IEA consecutively cuts oil demand growth forecast

In its latest monthly Oil Market Report, the International Energy Agency cut its forecast for global demand growth in 2019 for a second consecutive month. It is now projected at 1.2 million b/d, reduced from 1.3 million b/d in the previous report and 1.4 million b/d in the April report.

IEA noted that currently the major focus of the oil market is on oil demand as economic sentiment weakens. Global economic activity continues to show signs of weakness in 2019 and trade tensions remain at the center of market concerns.

In May, the Organization for Economic Cooperation and Development published an outlook for global gross domestic product growth for 2019 of 3.2%—lower than previously assumed. World trade growth has fallen back to its slowest pace since the financial crisis 10 years ago, according to data from the Netherlands Bureau of Economic Policy Analysis and various purchasing managers’ indices.

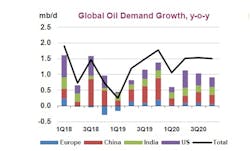

Global oil demand is now estimated to have risen by just 250,000 b/d year-on-year in this year’s first quarter, the lowest annual growth registered since fourth-quarter 2011, when the price of Brent crude oil averaged $109/bbl.

In the first quarter, oil consumption fell in the OECD by 600,000 b/d year-on-year and rose in non-OECD countries by 850,000 b/d. A global economic slowdown, lower growth in the petrochemical industry, and warmer-than-normal weather in the northern hemisphere were contributory factors. One should also bear in mind that annual growth in first-quarter 2018 amounted to 1.9 million b/d. This also contributed to low growth on a year-on-year basis.

The demand growth estimate for this year’s second quarter is now at 1.2 million b/d, down 300,000 b/d from last month’s estimate. In April, China’s oil demand was 230,000 b/d less then expected, owing to substantial downgrade for diesel and LPG.

However, these lower global estimates for the first and second quarter are partly offset by higher forecasts for the third quarter (+200,000 b/d) and the fourth quarter (+80,000 b/d) driven by lower oil prices and an expected rebound in petrochemical demand.

2020 demand outlook

In this report, IEA publish its first outlook for 2020.

As for 2020, oil demand growth is expected to accelerate to 1.4 million b/d. Non-OECD countries will be the main drivers, growing 880,000 b/d year-on-year, although OECD will also contribute 520,000 b/d, helped by petrochemical cracker plant additions in US and higher economic growth.

On a fuel-by-fuel basis, diesel and gas oil will see solid expansion, as new rules implemented by the International Maritime Organization force ship operators to switch away from high-sulfur fuel oil (HSFO), the use of which will decline markedly. IEA expect gas oil demand in the marine sector to rise about 200,000 b/d in 2019 and 900,000 b/d in 2020. HSFO consumption will decline 300,000 b/d year-on-year in 2019 and by 1.6 million b/d in 2020.

Global oil supply

During May, global oil supply edged down 100,000 b/d to 99.5 million b/d, nearly 3 million b/d below a November peak of last year. The month-on-month loss, led by Canada, Iran, Russia, and Saudi Arabia, was mostly offset by higher supply from Brazil, the US, Iraq, and biofuels. As for the Organization of Petroleum Exporting Countries, plunging Iranian production and lower Saudi and Nigerian output cut crude supply by 230,000 b/d to just under 30 million b/d, a 5-year low. Non-OPEC supply rose 130,000 b/d to 64 million b/d.

Compared with a year ago, global oil supply in May was 620,000 b/d higher. Driven by the US, non-OPEC output was up 2.1 million b/d, while OPEC was down 1.5 million b/d.

While supply growth in US is forecast to slow to 1.3 million b/d in 2020 from 1.7 million b/d this year, expansions in other non-OPEC countries are set to accelerate. Overall, non-OPEC supply growth will accelerate from 1.9 million b/d this year to 2.3 million b/d in 2020.

Norway is expected to show growth of 290,000 b/d after declining by 130,000 b/d this year and Brazil is projected to ramp up by a further 330,000 b/d following a 240,000 b/d increase this year. Canada and Russia will also post gains assuming production restraints are lifted.

Stronger non-OPEC supply growth next year means that even with higher demand growth vs. 2019, the requirement for OPEC crude could drop to 29.3 million b/d in 2020, about 650,000 b/d below the group’s production in May.

Global refinery throughput in May was just 80.4 million b/d, the lowest level in 2 years on maintenance and unplanned outages. By August, refinery runs could be more than 4 million b/d higher. In 2019-20, the global refining industry will add 3.5 million b/d of new capacity.

OECD oil stocks rose by 15.8 million bbl in April to 2,883 million bbl and are slightly above the 5-year average. In days of forward demand, stocks amount to 59.9 days, 1.6 days below the average. Preliminary data for May shows a large build in US crude stocks.