After nearly a year of robust supply restraint from OPEC and its allies (OPEC+), bloated world oil inventories that built up during last year’s COVID-19 demand shock have returned to more normal levels, according to the International Energy Agency’s latest monthly Oil Market Report.

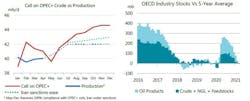

IEA data shows that, during March, OECD industry oil stocks drew by 25 million bbl to 2,951 million bbl, reducing the overhang versus the 5-year average to only 1.7 million bbl (and 36.9 million bbl above 2015-19). Stocks continued to fall in April.

Increased oil demand also contributed to deflated oil stocks. “Draws had been almost inevitable as easing mobility restrictions in the US and Europe, robust industrial activity and coronavirus vaccinations set the stage for a steady rebound in fuel demand while OPEC+ pumped far below the call on its crude. In response, oil prices resumed their upward trajectory during April and into May,” IEA said.

Crude prices rose in April and May despite surging COVID cases in some regions. Crude futures rallied by some $7/bbl from an Apr. 5 trough, to $68.81/bbl for ICE Brent and $65.31/bbl for NYMEX WTI on May 10. Backwardation increased on both contracts. North Sea Dated prices rose from a deep discount in early April to a premium of $0.91/bbl in early of May.

“While the market looks oversupplied in May, stock draws are set to resume from June, even with global oil supply on the rise,” IEA said.

OPEC+ ministers have endorsed their early April decision to boost supply by more than 2 million b/d from May to July, including a gradual return of 1 million b/d of Saudi production shut in on a voluntary basis since February. Further gains will come from Canada, the North Sea and Brazil after hefty maintenance is concluded. By year-end, world oil production is forecast to rise by 3.8 million b/d from April.

Nevertheless, under the current production scenario, supplies won’t rise fast enough to keep pace with the expected demand recovery, IEA noted.

“As vaccination rates rise and mobility restrictions ease, global oil demand is set to soar from 93.1 million b/d in 2021 first quarter to 99.6 million b/d by year-end. Weaker-than-expected 2021 first quarter oil use in the US and Europe and a reduced outlook for India due to the recent surge in Covid-19 led us to revise down 2021 demand growth to 5.4 million b/d (270,000 b/d lower than in IEA’s previous Report). The forecast for the second half of the year is largely unchanged, however, on the assumption that the situation in India and elsewhere improves.”

“The widening supply and demand gap paves the way for a further easing of OPEC+ supply cuts or even sharper stock draws. The group is set to meet again on 1 June to review policy. By that time, there might be clarity on indirect Iran-US nuclear talks taking place in Vienna that could result in the return of Iranian oil to the market. But India’s Covid crisis is a reminder that the outlook for oil demand is mired in uncertainty. Until the pandemic is brought under control, market volatility is likely to persist,” IEA said.