EIA revises down Brent price forecasts for 2023

In its January 2023 Short-Term Energy Outlook (STEO), the US Energy Information Administration (EIA) forecasts that the Brent crude oil price will average $83/bbl in 2023, down 18% from 2022, and continue to fall to $78/bbl in 2024 as global oil inventories build, putting downward pressure on crude oil prices. This compares with EIA’s previous 2023 Brent price forecast of $92.30/bbl in its last month’s STEO.

Global oil production

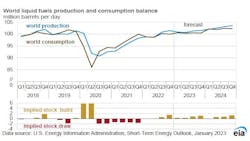

EIA now forecasts that world production of petroleum and other liquid fuels will increase by 1.1 million b/d in 2023, averaging 101.1 million b/d, and 1.7 million b/d in 2024, averaging 102.8 million b/d. This increase reflects large growth in several non-OPEC countries and in OPEC output that more than offset 1.5 million b/d of declines in Russia’s production over the forecast period. US and other non-OPEC producers outside of Russia will add 2.4 million b/d of oil production in 2023 and an additional 1.1 million b/d in 2024.

US oil production growth is driven by increases in crude oil production in the Lower 48 states—mostly in the Permian region—as well as a combination of increases to production of hydrocarbon gas liquids and biofuels, which together account for about 40% of US liquid fuels production growth in 2023 and 2024.

EIA forecast that Russia’s petroleum and other liquid fuels production will decline to 9.5 million b/d in 2023, from 10.9 million b/d in 2022, and then average 9.4 million b/d in 2024. According to EIA, the extent to which European Union (EU) sanctions, other sanctions, and the G7 price cap will affect Russia’s crude oil and petroleum product exports and production remains uncertain.

“We expect that most crude oil exports from Russia will continue to find buyers. But we expect the sanctions on petroleum products will cause greater disruptions to Russia’s oil production and exports because finding alternative buyers as well as transportation and other services to reach those buyers is likely to be more challenging than for crude oil,” EIA said.

OPEC crude oil production in EIA’s forecast averages 29.5 million b/d in 2024, up 800,000 b/d from 2022. Part of this growth is driven by Venezuela. Following the US Department of the Treasury issuing General License (GL) 41 at the end of November 2022, Chevron is resuming oil production in Venezuela for export to the US. However, “our OPEC production forecast is subject to considerable uncertainty, driven by a combination of possible outcomes for country compliance to existing OPEC+ production targets and changes to existing OPEC+ targets, as well as ongoing developments in Iran, Libya, and Venezuela,” EIA said.

Global oil consumption

EIA expects that global consumption of liquid fuels will increase to 102.2 million b/d in 2024 from an average of 99.4 million b/d in 2022, driven primarily by growth in non-OECD countries, such as India and China.

EIA forecasts growth in global demand for oil will slow in 2023 before picking up in 2024, as global GDP growth (based on forecasts from Oxford Economics) rises to 3.3% in 2024 from 1.8% in 2023. With more global oil production than consumption in the forecast, EIA expects global oil inventories will increase over the next 2 years.

“Although we forecast global oil consumption to increase, our demand forecast remains uncertain as a result of ongoing concerns around global economic conditions and the impact of the easing COVID-19 restrictions and rising case counts in China,” EIA said.

Based on the S&P Global macroeconomic model, EIA expects US real GDP to grow by 0.5% in 2023, with economic growth returning after contraction in first- and second-quarter 2023. In 2024, real GDP grows by 1.9%, driven primarily by an increase in household consumption. Relatively flat economic growth in 2023 results in total US energy consumption falling by 0.9% in EIA’s forecast. Total energy consumption then rises by 1% in 2024.

US product prices

US gasoline and diesel prices in EIA’s forecast generally decline as wholesale refining margins and crude oil prices fall.

In December 2022, the US retail price for regular-grade gasoline averaged $3.21/gal and the retail diesel price averaged $4.71/gal. Both December prices were the lowest since the beginning of Russia’s full-scale invasion of Ukraine in February. In EIA’s forecast for 2023 and 2024, US refinery runs and gasoline and diesel production are higher than in 2022, which along with increasing global refinery capacity, will contribute to narrowing US refining margins in 2023 and 2024.

EIA forecasts US gasoline refining margins will fall by 29% in 2023 and fall by 14% in 2024, leading to retail gasoline prices averaging around $3.30/gal in 2023 and $3.10/gal in 2024.

EIA expects that US refining margins for diesel will fall by 20% in 2023 and by 38% in 2024. Retail diesel prices will average about $4.20/gal in 2023, down 16% from 2022. In 2024, EIA expect prices to continue to fall, and average near $3.70/gal.