Regional factors define future polymer trading

A recent Accenture study found that all regions around the world are growing in polymer consumption, although their focuses are different.

Developed nations are focusing on adding value to existing products, creating new value-added products, and continuing to lead in developing new services. Developing economies are spending on the basicsexporting is their value-added activity.

Global investment is growing fastest in regions with higher risk, although manufacturers may be overlooking important, untapped opportunities in developed nations.

Requirements to supply polymers vary by each region’s market and product mix and, due to the wide variability possible in labor costs even within a particular country, future investment will be led more by subregions or “hot spots” rather than individual countries per se. Given that, future investment strategies will require an extremely refined understanding of each region’s product mix, political environment, and potentially wide variances in business costs.

Accenture conducted the study to understand the effect of anticipated changes in manufacturing geographies. Key to the study was a scope that included trade of the polymers themselves and also of polymers “in situ,” that is, contained in the end product (See box, “Our methodology in brief”).

One of the study’s objectives was to provide a balanced perspective on market sector trends within each region and what it will take to compete in emerging and developed regions.

Multipolar trends represent big opportunities or big problems for global producers as they strive for high performance (See box, “The multipolar world”).

Those who understand the need for investment in future underserved markets stand to reap significant advantage. Those who take a black-and-white look, however, risk eroding performance and losing competitive advantage to those companies with the vision to look not only outward for opportunities, but to the overlooked ones locally as well.

World investment

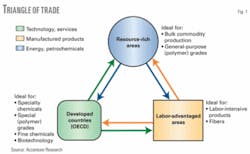

The “triangle of trade” (Fig. 1) shows the nature of global competition and forces for investment in polymer manufacturing. The basis of competition varies between regions:

- Technology and services in developed countries (such as North America, Western Europe, and Japan).

- Manufactured products in labor-advantaged regions (such as India and China).

- Energy and petrochemicals in oil and gas-producing areas (such as the Middle East and areas of Africa).

Likewise, the forces of investment in manufacturing reflect the respective competitive advantages in each region. In oil and gas-producing regions, therefore, the manufacturing focus is on bulk commodity production and general-purpose (polymer) grades.

Labor-advantaged areas are ideal for manufacture of textiles and other labor-intensive products. Finally, developed (Organization for Economic Co-operation and Development, OECD) countries are leaders in development of new products and lead in manufacture of value-added grades of polymer, fine chemicals, and biotechnology. As these products become commoditized, they then move to labor-advantaged regions, sometimes bringing along demand for higher-value chemicals.

The availability of feedstocks (oil or gas products that become the raw materials for the manufacture of petrochemicals) and labor also lead to development (and feeding into investment considerations).

Most petrochemicals are petroleum or gas based and because energy accounts for about 85% of the cost of petrochemical manufacturing, the sources of energy influence investment; but supply patterns are not static. As new low-cost feedstock regions develop, so too will new petrochemical and polymer sources and trade routes.

Regions such as the Middle East are also industrializing, especially in energy-intensive businesses, as a way to convert hydrocarbon resources to jobs and harness the added value downstream of the wellhead.

Even in areas with abundant energy sources, however, other issuesparticularly those related to political stability or heavy government involvement in the industriesprevent any one area from being the “ideal” region for investment. While Iraq has feedstock available, for example, the ongoing conflict certainly dampens investment prospects. Bolivia and Venezuela, likewise, have abundant gas resources, but significant political hurdles to overcome (Fig. 2).

Similarly, any examination of labor-rich countries as investment prospects must account for government policies that sometimes do not align with business needs. These issues include trade barriers and unfavorable regulations, to low-priority infrastructure development, to a lack of intellectual property protection and outright corruption. The ideal low-labor-cost region does not yet exist.

Polymer consumption

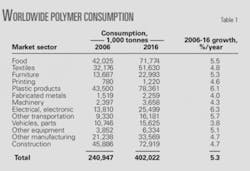

There is no absolute picture of smart investment in any particular region. The largest two market sectors will be the least susceptible to global trade changes in polymers.

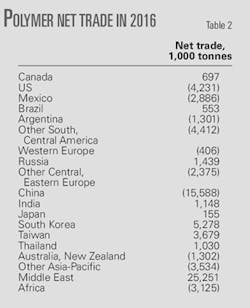

The Middle East and China will remain the axis of trade. The Middle East will be the largest exporter having an expected net export of petrochemicals of 25 million tonnes by 2016 (mostly geared toward serving China); correspondingly, China will be the biggest importer of polymers with an expected net import of 16 million tonnes by 2016.

Growth in other regions of the world may more likely be overlooked. The polymer industry will continue to grow in the US and Western Europe, due to demand for higher-end polymer products related to food packaging, medical instruments, and more. These regions should continue to be a target for global producers (Tables 1 and 2). By 2016, for example, demand for polymers in the US will result in a net import of about 4.2 million tonnes.

