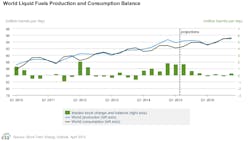

Global oil production continues to exceed demand, resulting in inventory builds, according to the US Energy Information Administration’s most recent Short-Term Energy Outlook (STEO).

Global oil inventory builds are projected to average 1.7 million b/d through this year’s first half. Global oil inventory builds typically moderate during the second half of the year, as demand rises and non-Organization of Petroleum Exporting Countries supply growth slows, particularly in the US, because of lower oil prices.

Global consumption increased by 900,000 b/d in 2014, averaging 92 million b/d for the year. EIA expects global consumption will rise by 1 million b/d in 2015 and by 1.1 million b/d in 2016.

EIA estimates that non-OPEC production jumped by 2.2 million b/d in 2014. EIA expects non-OPEC production to rise by 700,000 b/d in 2015 and 400,000 b/d in 2016, 300,000 b/d and 200,000 b/d lower, respectively, than in last month’s STEO. The slower growth in total non-OPEC supply is largely attributable to slower production growth in the US and Canada and declining production in Europe and Eurasia.

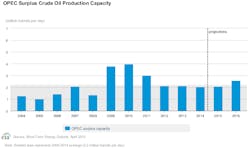

OPEC crude oil production is forecast to rise by 100,000 b/d in 2015, led by Iraq, and fall by 500,000 b/d in 2016. EIA expects OPEC surplus crude oil production capacity, which is concentrated in Saudi Arabia, to increase to an annual average of 2.1 million b/d in 2015 and 2.6 million b/d in 2016, after averaging about 2 million b/d in 2014.

“Surplus capacity is typically an indication of market conditions, and surplus capacity below 2.5 million b/d is an indicator of a relatively tight market. However, the current and forecast levels of global inventory builds make the projected low surplus capacity level in 2015 less significant,” EIA said.

North Sea Brent crude oil spot prices decreased by $2/bbl in March to a monthly average of $56/bbl. This decrease followed a $10/bbl increase in February, the first increase in 8 months. EIA projects the Brent crude oil price will average $59/bbl in 2015, unchanged from last month’s STEO, with prices rising from an average of $56/bbl in the second quarter to an average of $67/bbl in the fourth quarter. The Brent crude oil price is projected to average $75/bbl in 2016.

The return of Iran’s oil

The possible removal of economic sanctions against Iran, as part of the nuclear agreement announced early this month, could substantially change EIA’s current forecast in this STEO for oil supply, demand, and prices by allowing a significantly increased volume of Iranian oil to enter the market.

Iran is believed to hold at least 30 million bbl in storage. EIA believes that Iran has the technical capability to ramp up crude oil production by at least 700,000 b/d by the end of 2016, resulting in an annual average growth of about 500,000 b/d in global inventories in 2016, which would stress storage capacity limits and put downward pressure on prices.

EIA notes that, if a comprehensive deal is reached, the reentry of more Iranian barrels could result in a $5-15/bbl lower baseline STEO price projection in 2016 compared with the current STEO. Although the timing and volume of Iran’s exports remain uncertain, the market perception surrounding increased future supplies will also apply downward price pressure to near-term crude oil prices.