API: US petroleum demand continued to grow in May

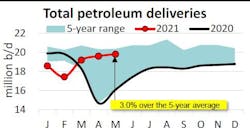

US petroleum demand in May, as measured by total domestic petroleum deliveries, was 19.8 million b/d, according to the American Petroleum Institute (API)’s latest Monthly Statistical Report. This reflected an increase of 1% from April and was 3.1% over the 5-year average.

API’s primary data for May 2021 reinforced how the recoveries in US economic growth and petroleum demand have continued to go hand-in-hand. The Institute for Supply Management’s manufacturing Purchasing Managers Index (PMI) had a reading of 61.2 in May, a 0.5 percentage point increase from April’s 48-year monthly historical high. Index values above 50 suggest an expansion, and the manufacturing PMI has exceeded that threshold for 12 consecutive months. According to the Bureau of Labor Statistics (BLS), non-farm payrolls increased by 559,000, and the unemployment rate declined by 0.3% to 5.8% in May.

Consumer gasoline demand, measured by motor gasoline deliveries, eclipsed 9 million b/d in May. This represented an increase of 1.3% from April but remained 5.1% below its May 2019 level of 9.5 million b/d.

In May, distillate deliveries of 4 million b/d decreased by 2.3% from April but sustained their sixth highest level on record for the month of May since 1945. DAT iQ industry trendlines showed mixed truck freight activity in May, with spot load posts up by 3.4% from April.

Jet fuel deliveries were 1.3 million b/d in May, which was an increase of 8.0% from April but 26.4% below its May 2019 level. However, Flightradar24 high frequency data showed the number of scheduled flights slipped by 1.2% m/m in May, so that jet fuel deliveries likely indicate an anticipation of higher summer air travel.

Deliveries of residual fuel oil were 261,000 b/d in May. This was an increase of 44.2% from April and its highest for May since 2018.

Deliveries of liquid feedstocks, such as naphtha, gasoil, and propane/propylene (other oils) used primarily in refining and petrochemical manufacturing, were 5.3 million b/d in May—its highest on record for May and 13.5% over its May 2019 level. This was broadly consistent with indications of solid refinery throughput and petrochemical production.

US oil supply

In May, US crude oil production held at 11 million b/d, a marginal 0.4% m/m increase due to steady rig productivity on increased drilling activity. Baker Hughes reported 353 active oil-directed rigs in May, a 3.6% m/m increase and 32.2% increase from 267 rigs in May 2020.

By comparison, natural gas-directed drilling in May rose by 6.8% m/m and 26.3% y/y. Rig productivity helped to support natural gas marketed production of about 102 bcfd in May per EIA, which corresponded with the extraction of 5.3 million b/d of natural gas liquids (NGLs) by API estimates. This increase of 100,000 b/d from April indicated solid NGL demand as industrial production continued to recover, as well as increased fractionation amid higher composite NGL prices.

International trade

The US remained a petroleum net importer in May and for a third consecutive month. Net imports of 600,000 b/d persisted in May due to a monthly increase in total petroleum exports to 8.2 million b/d (+200,000 b/d m/m) outpaced by increased petroleum imports of 8.7 million b/d (+400,000 b/d m/m). Within the totals, the increased exports were driven mainly by refined products (+300,000 b/d m/m), while the increased imports were driven by higher crude oil imports (+200,000 b/d m/m).

Refining, stocks

US refinery throughput was 15.8 million b/d in May, which as an increase of 1.7% from April but 7.8% below its May 2019 level. The implied capacity utilization rate of 87.1% for May increased by 1.8 percentage points from April to its highest levels since January 2020 and reflected ongoing refining activity recovery with increased product demand.

US total petroleum inventories, including crude oil and refined products (but excluding the Strategic Petroleum Reserve) increased by 0.1% m/m to 1.31 billion bbl in May from revised April estimates. Total inventories increased despite lower crude oil inventories, which fell by 2% m/m to 479.3 million bbl.