Frontera Resources opening play in northern Kura basin, Georgia

Oil and gas industry interest in searching for additional production potential throughout the Black Sea region has been on the increase for several years.

Bringing new production supplies on line in this area presents attractive economics to exploration and production companies due to close proximity to consumption markets and could be a boon to those countries in the immediate area that currently must import a sizable quantity of their energy supplyespecially natural gasfrom Russia and beyond.

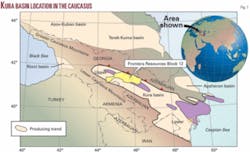

Recognizing the productive potential of the geology and the need for “homegrown” energy supplies in the area, Frontera Resources entered this region a decade ago to make the most of opportunities in what we refer to as the Greater Black Sea Region (Fig. 1).

Currently, we are actively pursuing what we have determined to be significant drilling opportunities in the oil-rich Kura basin, specifically in eastern Georgia where Frontera holds a 100% working interest in a 5,060 sq km license area known as Block 12, which it acquired in 1997 (Fig. 2).

Cretaceous play

Block 12 contains seven known, undeveloped oil fields along with numerous additional prospects for exploration and exploitation drilling.

As a result of extensive geological and geophysical evaluation efforts using a mix of traditional and newer, more sophisticated technologies, including AVO analysis, Frontera has identified two major geological plays within Block 12: the Tertiary Clastics Play and the Cretaceous Carbonate Play.

The focus on the Cretaceous play is relatively new in the upper Kura basin and represents an exciting new opportunity for exploration.

The Kura basin is a prolific hydrocarbon producing basin, spanning more than 400 km from the South Caspian Sea and Azerbaijan into central Georgia. The Kura basin, which actually is the onshore extension of the South Caspian basin, has been explored since the late 1800s, with the primary reservoir targets being the Pliocene and Miocene-age intervals of the Tertiary system.

The reservoir rocks typically are fluvial clastics sourced from the surrounding Lesser and Greater Caucasus Mountains. They have been such prolific producers in the basin that they are commonly referred to as the “productive series.”

Much of the early drilling in the basin was based on the presence of oil seeps and mud volcanoes at the surface. This old-time “technology” led to an extensive search for hydrocarbons that ultimately resulted in the drilling of hundreds of exploration wells throughout this onshore basin, leading to the discovery of more than 40 oil fields, five of which have recoverable reserves potential of more than 500 million bbl each. One sizable field that offsets Block 12 has produced 250 million bbl.

Geochemical analyses indicate the Oligocene-Miocene age Maykop shale interval to be the primary source rock for the hydrocarbon deposits, with thickness of the interval in the region sometimes greater than 2,000 m and total organic carbon as high as 11%.

Because the Tertiary reservoirs have traditionally been excellent objectives, operators have basically ignored the potential for production from the older Mesozoic-era Jurassic and Cretaceous systems, where the rocks are believed to be predominantly fractured carbonates.

Nevertheless, speculation about the potential of these older rocks has been rife among some explorationists, and the application of 2D, 3D and associated processing technology has enabled companies such as Frontera to identify and focus on a new play to evaluate and explore these horizons within the upper Kura basin.

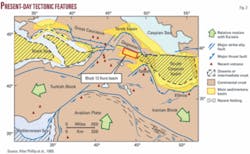

Even though the Kura basin is relatively narrow and quite deep--it is possible to still be in Miocene rocks at depths of 6,000-7,000 m in the central part of the basin--the new target Mesozoic interval can occur at much shallower depths below thrust sheets associated with the Pliocene inversion of the Greater Caucasus Mountains.

Frontera has been able to use newly-acquired seismic data to see and evaluate the Cretaceous and Jurassic rocks along the uplifted northern rim of the Kura basin, where they can be drilled between 2,000 and 3,000 m deep. We are also able to image these objectives on the flanks of the Tertiary basin above and below thrust sheets at 4,000 to 5,000 m in depth.

