EIA increases global liquid fuel demand forecast for 2023

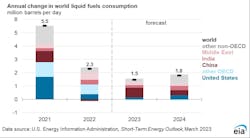

In the March issue Short-Term Energy Outlook (STEO), the US Energy Information Administration (EIA) increased its global liquid fuels consumption forecast to 100.9 million b/d in 2023 from an average of 99.4 million b/d in 2022—400,000 b/d higher than in last month’s outlook.

“The higher consumption forecast is primarily driven by upward revisions to global economic growth. We expect China will account for about half of the growth in global liquid fuels consumption in 2023. Forecast consumption in China increases by 700,000 b/d in 2023. We forecast consumption in India to increase by 200,000 b/d and other non-OECD consumption to grow by 500,000 b/d on average. This growth in non-OECD countries counteracts almost no consumption growth among OECD countries in 2023,” EIA said.

OECD consumption remains largely unchanged as the effects of inflation continue to limit GDP and oil demand growth. EIA forecasts global liquids fuel consumption will grow by an additional 1.8 million b/d in 2024, and non-OECD countries will account for 1.6 million b/d of the growth.

However, forecast uncertainty remains as a wide range of possible outcomes exist for both global economic conditions this year and travel and oil demand in China following its pivot away from a zero-COVID strategy, EIA said.

Global liquid fuels production

“Despite upward revisions to increasing our forecast of global liquid fuels consumption, we still expect consistent global oil inventory builds over the forecast period as global oil production continues to outpace consumption,” EIA said.

In February, Russia said it will cut oil production by 500,000 b/d in March. However, Russia’s liquids fuel production and exports continue to outpace EIA’s expectations as Russia finds buyers in alternative markets. As a result, EIA has raised its forecast for oil production in Russia through end-2024.

EIA now expects production of petroleum and other liquids in Russia will decline to 10.3 million b/d in 2023 from 10.9 million b/d in 2022 and then average 10.1 million b/d in 2024, about 400,000 b/d and 300,000 b/d more, respectively, than the agency’s forecasts in February’s STEO.

“More output in Russia contributes to our higher global liquid fuels production forecast. Given this revision to production, we expect that global oil inventories, which rose by 400,000 b/d in 2022, will grow by an additional 600,000 b/d in 2023 and 300,000 b/d in 2024, putting downward pressure on oil prices later in 2023,” EIA said.