EIA continues downward revision of global oil consumption forecast

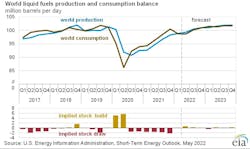

In the May Short-Term Energy Outlook (STEO), the US Energy Information Administration (EIA) continues to revise down its forecast for 2022 global consumption of petroleum and liquid fuels by 200,000 b/d from the April STEO to 99.6 million b/d, primarily a result of downward revisions to consumption growth in China and the US.

EIA forecasts global consumption of petroleum and liquid fuels will increase by 1.9 million b/d in 2023 to average 101.5 million b/d.

According to EIA’s estimates, 97.4 million b/d of petroleum and liquid fuels was consumed globally in April 2022, an increase of 2.1 million b/d from April 2021.

The Brent crude oil spot price averaged $105/bbl in April, a $13/bbl decrease from March. Although down from March, crude oil prices remain above $100/bbl following Russia’s full-scale invasion of Ukraine.

“Relatively slow increases in global oil production amid more rapid increases in consumption contributed to global inventories declining for 6 consecutive quarters from third-quarter 2020 to fourth-quarter 2021. Global inventories increased in first-quarter 2022 as a result of reduced January consumption related to COVID-19 measures, reduced March consumption related to COVID-19 responses in China, and relatively steady global production increases; declines in Russia’s oil production were not substantial until April. At the same time, potential decreases in demand from factors including the ongoing severe COVID-19 containment measures in China, particularly in Shanghai, as well as a decrease in the reported first-quarter US GDP estimate contributed to lower crude oil prices relative to March,” EIA noted.

Global oil inventory draws averaged 1.7 million b/d from third-quarter 2020 through end 2021. EIA estimates commercial oil inventories in the OECD ended first-quarter 2022 at 2.63 billion bbl, up slightly from February.

EIA now expects Brent prices will average $107/bbl in second-quarter 2022 and $103/bbl in second-half 2022. EIA expects the average price to fall to $97/bbl in 2023. However, this price forecast is highly uncertain.

“Actual price outcomes will largely depend on the degree to which existing sanctions imposed on Russia, any potential future sanctions, and independent corporate actions affect Russia’s oil production or the sale of Russia’s oil in the global market,” EIA said.

“The May STEO report does not include a European Union (EU) ban on oil imports from Russia. However, the bans being reported at the time of writing would likely contribute to tighter oil balances and higher oil prices than our current forecast. In addition, the degree to which other oil producers respond to current oil prices and the effects macroeconomic developments might have on global oil demand will be important for oil price formation in the coming months,” EIA continued.

EIA reduced Russia’s oil production in this month’s forecast compared with its April forecast, and EIA now expects oil markets to be mostly balanced from second-quarter 2022 through end 2023. Because oil inventories are currently low, EIA expects downward oil price pressures will be limited and market conditions will exist for significant price volatility.

Uncertainties

Key uncertainties IEA noted about the current oil markets include:

- The impact of sanctions on Russia in relation to its full-scale invasion of Ukraine and the ongoing effect of current sanctions and private sector actions.

- The potential for new sanctions on Russia, including the discussion of an EU-wide ban on energy imports from Russia, and the pace of its implementation.

- The pace of petroleum demand growth through the summer and the potential for demand destruction because of high retail fuel prices.

- The volume of new crude oil production that will come online at price levels near or above $100/bbl.

- The potential for renewed resurgences in COVID-19 cases and the nature of government responses.

- The ongoing impact of the coordinated release of petroleum supplies from strategic reserves in the US and Europe.

- Other geopolitical uncertainties related to Libya, the ceasefire in Yemen, or potential new developments on an Iran deal.