Special Report: US oil shale resources look promising yet still uncertain

The quest for commercial viability of oil shale ultimately could prove the most practical option among unconventional hydrocarbon resources to add large quantities of proved US reserves, say researchers working toward this goal.

Yet, it could take another 10-15 years to determine if the energy returned on the energy invested on oil shale development will prove worth the effort, oil companies note.

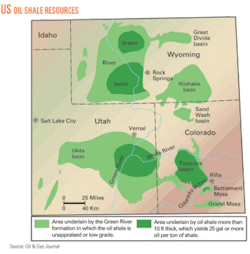

US oil shale is concentrated in northwestern Colorado, eastern Utah, and southwestern Wyoming. About 70% of oil shale is on federal land.

A 1-year congressional moratorium on the US Bureau of Land Management issuing final commercial oil shale leasing regulations expired Oct. 1. BLM has said leases are unlikely to be issued for years (see sidebar).

Government reports suggest oil shale development could add as much as 800 billion bbl of oil to US reserves. Worldwide, the oil shale resource base is estimated at 2.6 trillion bbl total and is found in more than 20 countries (OGJ, Aug. 9, 2004, p. 16).

Currently, Shell Exploration & Production Co. Unconventional Oil has three 160-acre leases that the BLM approved in its research, development, and demonstration program. BLM also granted one RD&D lease each to Chevron USA and American Shale Oil LLC, formerly EGL Shale Oil LLC.

These five leases involve in situ development in Colorado. BLM also approved a lease in Utah for Oil Shale Exploration Co. of Mobile, Ala. Most companies are researching various heat techniques. Chevron is focusing on chemistry to unlock the oil from the shale’s kerogen.

Avoiding the boom-bust

Companies have extracted oil shale off and on since the US Naval Oil Shale Reserve program was created about 100 years ago.

A previous oil shale boom was halted in 1982 when Exxon shut its $5 billion Colony oil shale project near Parachute, Colo.

Since the 1990s, ExxonMobil Upstream Research Co. has investigated more than 30 different technologies to extract oil from oil shale.

Currently, ExxonMobil’s leading candidate technology is the Electrofrac process, which is designed to heat oil shale in situ by creating hydraulic fractures and filling the fractures with an electrically conductive material.

Electricity would be conducted from one end of the fracture to the other, making the fracture a resistive heating element. Heat would flow from the fracture into the oil shale formation, gradually converting kerogen, the shale’s solid organic matter, into oil and gas that could be produced by conventional methods.

Oil companies involved in ongoing oil shale research emphasized the need to avoid boom-bust cycles. Industry spokesmen told OGJ that any successful oil shale technology must be sustainable throughout the ups and downs of oil prices.

“The boom-bust cycle issue really relates to the recovery cost of oil shale,” said Robert Lestz, Chevron’s oil shale technology manager. “We’ve taken a slightly different approach than our predecessors. We looked at this in a holistic process from the resources in the ground to the transportation fuel in the end. What is that energy balance you get from the resource to the finished product?”

He emphasizes the need to develop and maintain a sense of cooperation with the local community regarding environmental, social, and economic issues. Regional feedback helps Chevron develop its technical and business perspectives, Lestz said.

“Chevron said we need to develop a technology that will be much less energy intensive, environmentally responsible, and economically sustainable,” he said. “If we can have a process that is sustainable, then we alleviate the issues of boom-bust.”

Tracy Boyd, communications and sustainability manager for Shell’s Mahogany Shale Project near Meeker, Colo., agrees.

“The US has long known of this significant hydrocarbon resource, but past attempts have failed to develop the resource in an economically viable and environmentally and socially responsible manner,” Boyd said.

Previously, Shell said oil shale would be economic if prices for conventional oil were $30-35/bbl on the New York Mercantile Exchange. But Boyd said the company stopped making such forecasts.

There simply are too many unknowns today to accurately forecast the economics of future commercial oil shale projects, he said.

