Factors affecting near-term margins offer opportunities for refiners

Cherry Ding

Tim Fitzgibbon

Hari Govindahari

McKinsey & Co.

Houston

Brian Roth

McKinsey & Co.

Minneapolis

After sharply collapsing amid the COVID-19 pandemic, global oil demand experienced a stronger-than-expected rebound just as the refining industry was aggressively trimming its asset footprint. In addition, the invasion of Ukraine and subsequent sanctions on Russian crude and product exports added to a global market tightness already under way, pushing crude and product prices to new highs by March 2022 (see accompanying box).

While many uncertainties continue to influence near-term refining margins from both the supply-and-demand perspective, the four biggest drivers include impacts of Russian sanctions on global supply, Chinese policy toward refined product exports, projections for global-oil demand growth, and capacity growth from new refining projects.

This article examines how refiners, by focusing on the uncertainty and considerable volatility involved in the demand outlook, can use this time as an opportunity to reposition for resilience in a potentially difficult long-term environment.

Russian crude, product export sanctions

Impacts of Western sanctions and the price cap on Russian crude and product exports are still playing out, but early signs indicate that product exports may be harder to reroute than crude, potentially adding upward pressure on overall oil prices and refining margins in the near term.

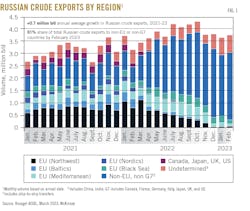

At yearend 2022, Russian seaborne crude exports grew to 3.8 million b/d, up 700,000 b/d from 2021 levels, thanks to a growing fleet of non-Western financed and insured ships that has helped Russia reroute crude deliveries to China and India (Fig. 1).

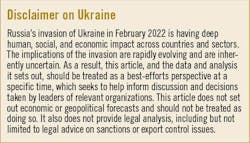

Compared to crude, product exports are generally more difficult to reroute. This could be due to either a lack of buyers—as Russian crude buyers are often major refined product exporters themselves—or to the smaller number of available product tankers. Consequently, an increasing volume of Russian exports has moved into storage at trading hubs or at sea, contributing to an overall tighter product market.

McKinsey’s near-term outlook anticipates a slight reduction in Russian product supply consistent with growing volumes in storage, with main contributions to market tightness and volatility to be driven by high costs of rerouting and persisting uncertainty.

China’s shifting policy

Perhaps the more unexpected driver of recent supply tightness has been shifting Chinese policy over refined-product export quotas. In second-half 2021, China began narrowing product-export quotas it sets for its domestic refiners, cutting total quotas in 2021 by 37% from 2020. The quota cutbacks are part of the country’s longer-term policy to reduce “exported emissions” that result from processing imported crude through typically more inefficient, marginal refining capacity.

The reduction in Chinese product exports has had a material impact on the market, adding to concerns of supply tightness. While the government of China began backing off product-export restrictions in late-December 2022—likely due to weaker-than historical fuel demand and historically high diesel-export margins—McKinsey anticipates lower exports in the future in line with the government’s long term policy stance. Sudden policy changes in one period, however, could pressure margins, albeit temporarily.

Near-term demand outlook

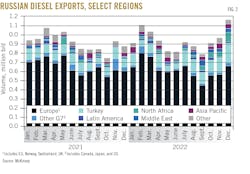

The biggest uncertainty for refiners remains the near-term outlook for demand, which over the next few years will depend on the magnitude of any global economic slowdown and the pace of its recovery.

The b1 scenario is a soft-landing scenario in which structural balance is achieved in 2-5 years as the world enters a new era of global cooperation. Under this scenario, the Ukraine conflict is contained, further Russian sanctions are avoided, and policymakers create incentives to boost public and private sector investments that help resolve near-term energy supply-demand imbalances within 2-5 years. This scenario, however, assumes monetary policy is insufficient to completely avoid a recession, with inflation remaining above central banks’ targets.

A more prolonged recession, lower fiscal support, and tighter monetary policy—consistent with scenario c2, for example—could result in an initial demand contraction followed by recovery to slightly above 2019 levels.

