Fitch Ratings: Credit metrics improve for oil field service companies

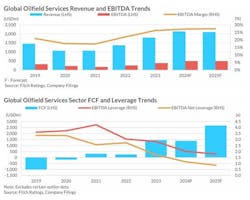

Robust market fundamentals have resulted in improved credit metrics for oilfield service issuers, including by reduced leverage, expanded EBITDA margins, and enhanced free cash flow (FCF) generation, according to a report from Fitch Ratings. Stagnant North American activity has been partly offset by increasing international activity, which has benefited issuers with geographic diversification.

The offshore drilling sector is experiencing a rebound, primarily driven by the floater market, where a combination of consolidation, retirement of older units, higher commodity prices, and increased drilling have led to improved utilization and day rates since 2020, the report said. Fitch Ratings expects a modest improvement in day rates in 2024 before they decline modestly in 2025 based on its oil price deck.

In contrast, US onshore has seen a decrease in rig and frac spread counts. US rig count fell to 600 in May 2024 from 696 a year ago, according to Baker Hughes. Active frac spread count dropped to 253 in May 2024 from 282 units a year before. Fitch expects the oil-focused rig count will stabilize in the short term and the number of active gas-focused rigs may increase based on its stable WTI and growing Henry Hub price assumptions.

However, Fitch believes both frac spread and rig count will be lower at the midcycle point given its WTI oil price deck gradually declining from $75/bbl in 2024 to $57/bbl in 2028. “Increasing drilling and completion efficiencies, stemming from larger pad sizes and faster drilling times, could also weigh on the aggregate US rig count in the medium term," the report said.

International rig activity remains strong, with counts rising and higher margins compared to the US. The international rig count rose to 978 in April 2024, from 947 a year before, and the Canadian rig count rose to 128 in May 2024 from 97 a year before. International margins have also historically been slightly higher than US margins, and the longer term of the contracts provides more certainty on future utilization. Service companies exposed to strong geographic diversification have been able to benefit from increasing opportunities internationally, said Fitch Ratings.

Moreover, despite the increased demand, new capacity additions in oilfield services are not likely due to shipyard capacity and prohibitive financing terms for new assets. Operators are more likely to focus on maximizing existing capacity through efficiency and pricing strategies.