Product pipeline completions lead planned construction lower

Topics Covered in the Webcast:

- Key influences in the global and US oil markets

- How past forecasts compared against actual historical data

- Forces influencing global oil demand, supply, and prices

- Major trends in US oil product markets

- How oil and gas from unconventional resources are reshaping markets in the US and around the world

View Industry Forecast and Review Webcast Now |

Planned pipeline construction to be completed in 2014 slipped 39% from the previous year, led by sharply lower levels of planned products pipelines. Crude and natural gas pipeline construction plans for the year also softened.

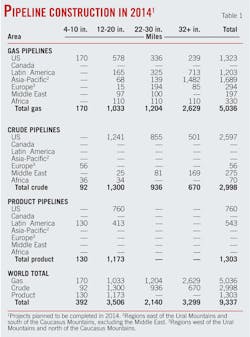

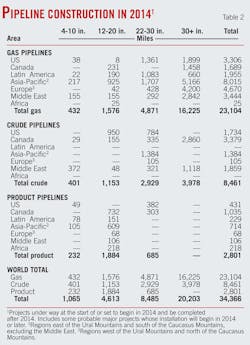

Operators plan to install 9,337 miles in 2014 alone (Table 1), with natural gas plans (5,036 miles) making up nearly 54% of the total, based on reports from the world's pipeline operating companies and data collected by Oil & Gas Journal. By contrast, crude and products pipelines made up nearly 60.5% of total planned construction in 2013.

Looking beyond 2014, for the sixth consecutive year less mileage is planned than had been the previous year, as plans softened in almost all regions.

Long-term pipeline plans rose in Canada and the Middle East, with natural gas, crude, and products plans all up in Canada, and planned mileage for both crude and natural gas pipelines higher in the Middle East.

Planned product pipeline construction for beyond 2014 registered sharp decreases in the US for the second consecutive year, as larger NGL projects continue to be completed.

As a whole, combining both current-year and forward estimates (Fig. 1), decreases in planned construction were seen in all regions except the Middle East and Canada.

As 2014 began, operators had announced plans to build more than 34,300 miles of crude oil, product, and natural gas pipelines extending into the next decade, a 23% decrease from data reported the previous year (OGJ, Feb. 4, 2013, p. 84). The majority (more than 67%) of these plans is for natural gas, consistent with the share for this segment seen in previous years.

Outlook

The downturn in worldwide pipeline construction trends runs counter to US Energy Information Administration energy consumption forecasts, which show an uptick in expected growth rates as the world continues to recover from the 2008-09 recession.

EIA forecast world marketed energy consumption to increase by 56% through 2040 (using a 2010 baseline), a period that encompasses the long-term pipeline construction projections stated here.

Energy demand growth will be strongest, according to the July 2013 analysis, among non-Organization for Economic Cooperation and Development (OECD) countries, which have so far propelled the global recovery. Non-OECD growth will be led by China and India where combined energy use will more than double over the projection period to make up more than one-third of total global demand by 2040. China's energy demand alone will be more than twice US energy demand by the end of the projection period.

On a far smaller scale, energy demand in the combined OECD Americas reporting block of Mexico-Chile will also more than double between 2010 and 2040.

Fuelling this energy demand growth is projected gross domestic product (GDP) growth in non-OECD Asia of 5.4%/year through 2040—led by India at 6.1%/year, the highest projected growth rate in the world—compared with a 3.6% global growth rate. China's rate of growth was flat from EIA projections a year earlier, while non-OECD Asia and worldwide growth were both higher, India passing China as the region with the most rapid expected growth.

Recently announced reforms will improve India's medium-term economic environment if fully implemented, according to EIA, which described the continued acceleration of structural reforms as essential to stimulating potential growth and reducing the country's poverty rate over the longer term. EIA's projected 6.1%/year GDP growth in India for 2010-40 is up from 5.5% the previous year.

Structural issues that have implications for medium to long-term growth in China include the pace of reform affecting inefficient state-owned companies and a banking system carrying a large number of nonperforming loans, according to EIA. Development of domestic capital markets to help macroeconomic stability and ensure China's large savings are used efficiently supports medium-term growth projections, according to EIA, which nonetheless sees the country's expansion slowing substantially toward the end of the projection period due to an aging population and shrinking workforce.

In December 2013, EIA's Annual Energy Outlook (AEO) 2014 forecast up-and-down movement in US liquid fuels consumption through 2040, peaking at 19.5 million b/d by 2018 (from 18.5 million b/d in 2012) before dropping back to 18.7 million b/d by 2034 and remaining at that level through 2040. Biofuels consumption increases through 2022 then remains relatively flat.

EIA projects US oil production climbing more than 47.6% to 9.6 million b/d in 2019 from 6.5 million b/d in 2012 and remaining at or above 7.5 million b/d through 2040, with production increases largely from tight onshore formations.

The agency increased its cumulative production of dry natural gas estimate for 2012-40 from its AEO 2013 forecast by 11%, primarily reflecting continued increases in shale gas production.

