Capital discipline reigns supreme for US onshore markets, as investors are demanding more free cash flows and less capital expenditures for most companies. Producers are facing a prolonged period of lower prices and access to financing from capital markets has become increasingly difficult.

According to OGJ’s latest survey about 2020 capital spending, US upstream spending will decline by 6% this year.

US independent E&Ps’ capital spending will decline by 7% year-over-year. Given the heightened global macro volatility, including the spreading of coronavirus, US E&P companies may continue to analyze the outlook for the oil and natural gas markets in 2020 and beyond and are prepared to reduce capital spending further if market conditions warrant it.

Despite lower upstream capital budgets, many companies still target decent annual production growth for 2020 with increased capital efficiency and lower well costs.

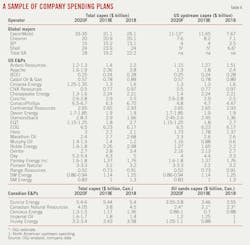

Some global majors, including ExxonMobil and Chevron, increased their US upstream spending significantly in 2019. Given the rising market uncertainties, OGJ estimates that global majors’ upstream spending in the US will slow down from a double-digit growth in 2019 to a low single-digit growth or a decline this year.

US refining and marketing spending will dip by 5% this year after a surge in 2019, due to concerns of more muted global demand.

Meanwhile, Canadian producers are expected to increase their spending this year after the Alberta government eliminated curtailments for some conventional drilling in the province, and because of reduced corporate income tax rates and rising takeaway capacity.

Internationally, the return of more substantial greenfield project sanctions, many of which are sponsored by NOCs, will give scope for growth in 2021 and beyond. According to a study from Morgan Stanley, worldwide onshore spending will fall 6% in 2020, led by the US. However, the slower-moving offshore market now looks set for material growth in 2020 and beyond. Offshore spending will grow at nearly 7% CAGR in 2019 to 2023, driven by higher activity levels and increased facility capex.

Global majors

Global majors’ overall capital spending will be largely flat from a year ago. However, their upstream spending in the US market will slow down from double-digit growth in 2019 to a low single-digit growth or even a decline this year.

ExxonMobil’s full-year capex for 2019 was $31.1 billion, $5 billion higher than its 2018 level, with basically all the increase occurring in the US. Driven by its Permian positions, ExxonMobil’s upstream spending in the US increased to $11.6 billion in 2019 from $7.67 billion in 2018.

ExxonMobil’s downstream spending (excluding petrochemicals) in the US increased to $2.35 billion in 2019 from $1.18 billion in 2018. Chemical spending in the US increased to $2.55 billion in 2019 from $1.75 billion in 2018.

For 2020, ExxonMobil’s capital spending will continue to increase, ranging from $33-35 billion. In 2020, Exxon will start up the first large-scale Permian central delivery point and full cube development. Besides the ongoing US tight oil development, deepwater projects in Guyana and Brazil will attract most of the upstream capital.

Chevron Corp. announced a 2020 organic capital and exploratory spending program of $20 billion (including expenditures by affiliated companies), supporting a portfolio of upstream and downstream investments, including Permian positions, TCO in Kazakhstan, and a queue of deepwater opportunities in the Gulf of Mexico. The company will reduce funding to, or even divest, various gas-related opportunities including Appalachia shale, Kitimat LNG, and others.

In 2020, Chevron’s spending in the US is expected to decline from last year’s level. US upstream spending is targeted at $7.6 billion, compared to $8.2 billion in 2019 and $7.1 billion in 2018. US downstream spending (including petrochemicals) is planned at $1.6 billion, compared to $1.87 billion in 2019 and $1.58 billion in 2018.

Shell’s cash capital expenditure in 2019 was $23.9 billion, flat with the $24 billion in 2018. Upstream spending however decreased from $12.44 billion in 2018 to $10 billion in 2019. Upstream spending in North America decreased from $6.6 billion in 2018 to $5 billion in 2019. Its expenditures on integrated gas and downstream increased by $480 million and $1.5 billion, respectively, year-over-year.

Shell’s full-year 2020 cash capital expenditure is expected to be around the lower end of the $24-29 billion range.

BP’s organic capital expenditures for 2019 and 2018 were $15.2 billion and $15.1 billion, respectively. BP’s upstream spending in the US was $4 billion in 2019, up from $3.5 billion in 2018. US downstream spending was $913 million in 2019, up from $877 million in 2018. International upstream spending was $7.88 billion in 2019, down from $8.54 billion in 2018.

BP expects 2020 organic capital expenditure to remain towards the lower end of a $15-17 billion range.

