High oil prices not denting demand outlook

High oil prices aren't making a dent in forecasts of rising oil demand.

Even a larger-than-normal inventory build during the seasonally slack second quarter will manage at best only to nudge oil markets toward more-normal levels, notes Jacques Rousseau, analyst with Friedman Billings Ramsey Co. Inc., Arlington, Va.

That lines up with Rousseau'sand a number of other oil analyts'contention that a combination of supply disruption fears and surging world oil demand growth will keep oil prices high through 2005. Rousseau on Apr. 12 ratcheted up his forecast for oil prices (West Texas Intermediate) to $31/bbl from $27/bbl in 2004 and to $28/bbl from $26/bbl in 2005.

Rising demand

Meanwhile, the demand forecasts are shuffled once again in the wake of fresh signs of a rebounding global economy.

The International Energy Agency, in its Apr. 9 monthly oil market report, hiked its forecast for oil demand growth in 2004 by another 60,000 b/d to 1.7 million b/d.

We would note here how many consecutive upward revisions to its demand forecast that makes for the agency, but, frankly, we've lost track.

Which is just the point. Oil demand growth seems to be exceeding just about everyone's expectations, and if fears of an oil supply glut in 2004 haven't totally evaporated just yet, they're getting pretty wispy.

According to IEA, higher projected demand for the second quarter, coupled with a cut in its first quarter assessment, trimmed the projected decline in second quarter demand to 2 million b/d. That compares with a second quarter demand slide of 3.1 million b/d in 2003.

The big gainers in the IEA demand forecast are also the countries with the most resurgent economies: the US and China (although the latter's probably is actually cooling a bit from superheated levels). IEA also notes that China may again exceed expectations of second quarter demand pegged at 6.2 milllion b/d.

Meanwhile, the US Energy Information Administration has boosted its forecast for global oil consumption by 300,000 b/d this year, a 2.2% gain on the yearand one expected to repeat in 2005after a 2% gain in 2003. EIA sees WTI averaging $33/bbl this year.

The outlook for US oil demand to ramp up growth is gathering momentum. EIA reckons US oil demand will rise by 1.4% this yearafter gaining 1.6% in 2003but then leap by a further 2.5% in 2005.

Those predictions jibe with forecasts by the secretariat of the Organization of Petroleum Exporting Countries, which sees 2004's largest oil demand growth occurring in China and North America. The OPEC secretariat estimates North American oil consumption at 24.9 million b/d in 2004, based on historical ratios of oil demand growth to gross domestic product growthbut it cautions that the number could be ratcheted up again, given current strength in US gasoline demand.

OPEC's role

The only thing that seems to mute the price bulls' unbridled enthusiasm is a residual skepticism about OPEC's credibility.

Rousseau contends that OPEC will have to lower its actual oil productionnot just quotasto the level of 23.5 million b/d (excluding Iraq) specified by the mandated Apr. 1 cuts in order to avoid a global crude oil surplus.

IEA pegs production by the so-called OPEC 10 in March at 25.8 million b/d, 2.3 million b/d above the target set for Apr. 1. And EIA projects the actual OPEC-10 cuts in the second quarter at only 1.5 million b/d.

The statistical arm of the US Department of Energy is banking on Iraqi production recovery to help keep total OPEC output at 27 million b/d through 2005. That would mean the group loses a bit more market share to its non-OPEC brethren, as EIA estimates non-OPEC supply will rise by 1.4 million b/d this year and 1.2 million b/d in 2005.

Such an outlook would leave room for a moderate amount of stockbuilding in the next 18 months or so. That would put downward pressure on oil prices, under normal circumstances.

We would note here what are normal circumstances are for oil demand prices, but, frankly, we don't recall what they were.

(Online Apr. 12; author's e-mail: [email protected])

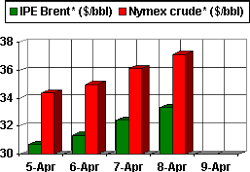

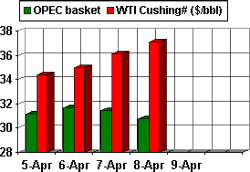

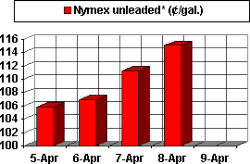

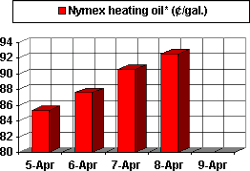

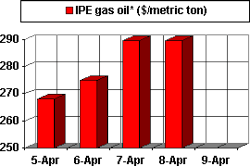

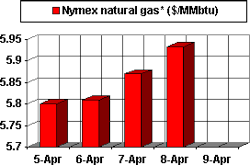

OGJ HOTLINE MARKET PULSE

Latest Prices as of Apr. 12, 2004

Prices unavailable for Apr. 9 with markets closed for Easter holiday.

null

null

null

null

null

null

null

E: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

Futures price, next month delivery. #Spot price.