The 2014 outlook projects the US becoming a net exporter of LNG in 2016 and an overall net exporter of natural gas in 2018, 2 years earlier than AEO 2013. EIA sees LNG exports from new liquefaction capacity reaching 2 tcf/year by 2020 and 3.5 tcf/year by 2035. Net pipeline imports from Canada fall steadily through 2033 and then increase through 2040, and net pipeline exports to Mexico grow by more than 400%.

OGJ has for nearly 60 years tracked applications for gas pipeline construction to the US Federal Energy Regulatory Commission (FERC). Applications filed in the 12 months ending June 30, 2013 (the most recent 1-year period surveyed) demonstrated the renewed strength in the US pipeline market despite the overall downturn.

• More than 820 miles of gas pipeline were proposed for land construction, and nearly 23 miles for offshore work. For the earlier 12-month period ending June 30, 2012, only 144 miles were proposed for land construction.

• FERC applications for new or additional horsepower at the end of June 2013 also increased, to more than 450,000 hp from 184,000 hp.

Bases, costs

For 2014 only (Table 1), operators plan to build more than 9,300 miles of oil and gas pipelines worldwide at a cost of more than $40 billion. For 2013 only, companies had planned more than 15,300 miles at a cost of more than $50 billion.

For projects completed after 2014 (Table 2), companies plan to lay more than 34,300 miles of line and spend roughly $146 billion. When these companies looked beyond 2013 last year, they anticipated spending roughly $144 billion to lay more than 44,800 miles of line. Land construction costs rose in the meantime from $3.1-million/mile to $4.1-million/mile.

• Projections for 2014 pipeline mileage reflect only projects likely to be completed by yearend 2014, including construction in progress at the start of the year or set to begin during it.

• Projections for mileage after 2014 include construction that might begin in 2014 but be completed later. Also included are some long-term projects judged as probable, even if they will not break ground until after 2014.

US average cost-per-mile for onshore pipeline construction (Table 4, OGJ, Sept. 2, 2013, p. 116) on FERC applications submitted by June 30, 2013, was $4.1 million. Average cost-per-mile for offshore pipeline construction was $7.6-million

Based on historical analysis and a few exceptions and variations notwithstanding, these projections assume that 90% of all construction will be onshore and 10% offshore and that pipelines 32 in. OD or larger are onshore projects.

Following is a breakdown of projected costs, using these assumptions and OGJ pipeline-cost data:

• Total onshore construction (8,733 miles) for 2014 only will cost nearly $36 billion:

• Total offshore construction (604 miles) for 2014 only will cost more than $4.6 billion:

—$298 million for 4-10 in.

—$2.7 billion for 12-20 in.

—$1.6 billion for 22-30 in.

• Total onshore construction (32,959 miles) for beyond 2014 will cost more than $135 billion:

—$3.9 billion for 4-10 in.

—$17 billion for 12-20 in.

—$31 billion for 22-30 in.

—$82.9 billion for 32 in. and larger.

—$1.4 billion for 4-10 in.

—$12.9 billion for 12-20 in.

—$7.9 billion for 22-30 in.

—$13.5 billion for 32 in. and larger.

• Total offshore construction (1,417 miles) for beyond 2014 will cost nearly $11 billion:

—$817 million for 4-10 in.

—$3.5 billion for 12-20 in.

—$6.5 billion for 22-30 in.

Action

What follows is a quick rundown of some of the major projects in each of the world's regions.

Pipeline construction projects mirror end users' energy demands, and much of that demand continues to center on natural gas, with the industry remaining focused on how to move that gas to market as quickly and efficiently as possible. The following sections look at both natural gas and liquids pipelines.

US, Canada activity—Gas, NGL

TransCanada Alaska, the state's licensee to build a natural gas pipeline from Alaska's North Slope, received state clearance May 2, 2012, to change the project's focus to a large-diameter pipeline to an Alaska tidewater site for in-state use, liquefaction, and export.

The move came after TransCanada Corp. and the North Slope's three major producers—BP PLC, ConocoPhillips, and ExxonMobil Corp.—announced Mar. 30, 2012, that they would work together to commercialize Alaska North Slope gas by focusing on large-scale exports from south-central Alaska as an alternative to a pipeline through Alberta to markets in the US Lower 48. The four companies completed the project's concept selection phase in February 2013.

ExxonMobil, BP, TransCanada, Alaska Gasline Development Corp. (AGDC), and Alaska's commissioners of natural resources and revenue in January signed a heads of agreement for the Alaska LNG Project, laying out the commercial framework for the LNG option (OGJ Online, Jan. 16, 2014).

