CNX to acquire Appalachian basin natural gas business from Apex Energy

CNX Resources Corp., Pittsburgh, has agreed to acquire the Appalachian basin natural gas upstream and associated midstream business of Apex Energy II LLC for about $505 million.

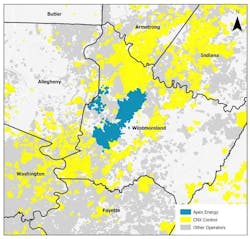

With the deal, CNX Resources expands its existing development footprint in the region, adding about 36,000 total net acres in Westmoreland County, Pa., that includes 8,600 acres of undeveloped Utica and 12,600 acres of undeveloped Marcellus.

The operator said expected 2025 average daily production from the acquired assets is 180-190 MMcfed and that existing infrastructure can be leveraged for future stacked pay development of the Marcellus and Utica.

Appalachia natural gas production

Prior to the deal’s announcement, in CNX’s third-quarter 2024 earnings presentation, the operator said it expected 2024 production volumes of 545-555 bcfe (liquids 8-9%).

In this year’s third quarter, the operator continued development of its deep Utica play, drilling three wells with an average total depth of 26,628 ft and an average lateral length of 12,783 ft. The initial reservoir performance across the recent deep Utica wells that were brought online this year are in-line with expectations of about 3 bcfe per 1,000 ft lateral, CNX said.

In prepared remarks accompanying its third-quarter report in October, CNX said the quarterly production volumes of 134.5 bcfe were flat compared with this year's second quarter, but that fourth-quarter volumes are expected to increase as the remainder of its planned 2024 wells come on-line.

Also in the October report was a brief look to 2025. CNX said it will continue to monitor natural gas prices and set activity accordingly.

“In addition to the 11 drilled but uncompleted wells (DUCs) still available from the completion activity deferrals earlier this year, our efficient capital operations create significant flexibility to respond to any potential pricing environment,” the company said.

Initial plans for the Apex Energy assets in 2025 were not detailed in the Dec. 5 release announcing the deal, which is expected to close in first-quarter 2025, but CNX said operating costs are estimated at $0.16/Mcfe. Overall, the company said it expects operational and other development synergies to “add incremental value to business in coming years.”

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.