“You tell me what the economic atmosphere is going to look like 15 years from now,” Boyd said. “What are going to be the costs of construction, services, and other oil field support? What are going to be the environmental requirements of the time? What will be the status of global warming and carbon controls on projects? There are just too many variables now to say at some point in the future if oil price is X, we can do it, and if it’s Y, we can’t.”

Shell runs freeze wall test

Shell has researched oil shale development methods for 27 years and has run field tests on private land near Meeker, Colo., since 1996.

“We envision that it will be at least the middle of the next decade and possibly longer before we would be making a decision to move forward with a commercial scale project,” Boyd said.

Shell’s patented In situ Conversion Process was tested on an area measuring 30 ft by 40 ft. Shell recovered 1,700 bbl of light oil plus associated gas, indicating its proprietary process generates more oil from a smaller surface area than previous oil shale processes.

Boyd said the in situ heating process can recover 60% of hydrocarbons in the shale compared with 28-30% recovered using traditional mining and retort processes. In situ does not involve open-pit mining.

Shell inserts electric heaters underground to convert kerogen in the shale to producible hydrocarbons that can be collected and pumped to the surface. Rock is heated slowly to 650-750° F.

In its Mahogany Research Project, Shell is running a freeze wall test on a 25-acre plot having a rectangular pattern of 136 holes targeted at 1,800 ft deep. A vertical ice wall is designed as a barrier to keep ground water out of the contained reservoir.

Within the wall, a closed-loop pipe system circulates ammonia, a common refrigerant. No heating or production occurs during this test. Freezing began in early 2007.

The test is scheduled to run for 2-3 years, possibly longer. It’s a long sequence of various tests to determine whether Shell can manage the wall effectively.

In addition to the freeze wall test, Shell is developing plans for pilot projects on the three RD&D leases that BLM granted in 2006, Boyd said. No details or anticipated schedules are yet available for the RD&D pilot projects.

Chevron’s hydrology wells

Chevron’s oil shale researchers are conducting various stages of research in numerous laboratories and in the field.

Last year, Chevron took cores from an entire section of its RD&D lease and ran hydrology tests to understand the aquifers and water flow. Lestz said three separate pads of hydrology monitoring wells are being drilled.

Regarding kerogen, Chevron’s research is still in various laboratories, he said. There are two phases in the laboratory. One is from the experimental side and the other is from the simulation and modeling side.

Chevron is working in its own laboratories in Houston and in Richmond, Calif., along with scientists at the University of Utah and also at Los Alamos National Laboratory, Argonne National Laboratory, and the Pacific Northwest National Laboratory.

“The oil shale rock itself is not like a typical oil and gas reservoir,” Lestz said. “It has no permeability or porosity. Our ability to convey chemistry is quite limited unless we can create flow paths in the shale. That is the whole purpose around how we go out and create surface area so we can basically have a delivery system for that chemistry.”

Researchers are looking at several different types of chemical delivery techniques. One possibility is injecting CO2 under high pressure underground.

“There are other things that we also are evaluating at this time,” he said. “CO2 has a lot of advantages, but CO2 by itself is not going to really solve our problems. It’s the additives that we add to the CO2 that creates the uniqueness.”

The idea is for the CO2 and additives to act as a solvent that will pull the oil from the shale. Other industries use similar approaches. The potato chip industry uses CO2 to pull grease out of potato chips, and the coffee industry uses CO2 to extract caffeine.

“The interest in the CO2 for oil shale again comes back to the environmental side knowing it’s a very clean, inert type product to put into the ground and there will be minimal invasiveness from an environmental perspective,” Lestz said.

He said it’s too early to discuss what other types of delivery techniques are being considered because that research still is in its early stages.

Lestz said commercial oil shale production “is definitely many years out… It’s not a short-term solution. It’s an answer for tomorrow, not an answer for today.”

He is encouraged by the fact that many companies are approaching oil shale research from many different ways.

“The actual answer at the end of the day may lie between all these technologies,” he said.