TransCanada had been awarded rights to build a North Slope gas pipeline under the Alaska Gasline Inducement Act in January 2008. In June 2009 TransCanada agreed with ExxonMobil Corp. affiliates to work together on the pipeline. ExxonMobil shares expenses in advancing the project's technical, commercial, regulatory, and financial aspects, while TC Alaska remains the AGIA licensee (OGJ, Sept. 14, 2009, p. 31). The Alaska Pipeline Project the two companies formed initially presented two alternatives for assessment by potential shippers, only one of which would move forward. One option would have transported an estimated 4.5 bcfd of gas from Alaska's North Slope about 1,700 miles across Alaska to Alberta, Canada, where it could be sent on existing pipelines to North American gas markets. The second option called for shipping an estimated 3 bcfd of gas about 800 miles to Valdez, Alas., where shippers could liquefy the gas in a plant constructed by others and ship it on tankers to US and international markets.

Alaska's Natural Gas Development Authority also continues to develop plans for intrastate gas pipelines, including the AGDC's own 737-mile, 24-in. OD line intended to bring North Slope gas south. AGDC submitted its plan for the project–the Alaska Stand Alone Pipeline (ASAP)–to the Alaska legislature in July 2011.

The plan included estimated first gas in late 2018. It also called for public ownership of the line, noting that lower borrowing costs would allow for the lowest possible tariff structure, with a private company to both build and operate the system. The plan also noted the apparent commercial feasibility of a 500-MMcfd LNG liquefaction anchor tenant for ASAP and estimated the cost of the pipeline at $7.5 billion, with a 30% margin of error.

The system as proposed would run from Prudhoe Bay following the Trans Alaska Pipeline System (TAPS) and Dalton highway corridors to near Livengood, northwest of Fairbanks, at which point it would follow the Parks highway corridor south to its terminus interconnect with the Beluga Pipeline near Big Lake (part of the Enstar Beluga distribution system). The system would include a 35-mile, 12-in. OD lateral to Fairbanks, with a capacity of 60 MMcfd.

AGDC received its Final Environmental Impact Statement from the federal government on the project in October 2012. The Alaska legislature in April 2013 appropriated more than $440 million to state natural gas transportation projects for fiscal 2014; $355 million of which was to continue development of the AGDC project, with $25 million to continue state reimbursement of preliminary planning and design on the Alaska Pipeline Project.

Large gas pipeline projects in Canada centered on shipping material from shale plays in Alberta and British Columbia to the Pacific Coast for liquefaction and export. In late 2012, Chevron Canada Ltd. announced plans to buy 50% of Kitimat LNG and the proposed Pacific Trail Pipeline (OGJ, Jan. 7, 2013, p. 42). Pacific Trail is a 290-mile, 36-in. OD pipeline that would move gas from Spectra's pipeline system to the Kitimat LNG terminal. The British Columbia government in July extended Chevron and Apache's window to start construction on the line to 2018.

Spectra Energy Corp. is itself planning with BG Group PLC jointly to develop a 42-in. OD, 525-mile gas pipeline from northeast British Columbia to supply BG's potential LNG plant in Prince Rupert, BC. The line would move 4.2 bcfd of gas from the Horn River and Montney developments to the coast for liquefaction and export. Pending regulatory approvals, Spectra and BG expect to begin building the pipeline mid-decade and complete it by 2019.

Progress Energy Canada Ltd. in August signed firm transportation agreements for an interconnection with TransCanada's proposed Prince Rupert Gas Transmission (PRGT) project to provide gas to the proposed Pacific Northwest LNG export plant near Prince Rupert. Delivery of 2.1 bcfd from TransCanada's Nova Gas Transmission Ltd. system to the 470-mile, 48-in. OD PRGT would begin in 2019.

Several projects are under evaluation to move NGLsNGLs, primarily ethane, produced in the Marcellus shale to both the Gulf Coast and Midcontinent.

Enterprise Products Partners LP in December began injecting ethane into its 1,230-mile Appalachia to Texas ethane pipeline (ATEX Express), running from the Marcellus-Utica shale areas of Pennsylvania, West Virginia, and Ohio to the US Gulf Coast. Originating in Washington County, Pa., the first leg of the system involved building about 595 miles of new pipeline extending to Cape Girardeau, Mo., closely paralleling an existing Enterprise pipeline. At Cape Girardeau, Enterprise reversed a 16-in. OD pipeline and placed it into ethane service.

ATEX has an initial capacity of 125,000 b/d, expandable to at least 265,000 b/d. Firm 15-year ship-or-pay agreements support the project. About 65,000 b/d of these contracted volumes are moving initially, expected to ramp up to more than 135,000 b/d beginning in 2018.

Williams Cos. and Boardwalk Pipeline Partners LP's proposed joint-venture Bluegrass Pipeline would also transport mixed NGL from the Marcellus and Utica shales to US Gulf Coast petrochemical and export markets. The companies expect the 200,000-b/d pipeline to enter service second-half 2015. Expandable to 400,000 b/d, Bluegrass would use new construction to Hardinsburg, Ky., and converted line from there to Eunice, La.