Total SA’s capital expenditures were $19.23 billion in 2019 and $22.2 billion in 2018. In 2020, capital expenditure is expected to decline to $18 billion.

Equinor’s organic capital expenditures was $10 billion for the year ended 2019. The expenditures are estimated at an average of $10-11 billion for 2020-2021.

US independent E&P companies

Based on capital budgets released by US independent E&Ps, OGJ expects that the overall US upstream spending of this group will decline 7% from the year-ago level, while not all companies scale back spending. Gas focused independents have cut back capital spending more. It is noteworthy that companies are prepared to reduce capital spending further if market conditions warrant it. Also, despite lower capital spending, many companies still target decent annual production growth.

ConocoPhillips’ 2020 operating capital guidance is in the range of $6.5-6.7 billion, compared to estimated spending of $6.3 billion in 2019. The plan includes funding for ongoing development drilling programs, major projects, exploration, and appraisal activities, as well as base maintenance. ConocoPhillips’ spending in the Lower48 will decline to $3.2 billion in 2020 from $3.3 billion in 2019, while spending in Alaska will increase by $200 million to $1.6 billion.

The company’s 2020 production guidance is 1.23-1.27 million boed, including the impact of a recent third-party pipeline outage in Malaysia. Production guidance excludes Libya.

Occidental Petroleum’s 2019 spending reached was $6.3 billion, nearly 70% of which was allocated to US assets, mostly in the Permian Basin. In 2020, the capital budget will be reduced to $5.2-5.4 billion. Spending in the Permian resources will be reduced to $2.2 billion from $3.3 billion a year ago. Meantime, Oxy forecasts a 2% annual production growth, averaging 1.33-1.36 million boed, primarily driven by Permian resources.

EOG Resources plans its 2020 capital budget at $6.5 billion, up from spending of $6.23 billion in 2019 and $6.17 billion in 2018. The company also targets a 12% US oil volumes growth this year, after a 15% growth last year. According to EOG, its capital efficiency will increase 9% and well cost will be reduced by 4% this year.

Hess announced a 2020 E&P capital and exploratory budget of $3 billion, of which more than 80% will be allocated to high return investments in Guyana and the Bakken. US upstream spending amounts to $1.73 billion for 2020, compared to $1.78 billion in 2019 and $1.37 billion in 2018. Hess plans $1.37 billion to fund a six-rig program in the Bakken this year.

Hess’ net production is forecast to average 330,000-335,000 boed in 2020, excluding Libya. Bakken net production is forecast to average 180,000 boed in 2020.

Continental Resources’ 2020 capital expenditures budget is flat year-over-year at $2.65 billion, which is 20% lower than the company’s original 5-year vision estimate for 2020. Approximately $2.2 billion is allocated to drilling and completion (D&C) activities, of which approximately 60% is allocated to the Bakken and approximately 40% to Oklahoma. The company is targeting 4-6% annual production growth year-over-year.

Murphy Oil is planning its 2020 capital expenditure to be in the range of $1.4-1.5 billion with full year 2020 production to range from 190,000-202,000 boed.

For 2020, Murphy Oil plans to spend $680 million in the Eagle Ford, representing a 13% increase from 2019. The company has also allocated $175 million to its Canada onshore business, which is 38% lower than in 2019. Approximately $480 million, or 33%, of capital, is allocated to its offshore assets, with 30% planned for the Gulf of Mexico and the remaining 3% for Canada offshore.

Apache established a 2020 upstream capital investment budget of $1.6-1.9 billion, a 26% year-over-year decrease at the midpoint. If oil prices deteriorate from current levels, Apache is prepared to further reduce activity and capital investment. At higher oil prices, the priority will be to retain cash for debt reduction. The company does not anticipate increasing capital investment above $1.9 billion. The company projects flat to low single digit corporate oil growth on an adjusted basis.

Marathon Oil has earmarked a $2.4 billion capital budget for this year, down 11% from 2019 levels. Development capital budget of $2.2 billion is down 9% from 2019. Most of the spending will occur in the US, and around 70% of development capital will be allocated to Eagle Ford and Bakken areas. Marathon Oil’s annual US oil production growth in 2020 is expected to be 6% at the midpoint of guidance.

Noble Energy’s organic E&P capital investment is in the range of $1.6-1.8 billion for 2020, some 25% below its 2019 level, which reflects lower spend on Leviathan field offshore Israel. Approximately 75% of the 2020 organic capital budget is allocated to US onshore development, primarily in the DJ and Delaware Basins.