Refining capacity growth

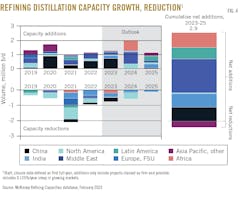

Globally, a new wave of greenfield projects is scheduled to start up over the next few years, mostly in Africa, Latin America, and the Middle East, bringing some relief to tight market balances. Between 2023-27, McKinsey expects an additional 4.4 million b/d of new distillation capacity to come online. These capacity additions are aimed at reducing local product shorts in specific markets (Africa), integrating petrochemicals (China), or upgrading local crude production into more valuable products (the Middle East).

At the same time, global refiners—particularly in Europe, Organization for Economic Cooperation and Development (OECD) Asia Pacific, and the US—continue to rationalize older, less competitive capacities at their plants, with many increasingly converting conventional units to production of biofuels.

Above-average margins

While this near-term outlook for market fundamentals suggests tight market conditions occurring in 2022 will soften slightly through the next 2-3 years, the supply-demand balance remains tighter than historical averages.

Refiner implications

While the current market outlook should translate into substantially higher cash flows in the near term, McKinsey expects refiners will continue to face long-term uncertainty due to the energy transition. In this higher and increasingly volatile margin environment, refiners will need to strike a balance between capturing high margins from current operations and using these cash flows to prepare for a harder long-term environment.

To capture high-upside potential in the near term, refiners could find opportunities to boost overall operational efficiency and utilization, including capital investments in upgrading and modernization projects that were uneconomic under lower-margin conditions. Areas of potential opportunity in the short term include improvements in turnaround planning, minimizing downtime, and increasing flexibility of feedstock and production slates.

To strengthen their competitive positions on the refining supply curve in preparation for greater volatility in commodity prices and margins, refiners could also consider ways to reduce operating costs without compromising safety and reliability. These include reducing energy consumption costs through efficient cogeneration of steam and power, improving operating efficiency through process digitization, and leveraging predictive maintenance to reduce maintenance costs.

Acknowledgment

The authors would like to thank Piotr Szabat, Shoko Tsuruga, and Pieterjan van Uytvanck for their respective contributions to this article.

Bibliography

Facts Global Energy, Energy database, December 2022.

McKinney, B., “Russia’s shadow fleet—understanding its size, activity, and relationships,” S&P Global, March 17, 2023.

McKinsey & Co., “2023, a testing year: Will the macro-scenario range widen or narrow,” January 2023.

McKinsey & Co., Global Energy Perspective Model, 2023.

McKinsey & Co., Global Downstream model, February 2023.

McKinsey & Co., Refining Capacities database, February 2023.

Walia, I., “China export quota vacuum not a threat for tankers,” Lloyd’s List, Aug. 2, 2021; China General Administration of Customs, People’s Republic of China, 2022.

Wech, D., “Will Russia struggle to find new buyers for its diesel,” Vortexa, Jan. 31, 2023.

Wittels, J. and Prem, P., “Russian diesel buildup at sea raises pressure on global supply,” Bloomberg, Feb. 17, 2023.

The authors

Cherry Ding ([email protected]) is an associate partner at McKinsey & Co. in Houston, where she leads downstream market analytics and works with clients on strategic market issues in refining and sustainable fuels. Before joining McKinsey, she was an energy market analyst in China and spent time at the International Energy Agency and Columbia Center on Energy Policy. She holds a dual BA-BS (2008) in international politics from Georgetown University’s School of Foreign Service and a Masters (2014) in economic analysis and energy policy from Columbia University’s School of International and Public Affairs.

Tim Fitzgibbon ([email protected]) is an associate partner at McKinsey & Co. in Houston, where he serves as a senior expert. Before joining McKinsey, he held the role of senior associate at ICF Resources Inc. He holds a BS (1988) in chemical engineering from Texas A&M University and a Masters (1990) in public policy from Harvard University.

Hari Govindahari ([email protected]) is a partner at McKinsey & Co. in Houston, where he leads work for several global oil and gas clients. He previously served as principal of energy for Boston Consulting Group in Singapore. He holds a BS (2006) in materials science engineering from the Indian Institute of Technology, Madras, and an MS (2008) in management from Stanford University.

Brian Roth ([email protected]) is a partner at McKinsey & Co. in Minneapolis. He previously worked for Koch Industries Inc. as a process engineer for the energy group. He holds a BS (2008) in chemical engineering from the University of Wisconsin, Madison, and an MBA (2013) in finance and operations from the University of Minnesota. He also has earned the Chartered Financial Analyst (CFA) designation.