OGJ100 companies benefit from higher commodity prices in 2021

Global oil demand and commodity prices rebounded last year as COVID-19 restrictions were increasingly lifted, and the latest OGJ100 survey shows the financial performance of included companies increasing in 2021 compared to 2020.

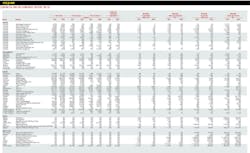

Oil & Gas Journal’s look at the leading 100 oil and gas producing companies based outside the US allows for comparison of the size and results of the entities. For many of the national oil companies in the report, though, no such information on assets, revenues, earnings, or capital expenditures is available. Companies in the OGJ100 are grouped by regions according to the location of their corporate headquarters.

Financial results in this report are indicated in US dollars. Due to exchange rate variation, results can be significantly affected when translated into US dollars.

Canadian producers

A sample of 16 Canadian companies included in the OGJ100 reported a 142% increase in total revenues in 2021 to $137 billion. The combined net income was $17.8 billion in 2021, compared to a loss of $20.3 billion for the same group a year earlier.

Western Canadian Select (WCS) weight differentials averaged $13.04/bbl in 2021, a slight increase of 4% from $12.57/bbl in 2020. The widening of the WCS heavy oil spread in 2021 compared to 2020 primarily reflected the increase in WTI benchmark pricing and the widening of the US Gulf Coast heavy oil pricing.

In 2021, the average Canadian dollar weakened slightly to the US dollar on average, rising to 0.798 from 0.745 in 2020.

Collectively, the Canadian group’s assets at yearend 2021 increased 24% to $240 billion from $192.8 billion at yearend 2020. This was partly due to a weaker Canadian dollar relative to the US dollar on Dec. 31, 2021.

The Canadian group’s collective capital expenditures in 2021 increased slightly to $13.2 billion from $8.78 billion a year ago.

The group’s worldwide oil reserves increased 15% from a year ago to 25 million bbl, while natural gas reserves increased 31% to 28.36 tcf.

Suncor Energy’s net income was $3.3 billion in 2021, compared to a loss of $3.2 billion in 2020. The company increased annual production by about 5.3% to 731,700 boe/d. The completed debottlenecking project at Firebag and increased production from MacKay River led to Oil Sands production of 644,200 boed, 9% higher than 2020 and the second-highest oil sands production on record. At yearend, Suncor resumed two-train operations at Fort Hills.

Cenovus Energy reported a net income of $468 million for 2021, compared with a net loss of $1.77 billion in 2020. Imperial Oil’s net income was $1.98 billion for 2021, compared to a loss of $7.5 billion in 2020.

European companies

OGJ100 companies based in Europe reported an estimated collective net income of $93.6 billion for 2021, compared to a loss of $54.72 billion a year ago. Year-on-year comparisons of the group’s figures were affected due to missing data from some Russian companies.

Ranked by assets, Shell is the largest of the European companies in the OGJ100, followed by OAO Gazprom, Total SA, and bp.

Shell’s net income was $20.63 billion in 2021, compared with a loss of $21.5 billion in 2020. Integrated gas earnings in 2021 were $6.34 billion, compared with a loss of $6.3 billion in 2020. The increase was mainly driven by lower impairment charges, higher realized prices for oil, LNG and gas, higher gains on sale of assets, and favorable tax movements. Upstream earnings in 2021 were $9.7 billion, compared with a loss of $10.78 billion in 2020, mainly driven by higher realized oil and gas prices, and lower impairment charges. Oil products earnings in 2021 were $2.66 billion, compared with a loss of $494 million in 2020.

bp’s profit for 2021 was $8.5 billion, compared with a loss of $20.7 billion in 2020. The operator produced 1.85 million b/d in 2021, down from the previous year. North America became the company’s largest producing region, with a daily output of 333,000 bbl.

TotalEnergies reported a net income of $16.4 billion in 2021, compared to a loss of $7.33 billion in 2020. TotalEnergies’ capital expenditures increased to $12.34 billion in 2021 from $10 billion in 2020.

Latin American producers

Petroleo Brasileiro SA (Petrobras) reported a net income of $19.98 billion in 2021, compared to a net income of $948 million in 2020. The company’s capital expenditures in 2021 increased to $6.3 billion from $5.8 billion a year earlier.

Mexican state energy giant Pemex reduced its losses by more than half in 2021 to $14.5 billion, helped by a jump in global oil prices.

Asian companies

PetroChina Co. Ltd. is again the largest of the Asia Pacific companies in the OGJ100 by assets, followed by Petronas and China National Offshore Oil Corp. Ltd. (CNOOC).

PetroChina’s net income jumped to $17.78 billion in 2021 from $4.85 billion in 2020, thanks to increased selling prices of oil and gas products and the increase in the sales volume. CNOOC’s profits increased to $10.9 billion in 2021, compared to $3.6 billion in 2020, and $8.8 billion in 2019.

Petronas made a profit of $11 billion in 2021, compared to a loss of $5 billion a year earlier.

Middle East

Saudi Arabian Oil Co. (Saudi Aramco)’s total assets increased to $576.7 billion at yearend 2021 from $510 billion at yearend 2020, and $398 billion at yearend 2019. The company made a profit of $110 billion, compared to $49 billion for 2020 and $88 billion for 2019.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.

Laura Bell-Hammer

Statistics Editor

Laura Bell-Hammer is the Statistics Editor for Oil & Gas Journal, where she has led the publication’s global data coverage and analytical reporting for more than three decades. She previously served as OGJ’s Survey Editor and had contributed to Oil & Gas Financial Journal before publication ceased in 2017. Before joining OGJ, she developed her industry foundation at Vintage Petroleum in Tulsa. Laura is a graduate of Oklahoma State University with a Bachelor of Science in Business Administration.