Disruptions in Red Sea boost oil traffic around Cape of Good Hope

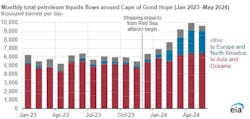

The volume of crude oil and oil products passing around the Cape of Good Hope, at the southern tip of Africa, surged nearly 50% in the first 5 months of 2024 compared with the 2023 average, as commercial vessels avoided chokepoints in the Middle East, according to Vortexa tanker tracking data.

Late 2023 attacks by Yemen-based Houthi militants led many commercial vessel operators to find alternatives to the Bab el-Mandeb Strait and the Red Sea, the waterways near Yemen's coast. The volume of crude oil and oil products flowing around the cape (in either direction) rose to 8.7 million b/d in the first 5 months of 2024 from an average of 5.9 million b/d in 2023. Oil products made up most of the increase.

According analysis of the US Energy Information Administration (EIA) and Vortexa data, the following trade increased around the cape:

- Middle Eastern crude oil producers, Saudi Arabia and Iraq, directed more oil westbound to Europe around the Cape of Good Hope rather than through the Suez Canal, which is accessed via the Red Sea and Bab el-Mandeb to the south. This shift in trade flow accounted for 15% of the total increase from the 2023 average to the period between January and May 2024.

- Asian and Middle Eastern refiners increased their oil product exports to Europe and diverted cargoes westbound around the cape, representing 29% of the increased trade around the cape.

- The US received both crude oil and oil products from the Middle East and Asia and sent more oil products to Asia around the cape. Total US trade around the cape increased by about one-third, or just over 600,000 b/d, in the first 5 months of 2024 from the 2023 average.

- While the Red Sea disruption had less impact on Russia's oil cargoes compared to other trade flows, Russia still sent nearly four times more crude oil and oil products, including volumes from the Caspian Pipeline Consortium, to Asia around the Cape of Good Hope in the first 5 months of 2024 than in all of 2023.

“Diverting vessels around the Cape of Good Hope increases costs and shipping time. For example, a journey from the Arabian Sea to Europe via the cape is about 15 days longer—nearly twice the time—than by the Bab-al Mandeb and the Suez Canal, which increases costs and delays shipments,” EIA said.