Rystad: West Africa’s crude output in lasting decline

Global oil production is slowly recovering towards pre-COVID levels, but in West Africa the pandemic is set to leave lasting effects. This important region for sweet crude oil production faces numerous challenges, including underinvestment, a lack of infill drilling at mature fields, and infrastructure that is either ageing or threatened, according to Rystad Energy analysis.

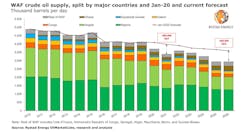

Sweet crude is the preferred oil grade to make jet fuel—a segment hard hit as oil demand plunged last year. West African crude oil production dropped to 3.71 million b/d last year from 4.12 million b/d in 2019 and is set to decline further to 3.39 million b/d this year.

“While we expect output to tick back up in 2022 and 2023 as jet fuel demand returns, production is set to fall below 3 million b/d already from 2025 unless heavyweights Nigeria and Angola can stage a strong comeback and shake off the dismal growth trends of the past decade,” said Nishant Bhushan, upstream analyst at Rystad Energy.

Prior to the pandemic, oil production in West Africa was poised for more investment and activity. Last year’s low oil prices and the unstable market conditions that have continued changed the outlook, as major operators opted for capital discipline and limited investment exposure in regions including West Africa.

As a result, Rystad Energy has reduced its forecast for West African crude oil output by 600,000 b/d for 2021 and by 650,000 b/d for 2026, compared with its pre-COVID-19 projections.

“The structural upstream obstacles that West Africa faces are realities that are not going away in the short term. Even if jet fuel makes a spectacular recovery and demand for light and medium sweet crude grades returns, Nigeria and Angola, as well as other neighbors in structural upstream decline, will not be in a position to supply the market,” said Nishant.

The region’s decline in 2021 is driven by its two biggest oil producers, Nigeria and Angola, which together are estimated to have lost 440,000 b/d versus the pre-COVID-19 forecast. Crude oil production has dropped significantly in Congo, Gabon, and Equatorial Guinea, which together produced 250,000-300,000 b/d in 2010, according to Rystad. Equatorial Guinea has seen a 60% reduction in oil production and Gabon nearly 35% in the past 11 years.

Crude oil production from West African countries was expected to pick up pace in tandem with their Middle Eastern counterparts as the OPEC+ group increased supply. But, as OPEC+ production caps have gradually eased, Nigeria and Angola have been unable to ramp up production to pre-shut-in levels.

“Crude production is not the only thing that’s been hit in the past couple of years. Since the start of 2020, we have also seen that the overall crude production capacity in Nigeria and Angola has taken a major blow. This is due to a number of reasons, including rapid declines at mature fields due to a lack of infill drilling, postponement of final investment decisions that were originally planned for 2020 and 2021, a lack of investment in oil and pipeline infrastructure which leads to frequent production shut-ins (prevalent in Nigeria), and civil unrest caused by militia groups,” said Nishant.

“West Africa has never had much unused capacity—most countries have produced at maximum capacity even as that capacity was gradually declining. When OPEC+ unveiled its massive 9.8 million b/d cut program in May 2020, the region had an overall oil production capacity of 4.2 million b/d. We estimate this has dropped by almost 420,000 b/d to around 3.8 million b/d by the end of 2021 and will keep shrinking to 3.5-3.6 million b/d by the end of next year.”