EIA raises 2024 oil price forecast on lower inventory

In the October Short-Term Energy Outlook (STEO), the US Energy Information Administration (EIA) forecasts the annual average Brent spot price in 2024 to be $95/bbl, $7/bbl higher than the previous month's STEO.

The Brent crude oil price averaged $94/bbl in September, $8/bbl higher than in August and $19/bbl higher than in June. Oil prices rose in September after Saudi Arabia extended its voluntary crude oil production cuts through the end of the year and US commercial crude oil inventories fell to the lowest level since early 2022 at the end of September. EIA forecasts crude oil prices will rise in the coming months, reflecting expectations of tightening balances in global oil markets.

Based on current assessments, EIA anticipates a gradual decrease of global oil inventories by 200,000 b/d during second-half 2023. EIA indicates that inventory reductions will persist at this rate throughout first-quarter 2024 due to the OPEC+ production cuts, which maintain global oil production levels below global demand. For the remaining three quarters of 2024, inventories are expected to remain relatively balanced, as the growth in global oil consumption slows while production increases.

Consequently, EIA projects that the Brent spot price will average $91/bbl in fourth-quarter 2023 and rise to an average of $96/bbl in second-quarter 2024, with some minor downward price pressures emerging in second-half 2024.

Oil supply

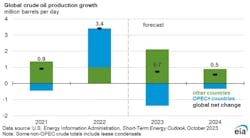

Global crude oil supply growth has been limited in 2023 because of voluntary production cuts from Saudi Arabia and reduced production targets from other OPEC+ countries. EIA expects countries within the OPEC+ agreement will collectively reduce their crude oil production by 1.4 million b/d in 2023, partly offsetting production growth of 2.7 million b/d by non-OPEC+ producers.

Furthermore, EIA's projection indicates that OPEC+ crude oil production will decrease by an additional 300,000 b/d on average in 2024. This forecast assumes some extension of voluntary production cuts from Saudi Arabia into 2024 and overall production from OPEC+ countries remaining below targets.

EIA forecasts global liquid fuels production (crude oil and other liquids) will increase by 1.3 million b/d in 2023 and by 900,000 b/d in 2024. Non-OPEC production will increase by 2.2 million b/d in 2023, more than offsetting the decline in OPEC output. Production growth outside OPEC is driven by new project starts in North America and South America. Non-OPEC production is projected to grow by 1 million b/d in 2024, with new projects in Guyana and Brazil contributing to the supply, alongside increased production in the US and Canada.

Uncertainties

Although the recent attacks on Israel have not affected physical oil markets, they raise the potential for oil supply disruptions and higher oil prices, according to EIA.

“In addition to these new developments, growth in global oil production remains a key uncertainty in our forecast for next year. Current OPEC+ production targets are set to expire at the end of 2024, and we assume that continuing voluntary cuts and other factors will keep actual OPEC+ crude oil production well below targets as the group tries to limit increases in global oil inventories,” EIA noted.

“However, should OPEC+ produce closer to target levels than we currently assume, it could reduce prices in 2024. Also, the rate at which US tight oil producers add drilling rigs and improve well-level efficiency is highly uncertain and could cause global oil production to vary significantly from our forecast. Finally, the global economic outlook remains uncertain, and unexpected changes in GDP growth in the coming months could affect oil demand.”