US Gulf Coast crude terminals expanding to meet Permian growth

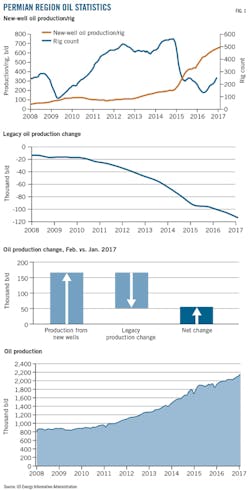

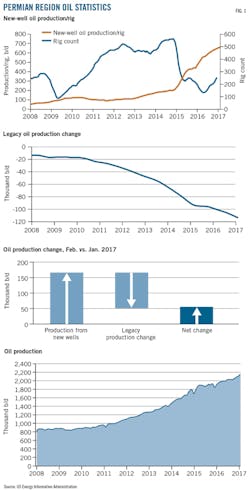

Continued growth of crude oil production in the Permian basin has prompted expansion of crude export capacity along the US Gulf Coast. The US Energy Information Administration's January 2017 Permian Region Drilling Productivity Report had both new-well oil production/rig and overall production stronger than they have been at any point in the past 10 years. New-well production/rig was 660 b/d and overall Permian production nearly 2.2 million b/d, as rising production from new wells outstripped declines in legacy production (Fig. 1).

Magellan Midstream Partners LP and LBC Tank Terminals LLC joint venture Seabrook Logistics LLC is building 1.7 million bbl (270,000 cu m) of additional crude oil and condensate storage adjacent to LBC's existing terminal in Seabrook, Tex. Seabrook Logistics is also connecting its storage to Magellan's Houston crude oil distribution system by building a 24-in. OD bidirectional pipeline between the storage and Genoa Junction and investing in a new Aframax dock with 45-ft draft. The $250-million expansion is expected to be operational mid-2018, subject to permitting and regulatory approvals.

If warranted by market demand, Seabrook Logistics could construct an additional 3 million bbl of storage, a second 24-in. pipeline between the site and Magellan's Houston crude oil distribution system and a second Aframax ship dock, which may be expanded to Suezmax. These components could be operational beginning late 2018.

These expansions would join more than 700,000 bbl of storage and a new 18-in. OD pipeline which will connect to an existing third-party pipeline to transport crude to a Houston-area refinery beginning first-quarter 2017.

The three expansions combined would provide both deepwater access through two Aframax docks to more than 5 million bbl of new storage capacity and pipeline connectivity with refineries and terminals throughout the Houston Ship Channel (HSC) and Texas City.

BridgeTex Pipeline Co. LLC, owned 50-50 by Magellan and Plains All American Pipeline LP, is expanding BridgeTex's current capacity from the Permian basin to 400,000 b/d from 300,000 b/d. The additional capacity is expected to be available second-quarter 2017 following enhancements to existing pumps and related equipment.

The 20-in. OD BridgeTex system currently transports crude from Colorado City, Tex., to the Houston area. Beginning early second-quarter 2017, a newly-built origin point at Bryan, Tex., 100 miles northwest of Houston, will begin accepting shipments from the Eaglebine region.

In anticipation of this incremental expansion of volumes shipped to its Houston crude oil distribution system, Magellan is building a new 24-in. OD pipeline from its East Houston terminal to Galena Park, Tex., expected to enter service mid-2018.

Magellan is also considering adding storage to a condensate splitting complex it's built in Corpus Christi, Tex., in conjunction with Trafigura AG, and expanding a recently announced refined products terminal in Pasadena, Tex.

Enterprise Products Partners (EPP) LP's Beaumont Marine West Crude Oil terminal brought its first 2.2 million bbl of storage on line in January 2016. The terminal is a multiphase project expected to have total capacity of 6.2 million bbl once complete. It is part of the same Jefferson County, Tex., complex as EPP's Beaumont Marine West Refined Products terminal, on the Neches River near Beaumont. EPP also plans to add 1.6 million bbl of capacity to its 21.4-million bbl Houston Ship Channel terminal in 2017.

