IEA: Momentum in LNG project development remains strong in 2024

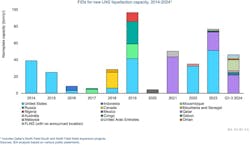

Since Russia's invasion of Ukraine in February 2022, over 150 billion cu m/year (bcmy) of LNG liquefaction capacity has been approved, including Qatar’s North Field South and North Field West expansion projects, according to data from the International Energy Agency (IEA).

The US accounted for 75% of the liquefaction capacity sanctioned between 2022 and 2023. However, no US LNG project has reached FID since January 2024 due to a temporary pause on pending decisions on exports of LNG to non-free trade agreement countries. The Middle East became the leading driver for new LNG project approvals in 2024, led by Qatar, the UAE, and Oman. Meantime, LNG developers in North America and the Middle East are increasingly focusing on reducing emissions through CCUS-based solutions, electrification, and renewable power supply.

In February 2024, Qatar announced it is proceeding with the North Field West expansion project, with a capacity of around 22 bcmy. This follows Qatar’s previously announced projects, North Field East in 2021 and North Field South in 2023. Altogether, these expansion projects will increase Qatar’s LNG liquefaction capacity by 85% (or more than 88 bcmy) to over 190 bcmy by 2030. In parallel, Qatar is developing CCUS-based solutions to reduce the emissions intensity of its LNG exports. By 2023 QatarEnergy had deployed 2.2 million tonnes/year (tpy) of CCUS capacity. Its target is a total capacity of 7-9 million tpy by 2030 and over 11 million tpy by 2035.

In April 2024, the Marsa LNG project in Oman reached FID with a capacity of 1.36 bcmy. It is expected to start operations by first-quarter 2028, primarily targeting the LNG bunkering market in the Gulf. The liquefaction plant will be 100% electrically driven and supplied with solar power.

The Ruwais LNG project of the UAE reached FID in June 2024. The 13 bcmy project is expected to start operations in 2028. The plant will have an electrically powered liquefaction system and will rely on renewable power supply, which is set to reduce the emissions intensity of the LNG.

In Canada, the Cedar FLNG project (4.5 bcmy) took FID in June 2024 and plans to begin operations by late 2028. The plant will use renewable electricity.

In Mexico, the Altamira FLNG 2 project (1.9 bcmy) secured construction financing in July 2024, with first LNG delivery expected in first-half 2026.

In September 2024, Golar LNG took FID on the conversion of an LNG carrier to an FLNG with capacity of 4.8 bcmy.

According to IEA, together with Qatar’s expansion projects, LNG liquefaction plants that have reached FID or are under construction would add about 270 bcmy of export capacity by end-2030. This increase in LNG production capacity could loosen market fundamentals and ease gas supply security concerns in the second half of the decade, IEA said.