Kinder Morgan Energy Partners LP and MarkWest Utica EMG LLC have also proposed a Y-grade pipeline project from the Utica and Marcellus to Mont Belvieu. The pipeline would have an initial design capacity of 150,000 b/d and be expandable to 400,000 b/d. The companies expect it to be in service by second-quarter 2016. The first 1,000 miles of the line would consist of converted Tennessee Gas Pipeline system, with 200 miles of newbuild between Natchitoches, La., and Mont Belvieu.

Project Mariner, announced in 2010 by Sunoco Logistics Partners LP and MarkWest Energy Partners LP, will transport 50,000 b/d of Marcellus shale ethane to the US Atlantic Coast for shipment to Gulf Coast chemical producers and European markets. Mariner West, a 65,000-b/d expansion of Project Mariner, began moving ethane to Sarnia, Ont., last year.

The combined projects include only 85-miles of new pipeline construction, using existing Sunoco infrastructure for the balance of each route. MarkWest is building ethane storage in the Philadelphia, Pa., and Nederland, Tex., areas as part of the project, using existing storage in Sarnia (OGJ Online, Aug. 10, 2012).

Sunoco held a binding open season in 2012 for Project Mariner East and expects propane deliveries to begin the second half of this year and full propane and ethane operations by first-half 2015. The system will use Sunoco's existing 8-in. OD pipeline between Delmont, Pa., and Philadelphia, with new pipe between Houston, Pa., and Delmont. MarkWest says the line's 70,000-b/d capacity can be increased to meet any future increases in demand. Toward this end, Sunoco held an open season late in 2013 for Mariner East 2, which the company would put in service early 2016.

The Bakken play also saw continued NGL pipeline activity. Oneok Partners LP put its 600-mile Bakken NGL Pipeline, transporting unfractionated NGLs from the Bakken shale to an interconnection with its 50%-owned Overland Pass Pipeline in northern Colorado, into service last year. The company will expand Bakken NGL to 135,000 b/d from 60,000 b/d by third-quarter 2014, and to 160,000 b/d by first-half 2016.

Enterprise Products Partners will place an 82,500-b/d Rocky Mountain expansion of its Mid-America Pipeline system in service in third-quarter 2014, looping the existing system with 263 miles of 16-in. OD pipeline and modifying pump stations to move new Uinta, Piceance, and Great Green River basin liquids production to Mont Belvieu.

Crude

TransCanada announced plans in July 2008 for the Keystone Gulf Coast Expansion Project (Keystone XL), providing additional capacity of 500,000 b/d from western Canada to the US Gulf Coast by 2012. The expansion would boost the Keystone system's total capacity to 1.1-million b/d at a total capital cost of about $12.2 billion. Keystone XL secured firm, long-term contracts for 380,000 b/d for an average of 17 years from shippers.

Keystone XL would include 1,980 miles of 36-in. OD line starting in Hardisty, Alta., and extending to a delivery point near existing terminals in Port Arthur, Tex. XL will use 41 pump stations—33 in the US and 8 in Canada—at roughly 50-mile intervals. Each station will use two-to-three 6,500 hp electric pumps, providing a total of up to 19,500 hp/station. Each station could be expanded to 32,500 hp as part of boosting the combined Keystone system's throughput to 1.5 million b/d. Keystone XL, however, has become embroiled in US domestic politics and its future is uncertain.

TransCanada, meanwhile, began work on its 700,000-b/d Gulf Coast Project crude oil pipeline between Cushing, Okla., and Nederland, Tex., despite both the delays to Keystone XL (of which it would be a component) and plans to reverse the Seaway pipeline to deliver crude along a similar route. TransCanada separated the Gulf Coast Project from Keystone XL in February 2012 and in July of that year received the final of three key permits needed from the US Army Corps of Engineers to advance the 485-mile pipeline, which entered service late last year.

Enbridge bought ConocoPhillips's share of Seaway, joining with EPP in the pipeline's ownership and jointly announcing that its flow would be reversed to deliver crude from Cushing to the Gulf Coast. Initial capacity of the reversed pipeline was 150,000 b/d, with expansion to 400,000 b/d completed in early 2013 (OGJ Online, Jan. 3, 2013). Seaway plans to reach a final capacity of 850,000 b/d by mid-2014.

Enbridge is also building its Flanagan South Project between Flanagan, Ill., and a connection with Seaway at Cushing. The company currently operates the 193,300 b/d Spearhead Pipeline along this route. The 600-mile, 36-in. OD Flanagan South line will largely parallel Seaway and open mid-2014 with 600,000 b/d capacity, expandable to 800,000 b/d.

Shell Pipeline is building the 226-mile, 300,000-b/d Westward Ho pipeline between St. James, La., and the Port Arthur-Beaumont, Tex., refining center to add new westbound capacity following reversal of its Ho-Ho Pipeline to run from Houston to Houma, La. The 30-in. OD Westward Ho will transport offshore US Gulf of Mexico production starting in 2015 and is expandable to 900,000 b/d.

Enbridge plans for the Northern Gateway Pipeline to transport 525,000 b/d of oil sands crude from near Edmonton, Alta. to a tanker terminal in British Columbia for shipment to China, other parts of Asia, and California. A line running parallel to the crude line would ship 193,000 b/d of condensate from the coast to Alberta.