The company plans to build a 400-mile, 24-in. OD pipeline to ship Permian crude to Sealy, Tex., and its Enterprise Crude Houston (ECHO) terminal. Long-term contracts had filled 60% of the pipeline's initial 300,000 b/d capacity as of December 2016. The pipeline, expected to enter service mid-2018, is expandable up to 450,000 b/d by adding four pump stations. It will provide segregated shipping of West Texas Sweet, West Texas Intermediate (WTI), Light WTI, and condensate. Shipments to ECHO would be distributable to any other storage or refining center on the Texas gulf coast.

Hazelwood Energy Hub is developing a blending site in St. Landry Parish, La. It will use both salt caverns and surface storage and be capable of blending up to 10 types of crude,

The Hazelwood site sits on 750 acres adjacent to Spectra Energy's Bobcat Gas Storage. Initially it will include four salt dome storage caverns and additional above ground tanks for a total of up to 13 million bbl with opportunities for further expansion.

Hazelwood will have access to an extensive pipeline network and will operate a barge loading and unloading site at the Port of Krotz Springs. The storage site is also adjacent to the Union Pacific railroad mainline and US Highway 190. These transportation options connect the site to customer markets throughout the Gulf Coast. Construction is expected to start first-quarter 2017 and continue into 2018.

Phase I of Fairway Energy Partners LLC's Pierce Junction Crude Oil Storage site is expected to enter service shortly. Pierce Junction's design allows for storage of three crude segregations totaling 10 million bbl. Fairway has rights to expand its capacity at the Pierce Junction salt dome to 20 million bbl.

The first phase includes two bidirectional 24-in. OD pipelines connecting to the existing Houston-area crude oil grid, adding more than 1-million b/d of pipeline receipt and delivery capability to the Houston marketplace. The lines run 21 miles from Pierce Junction's caverns to the Genoa Junction and Speed Junction hubs. Phase 1 also includes 10 million bbl of brine capacity with central pumping and metering.

Phase 2 will consist of two additional cavern systems totaling more than 9-million bbl capacity, sufficient brine-pond capacity to maintain a 1:1 crude-brine storage ratio, and up to 4 million bbl of surface tanks for additional segregation and blending. It will also include pipeline extensions to Webster Junction and Houston-Texas City seaborne terminals.

The Louisiana Offshore Oil Port (LOOP) is conducting a three-phase expansion of its Clovelly Hub storage site, adding seven new 355,000-bbl tanks totaling 2.485 million bbl. Phases 1-2, comprising a total of six tanks, are completed and in service. The seventh tank will enter service mid-2017.

The expansion will bring above-ground storage at LOOP to roughly 11.5 million bbl and total storage to 71.5 million bbl.

Centurion Midstream's Brownsville Terminal, under construction since September 2015, will initially have 3.5 million bbl of storage with the ability to add up to 10 million bbl. Located at the Port of Brownsville, the terminal will unload rail shipments from Centurion's Pecos terminal for export via a marine dock or for processing at an on-site 50,000-b/d condensate splitter that it plans to put in operation during 2017.

Phillips 66's Beaumont Terminal (Fig. 2) expansion is ongoing. The terminal will serve as the southern end of the Dakota Access-Energy Transfer Crude Oil Pipeline systems and the western origination point for the Bayou Bridge pipeline, connecting it to St. James, La. The Beaumont terminal will also include three marine docks on the Sabine River.

Phillips 66 commissioned 1.2 million bbl of crude storage at the terminal in fourth-quarter 2016, with 2 million bbl more expected to be available by mid-2017 and plans to ultimately expand to 16 million barrels. The company plans to complete the Bayou Bridge pipeline in 2017.

About the Author

Christopher E. Smith

Editor in Chief

Chris joined Oil & Gas Journal in 2005 as Pipeline Editor, having already worked for more than a decade in a variety of oil and gas industry analysis and reporting roles. He became editor-in-chief in 2019 and head of content in 2025.