The company expects relatively flat US production compared to 2019, with an increase in DJ and Delaware Basin production offset by reductions in the Eagle Ford Shale. The company however expects a 10% annual production growth in 2020—primarily from international offshore assets.

Cimarex Energy’s capital investment for 2020 is estimated to be $1.25-1.35 billion, including drilling and completion capital of around $1 billion. In 2020, oil production is projected to average 91,000-97,000 b/d, up 9% at midpoint from 2019 levels.

Concho Resources’ 2020 capital program is $2.6-2.8 billion, down 10% year-over-year. Midland Basin and Delaware Basin each account for half of the budget. Despite a lower capital spending, Concho expects a 6-8% growth in total production.

Devon Energy’s exploration and production capital spending for 2020 is targeted at $1.7-1.85 billion, down from $1.9 billion in 2019. The company expects a 7-9% growth in oil production.

Diamondback Energy’s capital spending for 2020 for drilling, completion, and infrastructure is $2.8-3 billion, 1% higher than the spending in 2019. Drilling and completion spending is $2.45-2.6 billion, compared to $2.45 billion spent in 2019. Diamondback expects a 12% growth in oil production.

Ovintiv (previously EnCana)’s 2020 capital investments total $2.7 billion, down 6% from the 2019 proforma capital investment. Approximately 80% of the investment will be allocated to development programs in the US and more than 75% are earmarked for its three core assets—the Permian, Anadarko, and Montney. Liquids are expected to comprise 56% of total production, up 2% from the 2019 estimated volumes.

Pioneer Natural Resources’ capital budget for 2020 is $3-3.3 billion, roughly flat with the 2019 spending. Pioneer expects 2020 oil production of 235,000-245,000 b/d and total production of 383,000-403,000 boed.

Parsley Energy reported full-year 2019 capital expenditures of $1.37 billion. Capital budget for 2020 is $1.6-1.8 billion.

Chesapeake Energy’s projected capital expenditure program is $1.3-1.6 billion for 2020, down from $2.24 billion in 2019 and $2.1 billion in 2018, with some 80% expected to be allocated to higher-margin oil opportunities.

Gas producer Range Resources plans to reduce capital spending to $520 million for 2020, which is expected to maintain gas production at about 2.3 bcfd. The 2020 capital spending will be directed towards Range’s Marcellus assets.

Antero Resources, a gas producer in Appalachia, announced a capital target of $1.15 billion in 2020 for drilling and completion (D&C), a 10% decrease from 2019. The company is also targeting asset sales of $750 million to $1.0 billion through 2020. The company expects net production growth of 8-10% through 2022.

Another major gas producer, Southwestern Energy’s 2020 capital investment will be 20% lower than 2019.

OCS lease bonus

The US Bureau of Ocean Energy Management has scheduled two lease sales in Gulf of Mexico, Nos. 254 and 256, to take place during 2020. OGJ forecasts that such payments will be around $300-400 million this year.

During 2019, BOEM held two lease sales. The first one, No. 252, resulted in $244.3 million in bonus payments. The other, No. 253, produced $159.38 million in bonus payments. In 2018, such payments were $302 million.

US refining and marketing

US refining and marketing spending will dip by 5% this year after a surge in 2019, due to concerns of more muted global demand.

Valero expects to invest about $2.5 billion in 2020, of which 60% is for sustaining the business and 40% is for growth projects. Growth projects including the Pasadena Terminal, St. Charles Alkylation Unit, and Pembroke Cogeneration Unit are still on track to be completed in 2020. Total capital spending for 2019 was $2.7 billion against a previous target of $2.5 billion.

Phillips 66’s capital program for 2019 was $3.9 billion (including $423 million funded by Gray Oak JV partners), falling well above the initial budget range of $3.3-3.5 billion. In 2020, Phillips 66’ capital budget is targeted at $3.3 billion.

Phillips 66’s capital budget for refining and marketing in 2020 is $1.2 billion, compared to expenditures of $1.37 billion in 2019 and $951 million in 2018. In addition to $600 million budgeted for reliability, safety, and environmental projects, refining capital will fund fluid catalytic cracking unit upgrades at the Ponca City and Sweeny refineries, renewable diesel projects, and others.

Marathon Petroleum has earmarked a capital program of $2.6 billion (excluding MPLX) for 2020. Capital budget for refining and marketing in 2020 is $1.55 billion, down from $2 billion in 2019. The company has canceled a planned $800-million expansion of coking capacity at its 564,000 b/d refinery in Garyville, La. It also cancelled plans to move forward with a petrochemical feedstock project proposed by former Tesoro Corp.