Enbridge expects to build Northern Gateway 2014-17, pending regulatory approval of filings made in 2009. Commissioning and start-up would occur 2015-16. Enbridge would also operate the Kitimat terminal. It would have 2 mooring berths, 14 storage tanks for petroleum and condensate, and be called on by roughly 225 ships/year.

British Columbia Premier Christy Clark, however, declared in July 2012 that the environmental risks of the project outweigh its economic benefits and asked that BC be compensated for allowing the pipeline, which was already encountering opposition from environmental groups, to cross its territory. That same month Northern Gateway announced additional measures to ensure pipeline integrity, including: increased WT, more remote-operated isolation valves, more in-line inspections, and staffing at remote pump stations.

In December 2013 a Canadian federal Joint Review Panel recommended the Canadian government approve Northern Gateway, subject to 209 required conditions and following 18 months of community hearings. Enbridge's Northern Gateway project team expects a final decision from the Canadian government in July 2014.

TransCanada last year reached binding long-term shipping agreements to build, own, and operate the Alberta-based Heartland Pipeline and TC Terminals projects. The projects will include a 200-km (124 mile), 900,000 b/d pipeline connecting the Edmonton region to Hardisty, Alta., and a crude terminal with 1.9 million bbl of storage in the Heartland industrial area north of Edmonton. TransCanada expects the projects to enter service second-half 2015.

TransCanada announced the related Grand Rapids Pipeline project in 2012, a 500-km system to transport crude oil and diluent between the producing area northwest of Fort McMurray and the Edmonton-Heartland region. The system will deliver 900,000 b/d of crude and 330,000 b/d of diluent by early 2017.

Pembina Pipeline Corp. last year reached binding commercial agreements to move ahead with its $2-billion Phase III Pipeline Expansion. Pembina expects the 540-km expansion to enter service between late 2016 and mid-2017. Phase III will follow and expand certain segments of Pembina's existing pipeline systems from Taylor, BC, southeast to Edmonton, Alta., with priority placed on areas in need of debottlenecking. The core of the expansion will entail building a 270-km, 24-in. OD pipeline from Fox Creek, Alta., to the Edmonton area.

The expansion will have an initial capacity of 320,000 b/d, expandable to more than 500,000 b/d. Once complete, Pembina will have three distinct pipelines in the Fox Creek-to-Edmonton corridor, with a combined capacity of 885,000 b/d, if fully expanded. The expansion will also increase pipeline interconnectivity between Edmonton and Fort Saskatchewan, including Pembina's Redwater and own Heartland Hub sites, and third-party delivery points in these areas (OGJ Online, Dec. 17, 2013).

Latin America

Petroleos Mexicanos is building the 600-mile Los Ramones pipeline project. The 2.1-bcfd pipeline will start at the US-Mexico border and be complemented on the US side by a 125-mile pipeline from Agua Dulce, near Corpus Christi, to McAllen, Tex., on the border with Reynosa in northern Mexico.

The Mexican project cost is estimated at $3 billion and the US project, $650-750 million, according to RBN Energy. When completed, Los Ramones will move gas from southern Texas to the state of Guanajuato in central Mexico, a regional hub for the country's auto industry. Los Ramones Phase 1 will run 71 miles from the US border to Los Ramones, Mexico, carrying an initial 1 bcfd through 48-in. OD pipe later this year. Phase 2 will lay 460 miles of 42-in. OD across 5 northern Mexico states, entering service in 2015.

Los Ramones is only one of several pipelines expected to come online in the next few years and underpin substantial growth of US gas flows to Mexico. Comisión Federal de Electricidad (CFE), Mexico's state-owned electric utility, awarded Sempra Mexico a contract to build, own, and operate a roughly 500-mile, $1 billion pipeline network connecting the northwestern Mexico states of Sonora and Sinaloa. The network will consist of two segments interconnecting with the US interstate pipeline system in Arizona, shipping natural gas to new and existing CFE power plants currently using fuel oil.

The first segment, a 36-in. OD, 310-mile pipeline, will run from Sasabe, south of Tucson, Ariz., to Guaymas, Sonora, shipping 770 MMcfd by late 2014. The second segment, from Guaymas to El Oro, Sinaloa, is a 30-in. OD, 200-mile pipeline moving 510 MMcfd. CFE expects to start the second line third-quarter 2016. CFE has fully contracted system capacity under dual 25-year firm agreements denominated in US dollars.

CFE also awarded TransCanada Corp.'s Mexican subsidiary, Transportadora de Gas Natural de Noroeste (TGNN), the contract to build, own, and operate two new pipelines. The 30-in. OD, 329-mile El Encino-to-Topolobampo Pipeline will run from El Encino, in the state of Chihuahua, to Topolobampo in Sinaloa, at a contracted capacity of 670 MMcfd. TransCanada expects to spend about $1 billion on the pipeline, supported by a 25-year natural gas transportation service contract with the CFE. The company anticipates the pipeline will enter service third-quarter 2016.

