Uganda advances projects for first refinery, new pipeline

The government of Uganda has entered an agreement with UAE-based Alpha MBM Investments LLC to advance development and construction of the country’s long-planned but delayed first crude oil refinery at Kabaale, Buseruka Sub-County, in western Uganda’s district of Hoima (OGJ Online, Apr. 12, 2018).

Signed on Mar. 31 by Uganda’s Ministry of Energy and Mineral Development, Uganda National Oil Co. (UNOC), and Alpha MBM Investments, the project implementation agreement paves way for design, construction, and operation of the proposed 60,000-b/d refinery, which will take 3 years to build, UNOC said.

To become East Africa’s first major crude processing plant upon startup, the refinery comes as part of Uganda’s plan to reduce its dependency on imported petroleum products, as well as meet local Ugandan and regional demand of petroleum-derived fuel project, according to the state-owned firm.

Uganda refinery project history, details

The Ugandan government previously had signed a project framework agreement (PFA) for the planned refinery with the Albertine Graben Refinery Consortium (AGRC)—comprised of YAATRA Africa LLC, Mauritius; Lionworks Group Ltd.; Mauritius; Baker Hughes General Electric’s (BHGE) Italian subsidiary Nuovo Pignone International SRL; and Saipem SPA of Italy, under which Saipem was begin front-end engineering design (FEED) as well as engineering, procurement, and construction (EPC) (OGJ Online, Mar. 13, 2019).

A final configuration study determining the refinery should be a residue fluid catalytic cracking-type plant was completed and approved by the government in 2019, followed by completion of the project’s FEED in 2021, according to UNOC’s website.

Following expiry of the original PFA in June 2023, UNOC confirmed Alpha MBM Investments in December 2023 signed a memorandum of understanding to become lead partner on the project.

Alongside the refining plant at Kabaale, UNOC said the broader refinery project will also include:

- A 211-km long multi-products pipeline that will evacuate refined products from the refinery to a storage terminal at Namwabula, Mpigi District.

- The Mbegu Water Intake and its corresponding water pipeline infrastructure that will supply water to the refinery. A storage terminal for the refinery’s finished products at Namwabula in Mpigi District.

The proposed refinery forms a leg of the country’s strategy to commercialize its oil and gas resources via processing and pipeline projects (OGJ Online, Aug. 22, 2024; Dec. 12, 2023).

EACOP pipeline project update

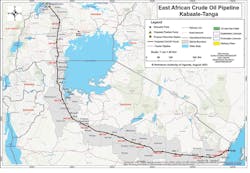

The Mar. 31 contract signing for the refinery follows a Mar. 26 announcement by East African Crude Oil Pipeline (EACOP) Co. Ltd. of its closing on the first tranche of external financing from a syndicate of financial institutions for its 246,000-b/d EACOP pipeline that will carry crude 897 miles from Kabaale, Hoima district, Uganda, to the Port of Tanga, Tanzania, for export to the international market, EACOP said.

Institutions participating in financing of the project include African Export Import Bank (Afreximbank), Standard Bank of South Africa Ltd., Stanbic Bank Uganda Ltd., KCB Bank Uganda, and the Islamic Corporation for the Development of the Private Sector (ICD), according to EACOP’s late-March release.

With construction already under way and more than 50% completed as of yearend 2024, the pipeline system includes 1,443 km (296 km in Uganda and 1,147 km in Tanzania) of insulated and buried 24-in. pipeline, six pumping stations, two pressure-reduction stations, and a marine export terminal in Tanzania housing a 3 Mw peak (Mwp) solar plant, all of which will be connected to national, primarily hydro-based grids for power supply, EACOP said.

Established in 2022 specifically to build the pipeline, East African Crude Oil Co. (EACOP) Ltd. includes affiliates of upstream partners TotalEnergies SE (62%), UNOC, 15%, and China National Offshore Oil Corp. (CNOOC) Uganda (8%), with the remaining 15% held by Tanzania Petroleum Development Corp. (TPDC).

About the Author

Robert Brelsford

Downstream Editor

Robert Brelsford joined Oil & Gas Journal in October 2013 as downstream technology editor after 8 years as a crude oil price and news reporter on spot crude transactions at the US Gulf Coast, West Coast, Canadian, and Latin American markets. He holds a BA (2000) in English from Rice University and an MS (2003) in education and social policy from Northwestern University.