A recent example of important exploration success that contributed to our confidence to pursue the technical evolution of the Mesozoic play occurred in 2003 when CanArgo Energy drilled the Manavi-11 well, based on 2D seismic and shallow well control, to a depth of about 4,500 m. The result was that, for the first time in the upper Kura basin, an important oil discovery was made in the Cretaceous carbonates sitting beneath multiple thrust sheets.

The Manavi-11 well successfully tested a feature seen on seismic that structurally juxtaposed the carbonate reservoir intervals against the Maykop source rock. This discovery was significant in that it established the presence of hydrocarbons in the Cretaceous section, thereby opening the door to further exploration of this interval in other locations within the basin.

Carbonate prospects

About 60 miles east from CanArgo’s Manavi prospect, along the same structural trend but at a much shallower depth, Frontera has identified two Cretaceous carbonate drilling prospects in the upper Kura basin at our Basin Edge Play Unit on the northern border of Block 12 (Fig. 3).

The Basin Edge “B” and “C” prospects are estimated to harbor a combined total resource potential of more than 1 billion bbl of unrisked recoverable oil in the primary Cretaceous objective along with secondary targets in Jurassic, Miocene, and Pliocene rocks. This Cretaceous carbonate play represents one of the newest and potentially most prolific exploration plays in the upper Kura basin.

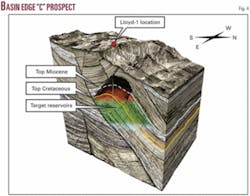

Frontera spudded the Lloyd-1 well on September 17, 2007 on the “C” prospect, a large surface anticline, which is estimated by Netherland, Sewell & Associates to contain unrisked resource potential in excess of 500 million bbl of recoverable oil (Fig. 4).

The well is expected to reach TD of 2,700 m in early December and has the potential to be very significant in that it would extend the play into an area of the basin where Cretaceous reservoirs have never before been tested.

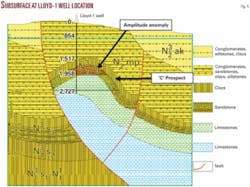

The structural closure at the “C” prospect as interpreted on seismic is located on the hanging wall of a large thrust sheet that sits on the north flank of a deep Tertiary basin (Fig. 5). This basin, which is known as the Didi Shiraki syncline, has three discovered fields located on its south side that produce oil from the “productive series” at depths between 800 and 1,500 m. The oil geochemistry from these fields has been tied to the Maykop source rock.

What is unique about the “C” prospect is that this feature is an anticlinal closure that harbors the potential for two objective levelsthe typical clastic productive Tertiary section and the older Cretaceous carbonatesmaking this one of the few places in the basin where both Miocene and Cretaceous rocks can be drilled in the same structure.

In order to adequately evaluate the “B” and “C” prospects, Frontera has relied heavily on seismic data for both, having commissioned several hundred kilometers of 2D seismic over the Basin Edge “B” and “C” closures, as well as a new 80 sq km, high resolution 3D survey over the “C” prospect itself. Processing and interpretation of the 3D survey revealed the “C” prospect to be a large independent four-way structural closure of 55 sq km.

Once we processed the seismic and acquired a clear view of the “C” prospect, we could see that the structure is about 20% larger than anticipated. The 1,000 m-high structure actually spills beyond the boundaries of the 3D survey, prompting Frontera to plan for additional geophysical acquisition in the future.

Using AVO technology, we also see an amplitude anomaly in the Tertiary section, appearing as a bright event in what we believe to be a clastic section. The top of the amplitude is about 1,600 m deep and follows structural contours. The Lloyd-1 well will drill directly through this event and into what we anticipate to be the Cretaceous section, where we do not expect to see similar amplitudes.

Given the nature and size of the structure, we anticipate the Lloyd-1 to be only the first of multiple wells needed to better understand the feature and, ideally, prove it out. A second drilling location has already been selected.

The Basin Edge “B” prospect is a similar feature located to the northwest along trend. It was initially seen from an early regional 2D seismic survey that extended north from the center of the Kura basin and over the prospect along the northern flank of the basin.

