IEA: Higher prices yet to trigger rebound in US shale

Higher crude oil prices have yet to trigger rebound in US shale oil, according to International Energy Agency (IEA) analysis.

The US shale oil industry has become renowned for its ability to respond swiftly to price signals, thanks to the short-cycle nature of operations. This was seen again at the start of the COVID-19 pandemic in second-quarter 2020 when the market crash caused operators to shut in 1.3 million b/d of production and slash annual capital budgets by over 50% (on average).

However, this year, despite WTI prices having risen to pre-pandemic levels above $60/bbl, IEA forecasts US shale oil to increase only modestly and reach a 2021 exit rate of 7.3 million b/d. This is almost 1 million b/d below early 2020 levels.

“Since the 2014-15 price crash, more and more of the US shale operators have focused on capital discipline and rewarding shareholders ahead of production growth ambitions. While there has been considerable success in driving down costs, operators have often been unable to resist increasing activity and production to take advantage of higher prices. Until now. In April 2021, the land rig count stood at 423 (EIA DPR), higher than the nadir of 236 in August 2020, but still 339 below the 2020 first quarter average of 762 when WTI was $57/bbl, much the same as the 2021 first quarter average price,” IEA said.

In fourth-quarter 2020, when companies set 2021 capital and production targets, oil prices averaged $15/bbl (35%) lower than first-quarter 2021. Despite this, in first-quarter earnings calls, the majors made little changes to previous company-level guidance. In relation to the US, Chevron sees its Permian basin volumes declining 5% this year while Exxon made only a 3.75% upward revision to its US production forecast. This is to be achieved without higher planned spend. Repsol is the outlier with a 10% rise in US upstream investment (group budget is unchanged, just reallocated), but focused on gas plays as the company tries to reduce activity carbon intensity. Meanwhile, the IEA-tracked peer group of US-focused independents has collectively left plans almost untouched. Investment will rise 5% y-o-y, but will remain 48% below 2019 spend, and production will hold 3% below 2020 levels.

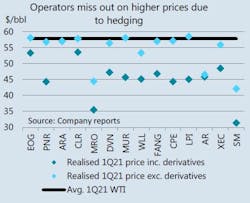

“The recent first quarter results presentations confirmed that many of the US independents have used higher cashflows to pay down debt early, with some even reinstating or raising their dividends. The calls also shed some light on another reason why the operators have been unable to respond to higher prices, namely hedging activity. At the end of 2020, with WTI around $40/bbl and with considerable uncertainty about the direction of the pandemic, firms took the opportunity to hedge some 2021 production and lock in revenues. As such, many were unable to take full advantage when WTI rose to average $58/bbl in 2021 first quarter,” IEA said.

“Indeed, in the peer group we track the average realize price including commodity derivatives was only $46/bbl in first quarter, not so far from the price assumption on which budgets were set. Looking forward the group has, on average, hedged over 40% of their remaining 2021 production at around $40-$50/bbl, well below current price levels,” it continued.

While the majors and other independent firms are adhering to promises, there is less clarity on the plans of privately backed firms. This group produces some 35% of US light tight oil supplies and in April it posted annual production gains for the first time in over a year, something the independents have yet to do, according to Rystad Energy. Private companies are stepping up well completions and oil field service providers reported higher fracturing demand. In the near term, these operators could surprise and push US shale oil supplies higher than currently forecast.