Crude prices slump as demand questions retake control

With the killing of a key Hamas leader and Israel’s pledge to not attack Iranian oil infrastructure, markets returned their focus to global demand concerns as OPEC analysts lowered their consumption growth forecasts leading to a sell-off that breached the key $70/bbl level for US crude. WTI traded between $75.10/bbl (Monday) and $68.95/bbl (Friday), a $6.15 drop across the week. Brent trade also experienced a Monday-Friday high-low scenario, with $78.55-72.05 as its range. Not even an across-the-board draw on inventories could support prices. Both grades look to settle much lower week-on-week, erasing the gains of the past 2 weeks. The WTI=Brent spread has widened slightly to -$4.35.

Israeli forces Thursday killed Hamas leader Yahya Sinwar, believed to be the mastermind behind the Oct. 7, 2023, attack on Israel. It is now thought that this gives Israel incentive to continue to pursue Hamas to end its presence in the region. Talk of a ceasefire between the rebels and Israel seems moot at this point. However, Israel’s pledge not to attack Iran’s nuclear or oil facilities has greatly reduced the risk premium in oil trading.

Meanwhile, OPEC, in its latest monthly oil market report, reduced its 2025 global oil demand growth forecast to 1.93 million b/d. It was the third downward revision from the starting estimate of 2 million b/d. Both the International Energy Agency (IEA) and US Energy Information Administration (EIA) also expect lower oil consumption ahead. Absent the geopolitical risk premium, these bearish reports weighed heavily on crude markets, resulting in “backwardation,” a condition in which the highest prices are in the near-term with lower prices in successive months.

Concerns over China’s oil demand continue as its September imports were down 7.4% from August to 11.1 million b/d on lower refining margins. EV sales and the conversion of trucks to LNG have dampened consumption of refined products there. Last weekend’s announcement regarding a new stimulus program there provided limited impetus for economic growth.

The EIA’s Weekly Petroleum Status Report indicated across-the-board decreases in crude and refined product inventories. But total US oil production rose to a new record high of 13.5 million b/d vs. 13.4 million b/d last week and 13.2 last year at this time. The agency is also reporting that oil production in the Permian basin is expected to average 6.3 million b/d this year and 6.6 million b/d next year. Productivity improvements such as longer laterals, optimizing spacing, and advanced fracturing techniques were cited as the efficiency gains.

US housing starts fell 0.5% in September, but confidence among home builders rose this month on the interest rate reduction. Meanwhile, US industrial output declined by 0.3% last month, reversing August’s growth. On the positive side, retail spending in September rose 0.4% and import prices fell for the second consecutive month, largely on lower fuel prices. All three major US stock indexes set new record highs again this week and are positive week-on-week. The US dollar is also stronger, which places additional downward pressure on crude pricing.

Oil, technical analysis

November NYMEX WTI futures contracts fell below the 8-, 13-, and 21-day moving averages and dropped more than $6.00 on the week. Volume, shown in the second box, is below average at 50k as November 2024 will expire next Tuesday and traders now focus on December. The relative strength Indicator (RSI), a momentum indicator shown in the third box, is “slightly oversold” at the 43 mark; 30 or below is considered very oversold while 70 or above is considered very overbought. Resistance is now pegged at $70.00. Near-term support is $ $69.00.

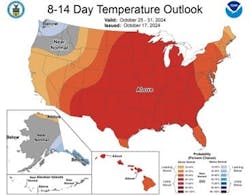

The precipitous drop in oil prices this week could lead to some “bargain” buying and technical moves back up to at least the 8-day moving average of $72.45/bbl. With the geopolitical risk premium off the table for now, fundamental traders will be looking for solid signals of increasing demand. However, early fall is the traditional turnaround period for refineries. And, with gasoline consumption down considerably, more capacity may be taken offline in the near term. Furthermore, in the 8 to 14-day forecast, the National Oceanic and Atmospheric Association (NOAA) shows above-normal temperatures for the majority of the US, making an increase in heating oil demand less likely.

Natural gas

Natural gas futures continued their almost perfect stair-step lower as even cooler temperatures along the East Coast and a large increase in LNG exports failed to support a direction change. The week’s high was $2.625/MMbtu on Monday, while the low was Friday’s $2.255. Supply last week was 108.0 bcfd vs. 107.5 bcfd the previous week. Demand was 99.7 bcfd, up from 96.6 the week prior and driven by an increase in residential usage, which overcame reduced power-generation demand in the wake of Hurricane Milton. Exports to Mexico were 6.3 bcfd vs. 6.4 bcfd the week before. LNG exports were 13.7 bcfd. vs. 12.7 the previous week.

European natural gas prices were quoted at ≈$11.75/MMbtu on rising fears of LNG shipment disruptions in the Middle East. The EIA’s Weekly Natural Gas Storage Report indicated an injection of 76 bcf vs. a forecast of 74 bcf and a 5-year average of 96 bcf. Total gas in storage is now 3.7 tcf, 3.0% above last year and 4.6% more than the 5-year average. With only 3 weeks left in the traditional injection season and, assuming an average build of +80 bcf/week, year-end storage totals could reach 3.94 tcf.

November 2024 NYMEX Henry Hub natural gas futures have now slipped below the 8-, 13-, and 21-day moving averages and have touched on the lower Bollinger Band limit, a buy signal. Volume is low at 100k. The RSI is “oversold” at 36. Support is pegged at $2.60/MMbtu with resistance at $2.72.

European gas storage levels are about 95% full with several LNG shipments having been diverted from Asia after landed prices spiked to around $11.75/MMBtu. Part of the uptick in prices was due to concerns over possible interruption of LNG supplies out of the Middle East. The next two weeks don’t look positive for natural gas demand as above-normal temperatures are forecasted. The recent cool snap along the East Coast appears to be short-lived.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.