TGNN also won the contract for the El Oro-to-Mazatlan Pipeline. The 24-in. OD pipeline will run 257 miles and have contracted capacity of 202 MMcfd. TransCanada expects the pipeline, which will interconnect with the El Encino-to-Topolobampo pipeline, to enter service fourth-quarter 2016 (OGJ Online, Nov. 6, 2012).

CPA Trading SA is building one of South America's bigger pipeline projects, a 520-km ethanol line running from Sarandi City to the Paranagua export terminal. The 12-in. OD pipeline will move 3.6-million cu m/year of ethanol, with construction starting later this year.

Asia-Pacific

China National Petroleum Corp. is building the country's Third West-East Gas Pipeline (WEPP 3), consisting of 7,378 km spread over one trunkline and eight branches. Three gas storage sites and one natural gas liquefaction plant are also part of the project. The 5,220-km trunk will start in Horgos, Xinjiang, and end at Fuzhou, Fujian province, crossing 10 provinces and regions including Xinjiang, Gansu, Ningxia, Shaanxi, Henan, Hubei, Hunan, Jiangxi, Fujian, and Guangdong. The pipeline will deliver 30 billion cu m/year (bcmy) using an operating pressure of 10-12 MPa.

CNPC expects the pipeline to be completed in 2015, connecting to Line C of the Central Asia-China Gas Pipeline, also now under construction. WEPP 3 will mainly transport gas from the Central Asia pipeline, using incremental production in the Tarim basin and coal gas in Xinjiang to supplement these supplies. Asia Gas Pipline LLC—a joint venture of KazMunaiGaz (KMG) and CNPC—let a contract to Rolls-Royce last year for compression on Line C inside Kazakhstan.

KMG and CNPC are also planning a new crude oil pipeline between Atyrau on the eastern coast of the Caspian Sea and China's Xinjiang province. The pipeline would parallel an existing 350,000-b/d line. The companies expect the 1,384-mile, 28-in. OD pipeline to enter service in 2018.

Turkmengaz plans to build a 770-km, 56-in. OD natural gas pipeline from eastern Turkmenistan to the Caspian Sea, moving 30 bcmy by 2015 for continued shipment to Europe. Talk of this pipeline coincides with renewed European interest in a Trans-Caspian gas pipeline, with Turkmenistan and the EU expected to hold talks on such a project early this year. A Trans-Caspian line would run roughly 300 km from the Turkmen coast to Azerbaijan, where it would link to the southern gas corridor (discussed later in this article) into Europe.

GSPL India Gasnet Ltd. is building a 1,670-km natural gas pipeline between Mehsana and Bhatinda, part of Indian plans to more than double the length of its gas pipeline system. The project received its environmental permits from the Indian government in May 2013. GSPL expects the 36-in. OD pipeline to enter service in 2015 with a capacity of 30-million cu m/day (mcmd).

Sister-company GSPL India Transco Ltd. is building a 1,585-km pipeline between Mallavaram and Bhilwara as part of the same effort. The pipeline will use pipes between 18- and 36-in. OD, also moving 30 mcmd by 2015 and having received its environmental approvals last year. Both pipelines will carry production and imports from India's east coast to consumers in central and northern parts of the country.

The GSPL companies are also building a 740-km , 24-28 in. OD gas pipeline to move 15-million cu m/day from Bhatinda on to Srinagar. The Jammu and Kashmir provincial government was expediting the permitting process for this line in 2013, with GSPL anticipating a 2015 in-service date. As of November 2013, however, local press reports said GSPL had not yet filed the necessary commercial documents to move forward.

Indian Oil Corp., meanwhile, is building a 680-km NGL pipeline system, connecting Paradip and Durgapur with 18-, 14- and 12-in. OD pipe. The system will move liquids from the Paradip refinery to LPG bottling plants. Both cathodic protection and mainline pipe lay contracts for the project were tendered last year, with IOC planning to begin NGL deliveries on the system during 2016.

Transneft is building the second stage of the Eastern Siberia-Pacific Ocean (ESPO) crude pipeline, which transports oil from fields in Eastern Siberia to consumers on the Pacific coast and for export to China. The company expects total capacity of ESPO-2 to reach 50 million tonnes/year (tpy), with construction between Skovorodino and Kozmino complete this year (OGJ Online, Sept. 10, 2012).

Rosneft and Transneft agreed in September 2012 jointly to build a branch off ESPO linking it to Rosneft's Komsomolsk-on-Amur refinery. The branch will have a capacity of 8-million tpy. Crude currently arrives at the refinery by rail. Transneft will finance the design and construction of the offshoot using long-term fees paid by Rosneft as part of a separate shipment agreement.