Essentially, the US and Western Europe will import polymers by 2016 that combined are the equivalent production of 10 world-scale polymer plants. All regions of the world will increase polymer consumption by 2016, with the US and Western Europe second and third, respectively, behind China. This forecast refutes the notion of investing strictly along the Middle East-China axis of polymer trade.

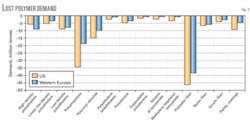

In addition, our research forecasts that “lost” polymer demand in the US and Western Europe, based on manufacturing net trade adjustments (the cumulative difference between projected sales and potential sales of polymers within the anticipated net trade of manufactured goods during 2006-16), equates to 150 million tonnes and 105 million tonnes, respectively.

Producing that volume of polymers would translate into the production capacity of about 40 US and 30 Western European world-scale polymer plantsplants that will be built in other regions due to the lack of competitiveness in downstream manufacturing in the US and Western Europe. Global producers should understand this gap and selectively allocate new investments based on each end-use market’s requirements in developed and developing regions (Fig. 3).

Future investment strategies

Polymer demand will continue to grow around the world. Our research shows, however, that investment strategies must be far more refined than focusing on particular countries. Requirements to meet polymer needs will vary by each region’s market and product mix.

Developed regions will continue to be large manufacturing centers and will continue to be the most inventive and value added. Plastics manufacturers in these regions are innovating constantly and continually looking for ways to squeeze costs out of their supply chain. We see providing domestic capacity as a real opportunity within the US, for example.

Textiles and the commodity portions of furniture and other manufacturing are the most susceptible to competition, whereas cutting-edge offerings in construction (not internationally traded per se), transportation, and food packaging represent better opportunities (Fig. 4).

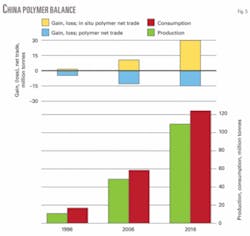

In China, as domestic capacity grows, the country will continue to experience a shortage of polymers. Its export of polymers in situ will rise dramatically during 2006-16 (Fig. 5).

Fig. 5 shows that textiles, commodity electrical and electronics, and basic machinery are strong in China. In 2007, China contributed just more than 15% of the world’s manufacturing, but only slightly more than 5% of the world’s gross domestic product, indicating its lack of value-added sectors, such as services.

Economic growth is skewed toward manufacturing investment for finished goods, which is causing increased inflation. This may result in competing, low-labor-cost nations such as India, Vietnam, Indonesia, and Latin America winning more investment.

One subregion or investment “hot spot” is along Thailand’s Myanmar border, where textile investment is growing rapidly due to its abundant low-cost labor pool. Textile investment is a good indicator of future manufacturing investment by other labor intensive, polymer-consuming industries.

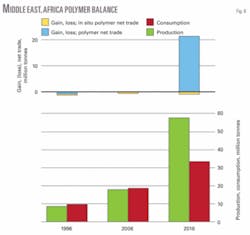

On the other end of the axis of trade, the Middle East and Africa will continue to be the largest exporter of polymers (primarily by the Middle East), and there will be a dramatic rise in their exports through 2016. Because most finished goods are imported to these regions, there will be a less dramatic but still notable trade deficit of in situ polymers during the next decade (Fig. 6).

Like China, the Middle East and Africa are far from a clear-cut investment case. Supply development challenges vary by country, as does the role of government in industry.

Some countries are under economic sanctions, such as Iran for example, and others may have foreign investment restrictions and other factors at play. Also, in most emerging markets, there are investment hindrances surrounding the areas of intellectual property protection, barriers to market entry and acquisitions, labor regulations, environmental and safety issues, and other concerns.

The obstacle in all cases will be to balance revenue growth with operating margins (which lead to total return to shareholders). This is an important point. We frequently see companies investing in China for revenue growth. Their operating margins get diluted, however, because more of their assets will be competing in the low price, cost-competitive markets of those regions.

In contrast, the developed regions offer slow revenue growth, but higher operating margins. There is growth in these areas, and the demand for polymers will no longer be confined to the most basic forms.

Competitive manufacturers will continue to demand innovative products, and companies with a smart global investment strategy understand that, while producers must be able to serve in China, product innovation begins in the developed nations and migrates elsewhere. To meet downstream needs, therefore, producers also need to remain on the leading edge of innovation.

Some of this innovation can come from the abundant pools of scientists and engineers in India and China. Many companies have placed research and development assets in those areas to serve traditional and burgeoning markets.

Keys to adding value

How do these trends translate into smart investment strategy? For making the most out of investing in a multipolar world, we recommend:

- Adding more value for current customers. The first key to adding value is to sell more to the same customer groupsmaterials, services, or systems. The paint industry, for example, no longer sells just paint to auto manufacturers; over time industry companies have taken over the role of the paint shopproviding expertise in applying the paint and recovering spent solvents or waste materials afterward.

