IEA: Russian refinery outages risk disruption to middle distillate markets

The recent series of drone strikes on Russian refineries has not yet significantly impacted global middle distillate markets; however, the potential remains for tighter clean product supplies in the coming months, according to the International Energy Agency (IEA).

The international markets for light and middle distillates depend on Russian shipments of diesel, naphtha, and jet fuel. Additionally, refining systems in Asia intake significant amounts of Russia's straight-run and cracked residue to boost upgrading unit feedstocks. Since late January, more than 2 million b/d of nameplate crude distillation capacity has been targeted by Ukrainian drones and industry reports suggest that up to 800,000 b/d of crude processing capacity has been completely or partially shut.

“Arguably, the targeting of energy infrastructure within the Russia-Ukraine war is not a new development. Ukraine’s two refineries were early casualties of the initial Russian advance into the country in 2022. Now, Ukraine’s stated aim to deprive the Russian government of revenue from product exports has refocused attention on market consequences of widespread loss of product supply,” IEA said.

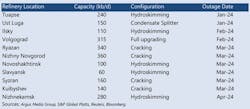

Russian refinery outages

According to reports, 11 refineries have suffered damage from the attacks, with several more unsuccessfully targeted thus far. Overall, the majority of Russia's refining infrastructure located west of the Urals mountains is susceptible to drone strikes. However, the impact on crude processing rates of these outages is not easily discernible, according to IEA.

“First, the lack of official data from Russian government sources makes third-party assessments critical. Second, even where there is a clear picture of whether the refinery is wholly or partially impacted by an attack, the scale of the loss to product supply depends on the duration of the outage and the units affected. The Tuapse refinery has yet to restart and reports indicate a mid-May resumption of operations is likely. Conversely, the Ust Luga condensate splitter appears to have recovered within a matter of weeks. The return of refineries to service is complicated by the international sanctions put in place by the US, UK, and EU governments to limit access to equipment and refining technology. Lastly, it seems reasonable that the Russian refining system is large enough that some outages could be offset by the deferral of planned maintenance or increased runs elsewhere in the system,” IEA said.

Against baseline forecast Russian crude runs of an average 5.2 million b/d in second-quarter 2024, IEA estimates that roughly 500,000-600,000 b/d of crude processing could have been lost for the quarter on a gross basis, before offsets.

“The shutdown of these refineries or units for between 4-8 weeks for repairs could mean a significant loss of diesel and naphtha supplies to international markets. And yet, Kpler trade data so far do not show that Russian diesel exports are falling. Weekly data through mid-March indicate that loadings have been maintained. Similarly, weekly refinery output data through late March from Russia’s Federal State Statistics Service (Rosstat) indicate that diesel output has dropped to 1.7 million b/d from 1.8 million b/d earlier in the year. This level of output is consistent with crude runs at 5-5.2 million b/d, rather than the 4.6 million b/d that a bottom-up assessment of the refinery outages would indicate,” IEA said.

Moreover, the broader perspective in distillate markets indicates easing supply tightness, as opposed to worries about an imminent supply shortage.

“Northwest Europe diesel cracks have fallen from a high of nearly $40/bbl in early February to less than $25/bbl at the start of April. Similarly, gasoil markets in Asia have slipped into contango, with rising stocks and tepid demand seen weighing on cracks and market structure. Thus, for now, oil markets appear relatively sanguine over the prospects of lower Russian exports,” IEA said.