Europe

The largest European projects continue to focus on the southern gas corridor. Gazprom and Eni SPA agreed in December 2007 to build the South Stream gas pipeline under the Black Sea and through Bulgaria. The subsea section will be 558 miles long, reaching a maximum depth of 2,250 m. The two overland branches of the pipeline will run northwest to Slovenia and Austria and southwest to Greece and Italy. Total pipeline length is 1,460 miles

Intergovernmental agreements for the project are in place with Serbia, Hungary, Greece, Slovenia, Bulgaria, and Austria. In December 2011, Turkey granted Gazprom permission to lay South Stream though its exclusive economic zone in the Black Sea. Pipeline construction started near Anapa, in Russia's Krasnador Territory, in December 2012. On completion, the €15.5-billion line will transport 30 bcmy. Participants plan to deliver first gas through South Stream by December 2015.

Partners in the Shah Deniz consortium made a final investment decision (FID) in December 2013 on Stage 2 development of the Caspian Sea natural gas field offshore Azerbaijan, triggering plans to expand the South Caucasus Pipeline (SCP) through Azerbaijan and Georgia, build the Trans Anatolian Gas Pipeline (TANAP) across Turkey, and begin work on the previously selected Trans Adriatic Pipeline (TAP) for shipment into Europe (OGJ Online, Dec. 17, 2013).

SCP expansion will twin the existing Baku-Tbilisi-Ceyhan (BTC) pipelines through Azerbaijan and Georgia, as well as adding two compressor stations to boost capacity by 16 bcmy. Project plans call for 441 km of new 56-in. OD pipe; 385 km through Azerbaijan and another 56 into Georgia, at which point the expansion will connect to the existing SCP.

The first additional compressor station will be 3 km inside Georgia, collocated with an existing BTC station near Rustavi. The second new station will be at a greenfield site on the existing line 139 km downstream, west of Tsalka Lake, Georgia. SCP's current capacity is 7 bcmy. BP expects work to be completed by end-2018.

TANAP (Fig. 2) would run 1,800 km at an estimated cost of at least $7 billion. The 48- and 56-in. OD pipeline will move as much as 30 bcm/year by 2018, coinciding with first gas from Shah Deniz II. Pipe procurement and the start of construction are both scheduled for 2014.

The Shah Deniz II consortium in June 2013 selected the Trans Adriatic Pipeline (TAP) as the project's European transport option. TAP will transport as much as 20-billion cu m/year of natural gas from Shah Deniz II through Greece and Albania to Italy, from where it can be shipped further into Western Europe.

The project will use 36- and 48-in. OD pipe, with service also expected to begin in 2018. The 36-in. pipe will make up the line's 115-km offshore section, with the 48-in. pipe used onshore. Total's planned length is 800 km. The Italian government approved the project in December 2013.

TAP shareholders include BP 20%, SOCAR 20%, Statoil 20%, Fluxys 16%, Total SA 10%, E.On AG 9%, and Axpo 5%. BP's partners in Shah Deniz II are Statoil 25.5%, State Oil Co. of Azerbaijan Republic 10%, Lukoil 10%, Total 10%, Naftiran Intertrade Co. 10%, and Turkish Petroleum AO 9%. BP's share is 25.5%.

Shah Deniz II will add 16 bcmy of gas production to the roughly 9 bcmy of Shah Deniz Stage 1. Field development, some 70 km offshore Baku in the Azerbaijan sector of the Caspian Sea, will include two new bridge-linked production platforms; 26 subsea wells to be drilled with two semisubmersible rigs; 500 km of subsea pipelines built at up to 550 m of water; the 16 bcmy upgrade to SCP; and expansion of the Sangachal Terminal.

The Galsi natural gas pipeline to bring Algerian gas across the Mediterranean Sea to Italy via Sardinia has stalled, current weak demand combining with already existent environmental concerns, economic issues, and anticipated supplies from the southern corridor projects to undermine the project.

The project envisioned four pipeline segments: 640 km onshore between Hassi R'mel gas field in Algeria and El Kala on the Algerian coast; 310 km between El Kala and Porto Botte in southern Sardinia in water as deep as 2,850 m; 300 km between Porto Botte and Olbia on the northern Sardinian coast; and 220 km between Olbia and Pescaia, southeast of Florence, in water as deep as 900 m.

Middle East

Despite a ceremonial groundbreaking in March of last year between Pakistani President Asif Ali Zardari and Iranian President Mahmoud Ahmadinejad, the long-contemplated gas export line from Iran to Pakistan continued to suffer setbacks in 2013. Iran cancelled a $500-million loan to Pakistan for construction of the pipeline in December, citing the effects of ongoing economic sanctions.

The project would transport as much as 2.2 bcfd of natural gas from the South Pars field in the Persian Gulf through 1,850 km of 56-in. OD line. (Iran, 1,100 km; Pakistan, 750 km). Pakistan and Iran signed an agreement in June 2010 for initial deliveries of 750 MMcfd beginning in 2014. Pakistan currently suffers from gas shortages.

