Producers, refiners report mixed first-quarter results

Marilyn Radler

Senior Editor-Economics

Laura Bell

Statistics Editor

High oil prices boosted the earnings of operators with strong liquids production during this year's first quarter, but low natural gas prices continued to weigh down results. Meanwhile, refiners reported various results depending on the location of their refineries, as those in the US Midwest benefited from lower crude costs than those on the East and West coasts.

A sample of 63 oil and gas producers and refiners posted a collective climb in first-quarter earnings of 4% and a 10% increase in revenues compared with first-quarter 2011.

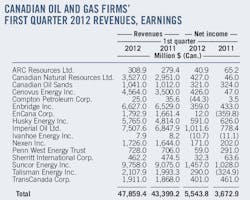

Meanwhile, a group of 16 Canadian-based producers and pipeline operators reported a combined 51% boost in first-quarter earnings and also posted a 10% increase in revenues.

Prices, refining margins

While Brent crude oil futures prices in this year's first quarter on average were up 12% from a year earlier, front-month crude futures on the New York Mercantile Exchange in the first 3 months of this year averaged $103.03/bbl compared with $94.60/bbl during last year's first quarter.

Refiner costs for crude surged, too. The average composite cost of crude oil for US refiners in the first quarter was $107.03/bbl, up from $93.85/bbl a year earlier, according to the US Energy Information Administration.

Cash operating margins in most refining centers increased from a year earlier. US Midwest refining margins in the first quarter averaged $21.44/bbl this year, up from $15.72/bbl a year ago, according to Muse Stancil & Co.

While the average margin also climbed moderately for US East Coast and West Coast refiners, the average margin on the US Gulf Coast fell by 13% from the first 2011 quarter to average $5.79/bbl.

Wellhead and futures gas prices sank from the 2011 first quarter as inventories and production continued to outstrip US demand. Front-month NYMEX gas averaged $2.503/MMbtu in this year's first quarter vs. $4.197/MMbtu a year earlier.

US producers

US-based oil and gas producers reported varied first-quarter 2012 results. In the sample of operators, 18 incurred a net loss for the first 3 months, and 13 posted a decline in earnings from the first quarter of 2011.

ExxonMobil Corp. reported $9.45 billion in earnings for the 3 months ended Mar. 31, an 11% decline from a year earlier. Higher liquids and gas realizations increased earnings by $980 million, although upstream earnings dipped by $873 million from the first 2011 quarter to $7.8 billion.

ExxonMobil said its oil-equivalent production was down more than 5% from first-quarter 2011. However, excluding the impact of higher prices on entitlement volumes, quota effects from the Organization of Petroleum Exporting Countries, and divestments, its production volumes were down 1% from a year earlier.

ExxonMobil's downstream earnings of $1.586 billion were up $487 million from first-quarter 2011, the company reported. Lower margins decreased earnings by $40 million, volume and mix effects increased earnings by $210 million, and all other items, mainly gains on asset sales, increased earnings by $320 million. Capital and exploration expenditures of $8.8 billion were up 13% from last year's first quarter.

ConocoPhillips posted a 3% decline in earnings from the 2011 first quarter to $2.955 billion. Earnings from upstream operations increased to $2.55 billion from $2.35 billion a year earlier, benefitting from strong crude oil prices offset by weak gas and natural gas liquids prices. Downstream earnings were $452 million, down from $482 million, mostly due to lower refining margins, partially offset by higher marketing margins.

First-quarter 2012 earnings included gains from asset sales of $987 million, largely from its Vietnam business unit sale, as well as noncash impairments of $562 million, primarily related to the Mackenzie Gas Project and associated leaseholds, ConocoPhillips said.

Independent producer Anadarko Petroleum Corp. announced that its earnings climbed to $2.2 billion in this year's first quarter, up from $237 million a year earlier. Production volumes of crude, condensate, gas, and NGL were up. Anadarko's average sales price of crude increased to $111.07/bbl from $94.58/bbl during first-quarter 2011, while its average realized price of gas fell to $2.60/Mcf from $3.93/Mcf.

Refiners

As they did last year, refiners in the US Midwest and Rocky Mountains area enjoyed lower crude costs and stronger margins than other refiners during the recent quarter compared with those a year earlier. Meanwhile, East Coast margins averaged $1.24/bbl during this year's first 3 months.

Sunoco Inc. swung to a $301 million profit from a first-quarter 2011 loss of $80 million due to the strength of the company's high-return logistics segment. Sharply rising crude prices pressured margins in Sunoco's refining and supply segment and retail marketing segment, resulting in losses for both, said Sunoco Pres. and Chief Executive Officer Brian P. MacDonald.

Marathon Petroleum Corp. reported $596 million in earnings for this year's first 3 months, up 13% from first-quarter 2011, as the company was able to capture value from changing market dynamics and to acquire price-advantaged crude oil and feedstocks.

Meanwhile Tesoro Corp. recorded a 42% decline in earnings from a year earlier due primarily to major turnaround activity and lower crack spreads in California, the company said.

Valero Energy Corp. reported a $432 million loss for the recent quarter as it recognized an asset impairment loss of $595 million on its Aruba refinery, where the company suspended operations in March.

Canadian operators, pipeliners

Half of the companies in a group based in Canada reported a decline in net earnings for the most recent quarter. While strong oil prices helped some results and low gas prices hurt earnings, some of the companies benefited from their hedging programs. And two of the firms incurred a net loss for the period.

EnCana Corp. posted $12 million in earnings for first-quarter 2012 as a result of $358 million in realized after-tax gains on its commodity-price hedging program. Operating earnings were $240 million, up 10% from a year earlier.

Primarily a gas producer, EnCana's first-quarter production was up 2% from first-quarter 2011 but 5% lower than fourth-quarter of that year. The company said it is targeting capacity reductions totaling about 600 MMcfd gross before royalties compared with 2011. Half of this reduction is attributable to declining production through a reduced capital program, and the other half is attributable to physical shut-ins or otherwise curtailed volumes.

"There is a current weakness in market fundamentals due to an oversupply of natural gas and it is clear that a continued reduction of drilling activity will be required to restore market balance," EnCana said.

Integrated company Cenovus Energy Inc. reported that its first-quarter net income jumped to $426 million (Can.) from $47 million (Can.) a year earlier. Conventional oil and oil sands production was up, and the company reported strong refining margins during the quarter, but its natural gas production volumes fell to 636 MMcfd from 652 MMcfd a year earlier.

Cenovus also realized a $48 million (Can.) hedging gain for this year's first quarter, whereas a year earlier the company incurred a loss of $201 million (Can.) from hedging.

Cenovus Pres. and Chief Executive Officer Brian Ferguson noted that while oil prices are high, Canadian heavy crude is still priced at a discount, and although that negatively impacts the price the company gets for the oil it produces, its refineries, which have heavy oil processing capacity, benefit from lower costs.

TransCanada Corp. reported that the warm winter, low natural gas prices, and reduced revenues from its US gas pipelines and storage contributed to the company's decline in first-quarter net income to $401 million (Can.) from its year-earlier earnings of $461 million (Can.). The Calgary-based company's revenues were $1.9 billion in this year's first 3 months, up 2% from first-quarter 2011.

Compton Petroleum Corp. reported decreased revenues during first-quarter 2012 as a result of lower production volumes and lower realized gas prices. Compton reported a net loss of $44.3 million (Can.) compared with earnings of $3.5 million (Can.) in the 2011 period largely due to a $33.2 million (Can.) impairment expense in the recent quarter related to the value of development and production assets, which were impacted by low gas prices, the company said.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com