The survey revealed fault closure at a structural crest. However, a thick, out-of-place limestone layer sitting above the prospect created static and velocity problems, preventing us from seeing the extent of structure prior to new 2D acquisition. The “B” prospect is a combination Tertiary-Cretaceous closure with a structural high point at 2,000 m below the surface. The prospect occurs 500 m updip of a Soviet-era well that drilled into both the Cretaceous and Jurassic sections and reportedly had hydrocarbon shows.

The presence of natural gas in many of the old shallow water wells in and around the “B” and “C” prospects provides an additional clue that hydrocarbons are located nearby. Water comes to the surface on natural gas lift from these wells and, in some cases, the local population uses the gas for cooking and other purposes. The isotope analyses of the produced gas suggest a thermogenic source.

Frontera’s Block 12 license area is equivalent in size to 225 blocks in the Gulf of Mexico or nearly one quadrant in the UK North Sea. The size of the license area has encouraged new, regionally-focused thinking in our technical work programs, leading to the identification of new plays.

The Cretaceous Carbonate Play represents a whole new opportunity in this license, where Frontera is pursuing a variety of different geologic objectives within its extensive portfolio of undeveloped fields and new prospects inventory.

Stability improving

During these times many countries are increasingly declaring their resources off-limits to outside interests. It bears mentioning that year to year Georgia has become an increasingly stable country, both economically and politically, and one that welcomes investments to develop its energy resources.

The production sharing agreement associated with Block 12 is a prime example of a fiscal regime that encourages the exploration process and the array of extensive work we continue to engage in throughout the license.

In general, we believe Georgia has become an attractive environment for economic development. Its stable, market-oriented economy is strengthened by a highly educated, motivated work force, and foreign investment is not just welcomed but encouraged. Infrastructure, banking, and legal systems have made great strides in approaching international standards, underpinned by a successful effort to eliminate the vestiges of corruption from the past.

Georgia’s achievements have resulted in the World Bank recently citing the country as the world’s top reformer for 2 years in a row.

According to information released by the government, Georgia expects to hold annual inflation at about 8% in 2007 and projects a record 12% rate of economic growth. Net private capital inflows reached about $1 billion in 2006 and are estimated to grow to over $2 billion this year.

Frontera itself has invested more than $100 million to date in Georgia’s oil and gas exploration sector, and our investment plans remain very aggressive for the foreseeable future because of our confidence in the continually evolving environment and the considerable potential that our historical investments have identified.

With drilling operations currently in progress, it is noteworthy that Frontera’s substantial progress in highlighting and evolving the new Cretaceous Carbonate Play during its 10-year effort in Georgia has been based on the methodology of using a best practices approach to grass roots exploration.

Old-fashioned yet essential basic field work had a prominent role in the mix of applications, including basin modeling, gravity surveys, and soil geochemistry surveys, which have been integrated with new 2D and 3D seismic data. The use of AVO technology has shown us for the first time that we have anomalies that could be hydrocarbon indicators in the basin. Once confirmed, this could open up a whole new way of exploring in the upper Kura basin.

Perhaps the most striking aspect of the array of advanced technical tools now available to the industry is that they position independent E&P companies such as Frontera to methodically uncover new plays and explore with the depth of a major.

The authors

Steve Nicandros is president and chief executive officer of Frontera Resources Corp. He has been president and a director of the company since it was founded in 1996. He became chief executive officer in 1997 and chairman in 2002. In 1994-96 he was president of Conoco Overseas Oil Co. responsible for Conoco’s worldwide development of upstream new business and mergers and acquisitions. He began his career in the oil industry in 1982 with Conoco Inc. He has a BS in political science from Southern Methodist University.

Reginal Spiller is executive vice-president, exploration and production with Frontera Resources. He has been a senior executive of the company since May 1996 where he has been responsible for Frontera’s exploration and production activities. In 1993-96 he was deputy assistant secretary for gas and petroleum technologies at the US Department of Energy. For five years prior that he was international exploration manager for Maxus Energy Corp., which held properties in Bolivia, Bulgaria, Czechoslovakia, and Indonesia. He has MS and BASS degrees in geology from Penn State University and State University of New York, respectively.