The Iran-Pakistan pipeline would be an extension of Iranian Gas Trunkline (IGAT) VII, which began flowing gas in September 2010. Running 907 km from Assaluyeh to Iranshahr in Iran's Sistan-Baluchestan province, the 56-in. OD line can carry 1.8 bcfd of South Pars gas, with National Iranian Gas Co. planning expansion to 2.9 bcfd.

The export pipeline would enter Pakistan in southern Balochistan, running to Sindh province where the country's main pipeline hub lies. From Sindh, gas would travel through Sui Southern Gas Co.'s existing distribution network

Iraq began technical work last year on twin 1,043-mile pipelines–one crude oil, one associated fuel gas--running from Basra to the Red Sea at Aqaba, Jordan (Fig. 3). The oil pipeline would use 56-in. OD pipe and the gas line 36-in. OD, with respective capacities of 1-million b/d and 258 MMcfd. The pipeline would cross 422 miles inside Iraq with the balance in Jordan. A second, 1.25-million b/d leg of the oil line is also planned to Syria's Banias, Mediterranean port, pending improvement of the country's security.

Iraq and Jordan signed an agreement on the project in April. Jordan will retain 150,000 b/d for domestic refining. Iraq is pursuing the project to decrease its dependence on the Persian Gulf as an oil export route. The countries are targeting a 2017 in-service date. SNC-Lavalin Group Inc. won a FEED contract for the pipeline.

Iran and Iraq agreed in 2013 to build a pipeline to carry natural gas from South Pars to supply three power plants in Basra province, Iraq. The pipeline will deliver 25 mcmd starting later this year. Plans for a 56-in. OD continuation of the line, shipping 110 mcmd to Syria, appear to have waned for the time being.

Abu Dhabi is building 500-km of 8-14 in. OD CO2 pipeline as part of the Masdar Initiative's carbon capture, usage, and sequestration (CCUS) projects. Abu Dhabi Future Energy Co. (Masdar) launched the project in 2008 with the stated goal of building the world's first zero-carbon sustainable city.

Abu Dhabi National Oil Co. (ADNOC) formed a joint venture with Masdar in late 2013 to explore and develop commercial-scale CCUS. The JV awarded Dodsal Group an engineering, procurement, and construction contract (EPC) to build a CO2 compression plant and 50-km pipeline to ADNOC crude oil fields, to be completed in 2016.

Oman Gas Co. (OGC) plans to build a 230-km, 36-in. OD pipeline to deliver natural gas from Saih Nihayda in central Oman to an industrial and maritime hub being developed in Duqm. OGC expects the 25-mcmd pipeline to enter service 2017, with an EPC contract to be awarded by end-2014.

Kuwait Gulf Oil Co. awarded Technip a contract for EPC and commissioning of its Gas and Condensate Export System (GCES) project spread across onshore and offshore locations in Saudi Arabia and Kuwait. GCES is designed to deliver a combination of lean gas, condensate, and sour gas through a single 12-in. OD export pipeline from Al Khafji Joint Operations (KJO) facilities in Saudi Arabia to Kuwait Oil Co.'s (KOC) tie-in and intermediate slug catcher.

Total export pipeline length is 110 km, with 4 km onshore in Saudi Arabia, followed by 47 km offshore, and 59 km onshore in Kuwait. Technip's operating center in Abu Dhabi will execute the project, scheduled to be completed by second-half 2014. DLB Comanche will complete offshore operations.

A 40-km, 20-in. OD dedicated oil-condensate line is also planned in Saudi Arabia as part of this project. Punj Loyd won the EPC contract from KJO, including modifications to the Ratawi gathering station, a scraper launcher, and tie-ins, for commissioning late third-quarter 2014.

Africa

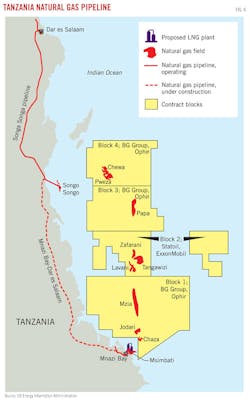

Tanzania is installing a 542-km gas pipeline from Mnazi Bay and Songo Songo to Dar es Salaam (Fig. 4). The pipeline, with a 36-in. OD trunk and 24 in. spur, will transport 784 MMcfd to Kinyerezi 1 power plant. China National Pipeline Bureau is building the line and expects it to enter service in December. As of November 2013 more than 140 km of the trunkline had been laid, with the balance of pipe lay expected to be completed in July.

National Oil Co. Kenya and Indian Oil Corp. are building a 14-in. OD, 352-km products pipeline from an interconnect with an existing line in Eldoret, Kenya, to Kampala, Uganda, and eventually to Rwanda. The countries expect the project to be complete by 2017, with bid evaluation for the Eldoret-Kampala leg underway in October 2013.

About the Author

Christopher E. Smith

Editor in Chief

Chris joined Oil & Gas Journal in 2005 as Pipeline Editor, having already worked for more than a decade in a variety of oil and gas industry analysis and reporting roles. He became editor-in-chief in 2019 and head of content in 2025.