Coterra to restart Marcellus operations in second quarter

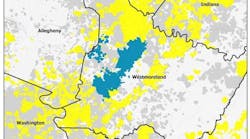

Coterra Energy Inc., Houston, will this spring restart activity in the Marcellus basin—where it suspended drilling and completion work last August—after a rise in natural gas prices and an overhaul of the company’s cost structure in the region.

Tom Jorden, chairman, president, and chief executive officer, and his team have penciled in $250 million in capital this year for the Marcellus and expects to average one rig and half a completion crew there over the course of the year. Early guidance calls for 10-15 wells to be turned in line.

Last year, Coterra spent $286 million in the Marcellus after executives budgeted $300 million, a sixth of total capex. Citing depressed prices, the company didn’t turn a well in line in the last 3 months of the year after initially budgeting for 11 net wells. On Feb. 25, Jorden told analysts on a conference call that this year’s $250 million budget could grow by $50 million if price action continues to be positive.

“In many ways, the stars are aligning for constructive pricing throughout 2025 and into 2026,” Jorden said. “But we don’t run our program on hope so we’re not going to make any decisions we don’t have to make […] We’re prepared to either hold our current course steady or pick up the pace a little bit. But [it’s a] very constructive outlook and we’d like to see that hold.”

Jorden said US natural gas producers don’t need natural gas prices to be above $5/MMbtu “to have a healthy runway” but will look for consistent support “in the mid-$3s or better” to consider bringing more gas to market.

Blake Sirgo, Coterra’s senior vice-president of operations, said on the conference call that the company’s Marcellus team went back to the drawing board last fall to re-engineer its processes and improve costs.

Their new plan, which Sirgo said has produced a “dramatic reduction,” increases the company’s lateral length by 60% and target a drilling cost of $800 per lateral foot.

As a result, Coterra will restart operation in April with two rigs and be prepared to boost its activity if merited.

Fourth-quarter results, broader capex plans

Coterra produced 682,000 boe/d in the fourth quarter and 113,000 b/d of oil. Net income came in at $297 million (on operating revenues of $1.4 billion) compared with $416 million in late 2023, when higher prices had pushed revenues to $1.6 billion.

Looking to 2025, Coterra is forecasting total production of 710,000-770,000 boe/d, with oil production of 152,000-168,000 b/d. In the first quarter, the company expects total production of 710,000-750,000 boe/d.

Leaders are planning for 2025 capex of $2.1-2.4 billion—in line with November estimates when announcing the $4-billion acquisition of some Permian basin assets from Franklin Mountain Energy and Avant Natural Resources—and up from 2024’s nearly $1.8 billion (OGJ Online, Nov. 13, 2024).

In 2025, the Permian is in line to get $1.57 billion, the Anadarko basin $230 million, and midstream, saltwater disposal, and infrastructure needs about $200 million.

In afternoon trading Feb. 25, shares of Coterra (Ticker: CTRA) were down about 2% to $27.42. Over the past 6 months, however, they have risen about 13%, a move that has grown the company’s market capitalization to more than $20 billion.

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has more than two decades of business journalism experience and writes about markets and economic trends for Endeavor Business Media publications Healthcare Innovation, IndustryWeek, FleetOwner, Oil & Gas Journal and T&D World. With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati and later was managing editor and editor of the Nashville Business Journal. Most recently, he oversaw the online and print products of the Nashville Post and reported primarily on Middle Tennessee’s finance sector as well as many of its publicly traded companies.