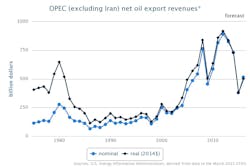

EIA: OPEC’s net oil export revenues declined 11% in 2014

Members of the Organization of Petroleum Exporting Countries, excluding Iran, earned $730 billion in net oil export revenues during 2014, according to estimates from the US Energy Information Administration.

The total—the lowest earnings for the group since 2010—is an 11% decline from $824 billion in 2013, primarily due to the decline in average annual crude oil prices, and to a lesser extent from decreases in the amount of OPEC net oil exports, EIA says.

Saudi Arabia earned the largest share of the earnings—$246 billion in 2014—representing one third of total OPEC oil revenues.

Iran’s revenues are excluded from the total because of difficulties associated with estimating that country’s earnings, including its inability to receive payments and possible price discounts offered to existing customers.

OPEC net oil export revenues, excluding Iran, could fall further to $380 billion in 2015 as a result of the much lower annual oil prices, EIA projects.

OPEC’s crude oil production and exports as a whole in 2015 will be unchanged from 2014 levels following OPEC’s decision on Nov. 27 to not alter production targets from previous levels EIA, says.

Consistent with OPEC’s announcement, Saudi Arabia has indicated its intention to maintain its export market share rather than cut production to keep prices higher. In the past, EIA explains, Saudi Arabia often played the role of the swing producer, temporarily cutting its production to offset supply growth elsewhere or weaker global demand, or increasing its output level to make up for a supply shortfall.

On a per capita basis, OPEC net oil export earnings, excluding Iran, are expected to decline by half from $2,186 in 2014 to $1,114 in 2015. OPEC net oil export revenues in 2015 are based on projections of global oil prices and OPEC production levels from EIA’s March 2015 Short-Term Energy Outlook.

OPEC revenues in 2016 are projected to rebound to $515 billion with the expected rebound in oil prices.