MARKET WATCH: NYMEX, Brent crude prices fall after OPEC meeting

The January contract for light, sweet crude settled below $40/bbl on the New York market Dec. 4 after members of the Organization of Petroleum Exporting Countries acknowledged they would accommodate current production, which is more than 1 million b/d over the quota.

Barclays analysts said the lack of guidance on a production quota underlines the discord among OPEC members.

“The high degree of uncertainty about supply levels for next year from its members (with Iran expected to boost output, and Libyan output fluctuating) adds further stress on its previous target of 30 million b/d,” Barclays analysts said in a research note.

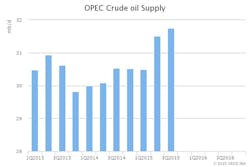

OPEC production for October was estimated at 31.7 million b/d, the International Energy Agency reported in its November Oil Market Report.

Ole Hansen, Saxo Bank’s head of commodities strategy, said, “The latest OPEC meeting yielded no change and no words about how the cartel is going to deal with the additional supply from Iran next year.”

Iran could bring 500,000 b/d on stream as early as February 2016 once sanctions are lifted, Hansen said.

“The first quarter is likely to be the most challenging of them all with rising supplies from Iran combined with a seasonal increase in US inventories leaving global inventory levels at high, and to some extent, unsustainable levels,” Hansen said.

During a news conference after the meeting in Vienna, OPEC officials emphasized that every country has a sovereign right to produce.

Energy prices

The January crude oil contract on the New York Mercantile Exchange declined $1.11 to settle Dec. 4 at $39.97/bbl. The February contract was down $1.11 to $41.39/bbl.

The NYMEX natural gas contract for January edged up only a fraction of a penny to a rounded $2.19/MMbtu. The Henry Hub gas price was $2.08 on Dec. 4, down 3¢.

Nicholas Potter, Barclays analyst in New York, noted that December gas futures are hovering in their lowest range since 1999. He attributed the low gas prices to warmer weather and also to growing US gas reserves.

“The [US Energy Information Administration] released its US Crude and Natural Gas Proven Reserve report recently, which showed that total natural gas reserves for 2014 were up 10% year-on-year to 388.8 tcf,” Potter said.

At current consumption of 27 tcf/year, EIA statistics imply 14 years of US proved gas reserves, Potter said in a Dec. 7 research note.

Heating oil for January delivery dropped 1.6¢ to a rounded $1.34/gal. The price for reformulated gasoline stock for oxygenates blending for January was down 2.6¢ to a rounded $1.27/gal.

The January ICE contract for Brent crude dropped 84¢ to $43/bbl, and the February contract was down 93¢ to $43.50/bbl. The ICE gas oil contract for December closed at $395.75/tonne on Dec. 4, up 50¢.

The average price for OPEC’s basket of 12 benchmark crudes for Dec. 4 was $38.08/bbl, up 19¢.

Contact Paula Dittrick at [email protected].

*Paula Dittrick is editor of OGJ’s Unconventional Oil & Gas Report.

Paula Dittrick | Senior Staff Writer

Paula Dittrick has covered oil and gas from Houston for more than 20 years. Starting in May 2007, she developed a health, safety, and environment beat for Oil & Gas Journal. Dittrick is familiar with the industry’s financial aspects. She also monitors issues associated with carbon sequestration and renewable energy.

Dittrick joined OGJ in February 2001. Previously, she worked for Dow Jones and United Press International. She began writing about oil and gas as UPI’s West Texas bureau chief during the 1980s. She earned a Bachelor’s of Science degree in journalism from the University of Nebraska in 1974.