EIA: US was world’s largest LNG exporter in 2023

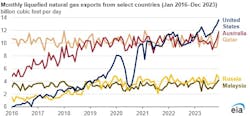

In 2023, the US emerged as the top exporter of LNG globally, surpassing all other nations. According to data from the US Energy Information Administration (EIA)’s Natural Gas Monthly, US LNG exports averaged 11.9 bcfd in 2023, a notable 12% increase (1.3 bcfd) compared with 2022.

Between 2020 and 2023, LNG exports from Australia and Qatar, the world's two other largest LNG exporters, maintained annual export volumes ranging from 10.1 bcfd to 10.5 bcfd, as reported by Cedigaz. Russia and Malaysia secured the fourth and fifth positions respectively as the highest LNG exporters globally over the last 5 years (2019–23). In 2023, LNG exports from Russia averaged 4.2 bcfd, and exports from Malaysia average 3.5 bcfd.

The surge in US LNG exports during first-half 2023 can be attributed to the resumption of operations at the Freeport LNG plant in February, ramping up to full production by April. Additionally, robust demand for LNG in Europe amidst high international natural gas prices further propelled US LNG exports. The latter half of the year witnessed record-breaking monthly US LNG exports, with November and December registering 12.9 bcfd and 13.6 bcfd respectively. EIA estimates that utilization of US LNG export capacity averaged 104% of nominal capacity and 86% of peak capacity across the seven US LNG terminals operating in 2023.

Echoing the trends observed in 2022, Europe (including Turkey) remained the primary destination for US LNG exports in 2023, accounting for 66% (7.8 bcfd) of US exports, followed by Asia at 26% (3.1 bcfd) and Latin America and the Middle East with a combined 8% (0.9 bcfd).

In 2023, Europe (EU-27 and the UK) continued to import LNG to compensate for the loss of natural gas previously supplied by pipeline from Russia. Europe’s LNG imports capacity continued to expand, and EIA expects it will increase by more than one-third between 2021 and 2024.

Among the countries importing US LNG, the Netherlands, France, and the UK collectively received 35% (4.2 bcfd) of total US LNG exports. Notably, LNG imports in the Netherlands surged following the expansion of the Gate LNG regasification terminal and the commissioning of two new floating storage and regasification units (FSRUs). Similarly, Germany commenced LNG imports in 2023 with the commissioning of three new FSRUs. EIA expects another four terminals (three of which are FSRUs) to come online between 2024 and 2027.

In Asia, Japan, and South Korea each received 0.8 bcfd of LNG exports from the US, the fourth- and fifth-highest US LNG export volumes by country in 2023. Japan, China, and India increased LNG imports from the US by a combined 0.6 bcfd compared with 2022. The Philippines and Vietnam started importing LNG in 2023; the Philippines imported LNG cargoes from the US only in October and November.

Meanwhile, in Latin America, US LNG exports to Brazil continued to decline in 2023 as the country predominantly relied on hydropower for electricity generation. The peak in US LNG exports to Brazil was observed in 2021 amid the country's worst drought in over 90 years.