PBF Energy’s capital expenditure for 2020 is targeted at $545-600 million. This compares to the company’s refining spending of $709 million in 2019 and $552 million in 2018. On Feb. 1, PBF Energy announced that its subsidiary completed the acquisition of the 157,000 b/d Martinez refinery and related logistics assets. With the acquisition, PBF increased its total throughput capacity to more than one million b/d and becomes the most complex independent refiner with a consolidated Nelson Complexity of 12.8.

HollyFrontier’s 2020 capital program for refining ranges from $270-300 million, compared to refining spending of $199 million in 2019 and $203 million in 2018. For 2020, HollyFrontier also arranges $130-150 million in renewables, $40-60 million in lubes, and $125-150 million for turnarounds and catalysts.

Delek US’s 2020 budget is being reduced by about 24% from 2019 levels to $325 million. Expected expenditures on refining is $205.2 million, down from $266.6 million in 2019. The refining spending was $204 million in 2018.

Cenovus Energy’s refining and marketing spending is $285-330 million, compared to $280 million in 2019 and $208 million in 2018. Cenovus has 50% ownership in two US refineries.

Husky will spend nearly $1 billion in its refining business in US, including $500 million for rebuilding the Superior refinery in Wisconsin.

Majors have large presences in the US downstream sector. As mentioned, ExxonMobil’s downstream spending (mainly refining) in the US increased to $2.35 billion in 2019 from $1.18 billion in 2018.

US petrochemicals

With access to cheap and abundant feedstocks, the US remains the destination of global petrochemical investment. Petrochemical producers have announced significant expansions of capacity.

According to the American Chemistry Council, since 2010, 334 chemical and plastics projects cumulatively valued at $204 billion have been announced, with 53% of the investment completed or underway, and 40% in the planning phase. Further gains in capital spending are anticipated, increasing by 5.4% in 2019 and 4.9% in 2020.

Major US petrochemical projects include Formosa Petrochemical Corp.’s $9.4-billion St. James Petrochemical Complex, Sasol’s $11.6-billion Lake Charles Ethane cracker and derivatives, PTT Global Chemicals’ $7.5-billion Belmont County Ethane Cracker, and many others.

ExxonMobil’s chemical spending in the US increased to $2.5 billion in 2019 from $1.75 billion in 2018. In 2020, OGJ forecast that ExxonMobil’s capital spending in the US chemical business will increase to $5 billion. Key projects include US Coast polypropylene, Vistamaxx, LAO, and Corpus Christi, Tex., cracker, and derivatives. Chevron Phillips Chemical Co.’s capital budget this year is estimated at about $1.3 billion, significantly higher than last year’s spending.

US pipelines, LNG

US pipeline projects grow as operators seek to bring burgeoning crude, NGL, and gas production to market.

According to OGJ’s most recent Worldwide Pipeline Construction report (OGJ, Feb. 5, 2020, p. 47), projects underway at the start of or set to begin in 2020 (to be completed after 2020) include 5,623 miles of gas pipelines and 7,253 miles of crude and product pipelines. These compare to 3,785 miles of gas pipelines and 4,919 miles of oil pipelines for this category (underway at the start of or set to begin in 2019) a year earlier.

For US LNG, a “second wave” of expansion programs and new projects is emerging this year, with completion targeted for 2022-2025. Major expansions to existing facilities include the addition of liquefied trains at Cheniere’s Corpus Christi and Sabine Pass facilities, and Venture Global’s new Calcasieu Pass project. Golden Pass, a joint venture between ExxonMobil and Qatar Petroleum, completed its financial closure early last year, with the goal of achieving commercial operations by 2024.

Among the projects approved by FERC and continuing to seek financing arrangements are Freeport LNG Train 4, Cameron LNG Phase 2 (including two other trains), Energia Costa Azul and Port Arthur of Sempra, Plaquemines of Venture Global, Driftwood LNG of Tellurian, Brownsville by Annova LNG, and Rio Grande by NextDecade. FERC applications for other projects such as Jordan Cove, Alaska LNG, and Commonwealth LNG are pending.

Canadian upstream spending

After years of spending reductions, Canadian producers are expected to increase spending in 2020 after the Alberta government eliminated curtailments for some conventional drilling in the province, and because of reduced corporate income tax rates. The province also enabled producers to ship more crude by rail. Meantime, more pipeline capacity is under construction.

The financial figures in the Canadian section are presented in Canadian dollars unless noted otherwise.

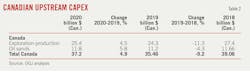

According to OGJ forecast, Canadian conventional upstream spending will increase 4.5% this year to $25.4 billion. Oil sands spending will also increase nearly 6% to $11.8 billion.