- Using mergers and acquisitions (M&A) to enhance market position. Accenture research into high performance has shown that companies that are leaders in M&A increased margins relative to their peers. These companies have M&A instituted as a process, with people dedicated to the acquisition and timely integration to get new areas of business up and running quickly.

Also key is that top-tier businesses do not acquire simply to add volume. Rather, they acquire to add valueto enhance their services and products for their customers. Selective M&A can also be used to enhance positioning; a domestic paint manufacturer, for example, may acquire a company with a more global presence to serve in other areas. - Managing scale and selectively using technology and assets to take advantage of multipolar trends. High-performance chemical manufacturers have a keen awareness of global forces and opportunities and have established M&A practices to support geographic or market positioning. Yet they also continue to develop their home markets, using them as a platform to develop new technologies, new markets, and business know-how, which can then be used in their global operations.

The author

Paul Bjacek ([email protected]) is the global chemicals-natural resources strategic research lead for Accenture, Houston. He has 21 years’ experience in the chemicals industry, 7 of which were with Chevron Chemical Co. Bjacek is currently engaged in assessing high-performance businesses and practices in the chemicals industry. He holds an MS from the London School of Economics and a BS in chemistry and business from the University of Scranton, Pa. He is past president of the Commercial Development & Marketing Association.

Our methodology in brief

Accenture Research developed a method for forecasting demand for chemicals by linking industry-expert-derived forecast demand in downstream end-use markets, supplied by Global Insight (USA) Inc. To do this, we identified polymer consumption in each major end-use market and region.

This approach of examining demand for polymers produces a more reliable demand outlook because it takes into consideration not only chemicals but also end-market expertise.

For this study, we examined the demand for certain polymer segments1 within many end-use markets2 covering the consumption of all major plastics, fibers, and paints (which we call “polymers” in this study), across a comprehensive group of manufacturing countries and regions that encompass the entire world market.3

We examined finished goods and polymer trade flows and balanced the demand outlook with our own supply forecast, which is based on our understanding of polymer production economics, feedstock trends, and other geopolitical factors.

Based on this work, we observed that:

- World investment is growing fastest in regions with higher risk.

- All regions are growing in polymer consumption, although their focuses are different.

- Seeds of future polymer demand growth can be found in subregions or “hot spots” with a particular advantage.

- Raw material centers are evolving as new resources are found and political tides change.

- The future chemical industry will include more government ownership and, therefore, the competitive landscape will develop differently.

- Within each region there are “safe haven” markets that are least susceptible to international trade swings.

- Companies are finding alternative sources of talent in order to lower costs and achieve higher levels of innovation, such as through the establishment of research and development centers in emerging markets and outsourcing various functions.

- Future investment strategies will require an extremely refined understanding of each region’s product mix, political environment, and potentially wide variances in business costs.

End notes

- Thermoplastics, polyurethanes, fibers, and paints.

- Food, textiles, furniture, printing, plastic products, fabricated metals, machinery, electrical and electronics, other transportation, vehicles and parts, other equipment, other manufacturing, and construction.

- Includes Africa, Argentina, Australia and New Zealand, Brazil, Canada, China, India, Japan, Mexico, the Middle East, Russia, South Korea, Taiwan, Thailand, the US, Western Europe, and other countries in Central and South America, Central and Eastern Europe, and Asia-Pacific regions. Our selected industries do not cover all manufacturing, and our forecast is a baselinethat is, it does not take into account the effect of anticipated environmental legislation, trade legislation, substitution trends, technology trends, paint formulation methods, and oil or raw material price changes.

The multipolar world

Globalization, the formative idea of our age, continues to affect the economic geography in ways we are only beginning to understand. The rise of this new worldwhat Accenture calls the multipolar worldis constantly reshaping our perspective.

Increased economic interdependence across five key dimensions characterizes this multipolar world:

- Capital. The rapid growth of emerging economies as sources of outward foreign direct investment and destinations for portfolio investment.

- Talent. Favorable demographics spurring rapid growth of emerging-market workforces.

- Resources. Increasingly intense competition for energy, commodities, and raw materials.

- New consumers. Rapid income growth creating up to a billion new consumers in emerging markets.

- Innovation. The growth of new clusters of innovation and specialization in emerging economies.

The multipolar world is opening new opportunities not only to traditional companies, but also to local and resourceful operations that understand more closely the potential in their “own backyards.”

The multipolar world is not a world of absolutes, where traditional first-world economies begin to give way before the rise of countries such as India and China. Rather, in the multipolar world, not only will the traditional and new powerhouses have significant roles, but other players will also: Mexico, Russia, South Korea, Brazil, and Eastern Europe, among others.