EIA revises up 2022 Russia production forecasts

In its July Short-Term Energy Outlook (STEO), the US Energy Information Administration (EIA) forecasts Russia’s liquid fuels production will average 10.7 million b/d in second-half 2022, up from a forecast of 10 million b/d in last month’s STEO. The increase reflects EIA’s expectation that Russia’s production will remain in third-quarter 2022 before EU sanctions take effect at end 2022. However, EIA forecasts a larger drop in Russia’s production next year, with 2023 production averaging 9.3 million b/d, down by 200,000 b/d from last month’s forecast.

In this midyear STEO, EIA forecasts global consumption of petroleum and other liquid fuels will grow by 2.2 million b/d in 2022. This growth is less than its January STEO forecast 2022 growth of 3.6 million b/d. The reduced consumption forecast reflects the reduced global GDP forecast and the COVID-related lockdowns in China during first-half 2022. EAI’s global economic forecasts come from Oxford Economics, which forecasts GDP will increase by 3.2% in 2022 compared with the 4.5% used in the January STEO. Forecasted GDP grows by 3.3% in 2023, and global consumption of petroleum and other liquid fuels grows by 2 million b/d in 2023.

EIA expects non-OPEC production will increase by 2.2 million b/d in 2022 and by an additional 600,000 b/d in 2023. The US leads production growth among non-OPEC countries in the forecast, and Brazil, Canada, and Norway also contribute significantly to growth. Production increases in these countries more than offset a decline in Russia’s driven by sanctions and independent corporate actions.

US crude oil production is forecasted to average 11.9 million b/d in 2022 and 12.8 million b/d in 2023, which would set a record for most US crude oil production in a year. The current record is 12.3 million b/d, set in 2019.

Regarding Russia’s production, “our assumptions about the EU import ban and the reduced availability of shippers are reflected in our lower forecast on Russia’s crude oil production for 2023. Russia’s production will ultimately depend on how markets and trade flows evolve based on these sanctions as well as any other potential future sanctions. We forecast Russia’s production of liquid fuels will fall to an average of 10.4 million b/d by fourth-quarter 2022, down from 11.3 million b/d in first-quarter 2022. We expect that Russia’s production will fall to 9.1 million b/d by the end of 2023,” EIA said.

At the June 2022 OPEC+ meeting, participants reaffirmed their decision to advance their planned September production increase to July and August and to continue their production agreement through December 2022 to compensate for some under-producing members.

“Notably, they made no adjustments to reflect reduced crude oil production from Russia as a result of sanctions,” EIA said.

OPEC

EIA’s forecast assumes that OPEC+ member countries will not fully increase production in accordance with their targets in 2022. In addition to less oil from Russia, some countries will be unable to meet their new targets because of limited production capacity, and other countries will limit increases because of uncertainty over the magnitude of Russia’s oil losses as well as weakening global oil demand.

OPEC crude oil production averaged 28.3 million b/d in first-half 2022, up 3 million b/d from the same period in 2021. EIA forecasts that average OPEC crude oil production will increase to an average of 29.1 million b/d in second-half 2022 and then increase to 29.3 million b/d in 2023. However, “our OPEC crude oil production forecast is subject to considerable uncertainty, driven by a wide range of possible outcomes for country compliance with existing production targets and for future global demand growth,” EIA said.

EIA expects that surplus OPEC crude oil production capacity will decline to an average of 2.8 million b/d in 2022 from 5.2 million b/d in 2021 as OPEC production increases. EIA also expects it to decline further to an average of 2.6 million b/d in 2023, compared with an average surplus capacity of 2.6 million b/d from 2010 to 2019.

Global oil inventories decreased by an average of 1.4 million b/d from third-quarter 2020 through first-quarter 2022. In EIA’s forecast, global oil inventories increase by 1.2 million b/d in second-half 2022, largely reflecting growth in global oil production paired with slowing growth in oil consumption. However, decelerating production growth will lead to mostly balanced markets in 2023, with inventory levels mostly unchanged next year.

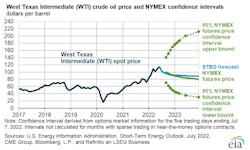

The spot price of Brent crude oil averaged $71/bbl in 2021, and EIA forecasts the Brent price will average $104/bbl in 2022 and $94/bbl in 2023.