According to its latest corporate guidance, Suncor Energy’s capital program in 2020 is expected to be $5.4-6 billion. Expenditures on oil sands will be $3.55-3.8 billion compared to expenditures of $3.46 billion in 2019 and $3.54 billion in 2018. Conventional E&P spending is budgeted at $1-1.15 billion, compared to $1.02 billion in 2019 and $946 million in 2018. Suncor expects the 2020 full-year total production to be 800,000-840,000 boed, which is slightly up from the actual level of 2019.

Cenovus Energy’s capital expenditure plan for 2020 is $1.3-1.5 billion, compared to $1.17 billion in 2019 and $1.36 billion in 2018. About 70% of the 2020 budget is sustaining capital primarily to maintain base production at its Foster Creek and Christina Lake oil sands operations. Oil sands spending in 2020 is planned between $865 million and $1 billion, up from $706 million in 2019.

Imperial Oil’s capital and exploration expenditures totaled $1.8 billion in 2019. In 2020, capital expenditures are expected to range lower between $1.6 billion to $1.7 billion, primarily due to Aspen. Roughly 70% of the capital is associated with upstream assets.

Canadian Natural Resources’ 2020 capital budget is targeted at $4.05 billion, compared to $3.8 billion estimated for 2019. In 2020, some $1.55 billion is allocated to conventional and unconventional assets and $2.5 billion is allocated to long life low decline assets.

Husky Energy’s capital program for 2020 will be $3.2-3.4 billion, with annual production forecast to be 295,000-310,000 boed. Spending on thermal and oil sands will range between $1.05 billion to $1.1 billion.

Canada downstream

OGJ estimates that Imperial Oil’s refining and marketing spending will be around $450 million, compared to $484 million in 2019 and $383 million in 2018. Imperial Oil, the largest petroleum refiner in Canada, operates three refineries in Canada.

Suncor’s refining and marketing spending for 2020 is between $700-800 million, compared to $818 million in 2019 and $856 million in 2018. Suncor operates three refineries in Canada and one refinery in Colorado, US.

Irving Oil, which operates the largest oil refinery in Canada, usually doesn’t disclose its spending plans.

According to the year-end survey of business conditions by the Chemistry Industry Association of Canada (CIAC), capital expenditures of the industrial chemicals for Canada are projected to be $3.1 billion in 2019—a high level in historical terms, although down 25% from the peak observed in 2018. The level of capital investment is expected to increase by 5% in 2020.

Inter Pipeline will spend $935 million to build the Heartland petrochemical complex. The facility is under construction near Fort Saskatchewan and will be Canada’s first integrated propane dehydrogenation (PDH) and polypropylene (PP) unit to convert Alberta propane into pellets of plastic products.

Dow is moving forward to expand ethylene capacity at the Fort Saskatchewan plant, with a cost of $200-225 million.

International upstream spending

International offshore markets are a bright spot for global upstream capital spending, with continued growth from normalizing rig demand and pricing, as well as some continued momentum in project sanctioning.

In a recent report, Morgan Stanley expects modest improvement in global offshore spending in 2020, but sees growth accelerating thereafter, improving 30% through 2023 (vs. 2019), and representing an incremental $40 billion of annual investment.

“While spending should improve sequentially throughout our forecasted period, concurrent double-digit expansion in both drilling & services and infrastructure investment result in 85% of incremental capex occurring in 2021-22,” the company said.

Africa, the Middle East, and Brazil will outperform other regions, improving 45%, and 65% vs. their respective 2019 bases, in Morgan Stanley’s view. In total, offshore spending will remain far from prior peaks, and the 2023 estimates are 35% lower than 2014.

In international upstream onshore spending, steady low-to-mild single-digit growth continues through 2023, according to Morgan Stanley. In general, spending in international onshore markets is heavily driven by Asia Pacific (especially China), the Middle East, and Russia. Spending also tends to be heavily influenced by the OPEC+ production cut policy.

Global LNG spending

Global LNG investment is growing significantly. The current market is severely oversupplied, but the industry needs to develop new LNG supplies to meet growing demand.

Last year, a record of 71 million tonnes/year of new capacity was approved, including the approval of Nigeria’s LNG train 7 in December 2019. With large projects in Qatar, the US, and Mozambique, that number could be matched in 2020.

According to Wood Mackenzie, expenditure on LNG projects in 2020 will increase by 50% over 2019 and exceed $30 billion (excluding non-integrated plant expenditures).

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.