IEA: Global gas production growth to be slightly negative in 2022

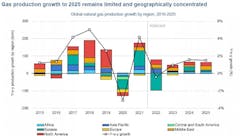

In its 2022 third-quarter Gas Market Report, the International Energy Agency (IEA) anticipates global gas production growth being slightly negative in 2022, as the expected drop in Russian production resulting from lower demand and higher import diversification in Europe offsets increases from other regions. Limited increases are expected in subsequent years, principally from North America and the Middle East.

According to IEA data, global natural gas supply increased by an estimated 4.1% globally in 2021, supported by the market recovery but hampered by a series of planned and unplanned outages that limited output in several producing and exporting countries. The resulting market tightening was further exacerbated by a drop in Russian supply to Europe despite available production and transport capacity.

Gas production in North America grew by 2.1% in 2021 despite limited spending in the US upstream sector, supported by increasing domestic and export demand. In IEA’s forecast, North America leads medium-term global growth in natural gas supply with about 85 bcm added between 2021 and 2025. The region accounts for about 40% of the net increase in production capacity and over half of global net production growth between 2021 and 2025.

The US continues to lead the trend, with average growth of 2% supported by limited domestic and LNG export development and primarily supplied by the Appalachian basin, complemented by contributions from other dry shale gas plays and associated gas from tight oil basins.

Canadian production grows at a slower pace and principally towards the end of the forecast period to provide feed gas for the LNG Canada project, while Mexico continues its declining trend.

Eurasia’s gas production rebounded by over 10% in 2021, accounting for over half of incremental global gas supply. Strong recovery in domestic demand together with higher exports (primarily towards Asia) supported this strong growth. Gas production is expected to decline by over 12% in 2022 on lower domestic demand and Russia’s rapidly declining pipeline supplies to Europe, IEA said.

According to IEA, Russia’s rapidly deteriorating export prospects in Europe are expected to weigh on the region’s production outlook. Gas production is expected to recover by 1% per year between 2022 and 2025, but total output would remain 10% below 2021 levels by the end of the forecast.

The Middle East is a major contributor to global gas supply growth, adding nearly 70 bcm of production between 2021 and 2025, which represents a 10% increase on the region’s gas output. This is driven by a handful of large-scale projects currently under development, including various phases of South Pars in Iran, Hawiyah in Saudi Arabia, Barzan in Qatar, and Karish in Israel.

Gas production in the Asia Pacific region is set to increase by 4% between 2021 and 2025 and approach 680 bcm by the end of the forecast period. Most of the region’s growth is in China, which could see its domestic production increase by 12% (or 25 bcm) from 2021 levels to reach 230 bcm in 2025. India’s domestic production revival is also expected to continue, boosting output by close to 9 bcm (27%) between 2021 and 2025. Australia’s gas supply stabilizes at around 150 bcmy, while most of the other producers in the region (including Indonesia, Malaysia, Thailand, Viet Nam, Pakistan, and Bangladesh) are set to experience production declines over the forecast horizon.

Africa’s production of natural gas reaches over 290 bcm by 2025, increasing at an average of 2.7% per year over the forecast period, less than half its pre-pandemic rate (averaging 6.1% during the 2015 to 2019 period). This results from a combination of limited additional upstream and LNG export capacity due to be commissioned up to 2025, and more modest domestic growth as mature North African markets start to plateau while demand in emerging African markets is hampered by high import prices and limited availability of local resources.

Gas production in Central and South America, which experienced 2 years of decline in 2020 and 2021, is expected to partly recover and reach 156 bcm by 2025, above its 2020 level (150 bcm) but still significantly below its 2019 level (167 bcm). This is led by Argentina’s gradual ramp-up of pipeline capacity to debottleneck its Vaca Muerta shale gas deliveries, while Peru sees some increase with the recovery of its LNG export capacity and additional domestic growth. Brazil’s output almost stagnates to 2025. Legacy exporters Bolivia and Trinidad and Tobago see some capacity being developed, but this is not sufficient to return to past production levels, while Venezuela’s production continues its decline.

Europe’s gas production declined by 3.5% in 2021, driven by lower output from the Netherlands, Norway, and the UK. Production is expected to recover by almost 3% in 2022 on lower maintenance in Norway and the UK. Overall gas production is set to decline by close to 1.5% per year between 2021 and 2025. Output is expected to remain broadly flat in Norway and Ukraine, while UK and EU output drops by 20% by 2025 compared to 2021 levels. In the Republic of Türkiye, Sakaryia field is set to deliver first gas in 2023 and ramp up during 2024-2025.