to the news and crude rallied.

The Energy Information Administration’s Weekly Petroleum Status Report showed an unexpected draw in crude inventories. Refined products were also lower. The US oil and gas rig count was down 1 to 585, 47 fewer than this time last year. However, oil production rose to 13.4 million b/d due to efficiency gains in drilling and completion.

US West Coast refiners have been expecting bitumen from Canada’s Trans Mountain Express pipeline to lessen feedstock prices. Instead, thus far, most barrels are heading to Asian markets. Once again, the failure to approve the international border crossing for Keystone XL looms large. Meanwhile, a potential rail strike in Canada could disrupt bitumen shipments out of Alberta to the US especially, the East Coast.

In addition to the positive comments emerging from the Fed meeting, new home sales for July were up 10.6% to 739,000 vs. a forecasted total of 620,000. The optimism growing out of Jackson Hole has led to gains across all three major US stock indexes. The USD is at its lowest level in 18 months which is also supportive of crude prices.

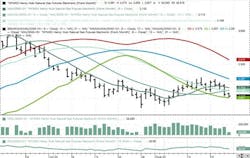

October 2024 WTI NYMEX futures are now the “prompt” month and prices are trading below the 8-, 13- and 21-day Moving Averages (MA) and remain well-below the 200-day MA. Wednesday’s Low breached the Lower-Bollinger Band which represents 2-Standard Deviations from the Mean. Buying ensued as a result. Volume is around the recent average at 270,000 as traders turn their focus to October. The Relative Strength Indicator (RSI) is neutral at 46 mark. Thirty or below is considered oversold while 70 or above is considered overbought. Resistance is now pegged at $75.00 (the 8-day MA) with near-term Support at $72.85.

Looking ahead

The Federal Reserve needs to deliver on its hint of an impending interest rate cut. Meanwhile, traders will have to monitor the on-again/off-again Israel/Hamas ceasefire talks. Most recently, Hamas disagreed with some Israeli proposals. Look for OPEC+ to change course on planned output increases unless Brent stabilizes above $80/bbl.

No tropical developments are foreseen for the next 7 days. Labor Day is soon upon us and peak driving season will end. It is also time to start monitoring distillate inventories as demand for Heating Oil will pick up in the Northeast by or before November.

Natural gas, fundamental analysis

Cooler temperatures along the East Coast and a storage injection that was higher than expected has September natural gas again testing $2.00/MMbtu lows. The week’s High was $2.28/MMbtu Tuesday while the Low was Friday’s $2.005. Supply last week was 107.8 bcfd vs. 107.8 the prior week. Demand was 100.5 bcfd vs. 99.3 with only a minor increase in power generation.

Exports to Mexico were 6.8 bcfd vs. 7.0 the prior week. LNG exports were 12.8 bcfd. vs. 12.6 the prior week. European natural gas prices remain strong with the Dutch TTF quoted at $11.70/MMbtu while Asia was $14.35. The EIA’s Weekly Natural Gas Storage Report indicated an injection of +35 bcf vs. a forecast of +28 bcf. Total gas in storage is now 3.299 tcf, 7.2% more than last year and 12.6% higher than the 5-year average. This was a increase in the surplus over last year.

September 2024 NYMEX Henry Hub Natural Gas futures are now trading below the 8-, 13- and 21-day Moving Averages and sitting right on the Lower-Bollinger Band limit, a Buy signal. Volume is below average at about 55,000 as traders switch their focus to October. The September contract will expire next Wednesday. The RSI is neutral at 42. Support is pegged at $2.00 with Resistance at $2.10.

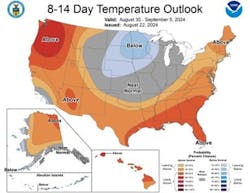

Looking ahead

Natural gas producers such as EQT and Coterra are choking back production on lower price levels. However, oil will continue to be produced along with its associated gas. The US remains well ahead of the 5-year average for total natural gas in storage and continuing injections are expected until widespread cold weather sets in in late fall. In the near term, temperatures remain seasonal and above normal in some areas. However, a shift to cooler temperatures is expected the first week in September.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.